Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628742

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628742

APAC Canned Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

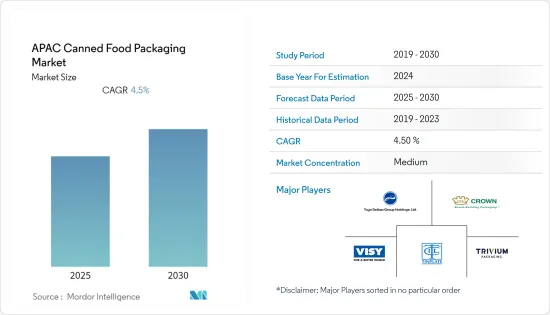

The APAC Canned Food Packaging Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Hypermarkets/Supermarkets are the primary channels of distribution of canned food in the region. Wider availability of products under one roof, ranging from soups to meat products, has fueled the growth in the sales channel. Supermarkets sell products at a competitive price to expand their consumer base. Bundling products has been a popular strategy that has promoted the growth of products, such as instant noodles, ready meals, and canned soup. Walmart, Carrefour, Metro Inc., Ito Yokado, AEON, the Tokyu Store, 7-Eleven, and Woolworths are the major superstores in the region.

- Growth in the canned food packaging market is directly proportional to changes in the food industry and the costs associated with packaging. According to Australian Statistics Bureau records, Australia's canned food market has grown significantly, with food retailing up 12% to AUD 151.34 billion. However, increased material costs can hinder the market growth during the forecast period.

- Consumer demand for convenient canned food products that are healthy, ethical, and comforting, and fit for fast-paced life is increasing in developing economies. Moreover, the rise in disposable income in emerging economies such as China, India, and Brazil has increased expenditure on time-saving and labor-saving canned food products. According to the National Bureau of Statistics of China, the annual disposable income per capita of urban households has increased by more than 100% in the last ten years, reaching RMB 43,834 in 2020.

- Southeast Asian countries like Malaysia and Thailand are expected to generate lucrative sale opportunities for canned food products due to the emerging tourism sector seeking packed food, whether metal or steel packaging. Therefore, hotels ensure providing packed canned food, especially canned meat, due to its perishable nature. Airtight packaging brings imperishability, ensures the product's long shelf life, and positively influences canned food demand.

- The spread of COVID-19 spurred the demand for canned food across the Asia Pacific region due to increased dry food procurement backed by hygiene concerns. However, the market cannot wholly capitalize on the sudden demand influx due to a complete lockdown and suspension of the production activities, which hindered the market's growth during the year 2020. Further, since health concerns are likely to be sustained even after the disease outbreak registers slowdown, sustained growth of the market is expected to be witnessed in the coming years.

APAC Canned Food Packaging Market Trends

Steel Canned Food Demand is Expected to Grow Significantly

- The steel can perform well where value is a key driver, as it remains a low-cost pack type, having robust basic functionality. Canned food brands use three-piece welded cans to keep the final product's cost low, making it accessible to a broad audience.

- A unique worldwide initiative, Canvironment week aims to make a significant and sustainable impact by creating general awareness about the exclusive benefits of usage of Cans, such as eco-friendly nature. Can makers and Brand owners worldwide be coming together to build a 'United Global Metal Can Sustainability Movement'? These kinds of initiatives promote metal can packaging.

- Sealed and tamper-proof steel container food is in high demand as it protects food from harmful bacteria and holds its nutrition value for an extended time. Also, due to the busy lifestyles of consumers, canned food is expected to gain more importance.

- The accessibility and affordability of canned food make it a solution to the people's need for safe, nutritious, and quality produce and protein. Steel food can is environmentally friendly, curbs food waste, and fuels the economy. Steel can is 100% recyclable and made from a minimum of 25% recycled content.

- New and innovative products, along with the growing consumer demand, are driving the canned food market. New product launches help vendors increase their sales and market share. For instance, in November 2019, Thai Union Group PCL (Thai Union) launched a new tuna product, SEALECT Tuna Fitt, in Thailand to attract health-conscious consumers. Similarly, in July 2019, Princes launched Mackerel Sizzle and Infused Tuna Fillets, two new fish-based product ranges. The company launched the products to extend canned fish products into the evening meals of end-users.

Australia is Expected to Hold Significant Market Share

- According to Pacifical C.V., canned tuna is Australia's most popular canned seafood item. Tuna has 76% of the canned seafood share. It is offered mainly in a 95g format. 185 g and 425 g net weight are also available. The Simplot Australia brand "John West" leads the canned tuna category with a 37.3% market share.

- Fresh beef from Brazil is not permitted for import to Australia, but fully cooked canned beef from Brazil can enter the country as a manufactured or processed product ready to eat. Supermarket chains like Cole and Woolworths are selling 'made in Brasil' beef under their brand names, affecting the sales of locally produced canned meat brands like Hamper, which almost cost twice compared to Cole's canned corned beef.

- The Canned Food Information Service Inc (CFIS) is promoting Australian food packaged in steel cans. Through publicity, it tries to convince potential customers about the merits of this food delivery system, clear all the misconceptions, and focus on generating more purchases; to ensure that Australian canned food remains a common ingredient in meals rather than an occasional or standby food. These actions are also influencing canning companies to become more responsible for their choice of future packaging direction to create a climate of greater confidence in the future of the steel can.

- During March 2020, canned vegetables and fruits sales increased by 118.5% and 73.9%, respectively. E-commerce played a significant role in the growth of canned food, as the digitally savvy consumers found it easy to order online and choose from a wide variety of brands and products. However, during the pandemic, consumers have adapted to shopping more frugally and envisage using their newly developed food preparation skills to use cheaper fresh produce in the home. This trend can affect the sales of canned vegetables and fruits in the long term.

APAC Canned Food Packaging Industry Overview

The Asia Pacific Canned Food Packaging Market is moderately competitive. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- May 2020 - Crown Holdings Inc launched a new gift tin for brands with decorative finishes and textures on metal packaging to attract consumers. The donated tin inks create an oxidized mineral effect, giving the appearance of natural weathering over time and drawing a color palette that incorporates the diversity of nature.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 52724

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Development of New and Diversified Packaging Styles and High Potential in Emerging Economies

- 4.4.2 Increasing Popularity of Ready-To-Eat Food Products

- 4.5 Market Challenges

- 4.5.1 Availability of Alternative Packaging Solutions and High cost of Metals

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Metal

- 5.1.2 Steel

- 5.1.3 Aluminum

- 5.1.4 Others

- 5.2 By Product Type

- 5.2.1 Readymade Meals

- 5.2.2 Meat

- 5.2.3 Sea Food

- 5.2.4 Fruits and Vegetables

- 5.2.5 Others

- 5.3 By Country

- 5.3.1 China

- 5.3.2 Australia

- 5.3.3 Japan

- 5.3.4 India

- 5.3.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Crown Holdings Inc.

- 6.1.2 Trivium Packaging

- 6.1.3 Tata Tinplate

- 6.1.4 Visy Industries

- 6.1.5 TOYO SEIKAN GROUP HOLDINGS, LTD.

- 6.1.6 Lageen Food Packaging

- 6.1.7 YiCheng Industrial (Shenzhen) LTD

- 6.1.8 Universal Can Corporation

- 6.1.9 CPMC HOLDINGS LIMITED

- 6.1.10 KIAN JOO GROUP

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.