PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628731

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628731

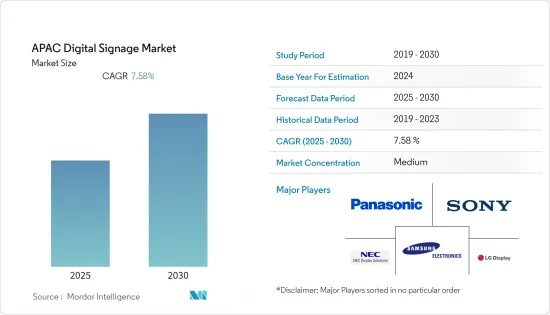

APAC Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The APAC Digital Signage Market is expected to register a CAGR of 7.58% during the forecast period.

The market is expected to have a steady growth owing to the increased application of video walls and digital billboards for brand marketing in developing nations such as India, Singapore and developed countries such as China and Japan.

Key Highlights

- Digital signage has played an important factor in influencing the purchase decision, and institutions, like the government, healthcare, public transit, and retail stores, are now heavily relying on digital signages to better engage their targeted audiences to communicate their message.

- As digital signage enables content and messages to be displayed on an electronic screen or digital sign and can be changed without modification to the physical sign, aggressive growth over the next few years across various emerging economies is anticipated. The adoption of digital signage is becoming more popular and mainstream with the technological advancements and decrease in price.

- The vendors offering digital signage solutions are continuously investing in product innovations. For instance, Samsung announced the global launch of The Wall Luxury, which is the latest version of its modular MicroLED screen, which can be tailored to any size and aspect ratio. Such innovations and the global increase in ad spending are expected to drive the demand.

- The COVID-19 outbreak has affected the studied market, as the manufacturing facilities were closed in the initial phase and work from home trends also reflected the demand decrease. However, the scenario expanded the scope of marketing through digital signage across many industries, especially in hospitals and public places, which utilized the technology for displaying important information.

APAC Digital Signage Market Trends

OLED to Show Significant Growth

- OLED technology holds the promise of significantly enhanced picture quality, with the potential for innovative new consumer display presentations. It is often hailed as the future of digital displays and screens.

- It is the only technology that overcomes the limitations of conventional displays, as it offers enhanced reality combined with a dynamic form. OLED provides superior light and color expression, as it is based on self-emitting light sources. Its flexibility and transparent nature are the results of the development of innovative OLED materials.

- A country such as Vietnam is marketing the application of OLED digital signage boards in the country. For instance, in August 2021, the country hosted the International LED/OLED and Digital Signage Show at Saigon Exhibition and Convention Center Ho Chi Minh.

- Moreover, LG Electronics India recently installed OLED digital signage at the largest shopping mall in Delhi, utilizing 63 custom-made curved 55-inch OLED panels. Standing eight meters tall, the OLED displays are installed in a ring so that they can be observed at any angle. Additionally, the tech giant supplied OLED signage at another Ambience Mall in Gurgaon, Delhi.

India to Hold the Highest Market Share

- Last year, amidst the COVID-19 pandemic, the adoption of digital signage increased significantly in the region despite a decline in the global economy as businesses sought innovative ways to reach their target audience better.

- According to Scala, India represents one of the largest gems and jewelry sector markets and contributed 29% of global jewelry consumption. This sector contributes 7% to the Indian economy and provides jobs to more than 40 lakh people.

- Purchasing jewelry has been an inherent part of Indian tradition and culture. However, Personalisation is vital in increasing customer satisfaction and building brand loyalty as most customers prefer to purchase jewelry in-store. During the pandemic, jewelers across the country have opted for a 'phygital' approach to reach more customers and keep their revenues high while ensuring a safe and seamless shopping experience.

- For example, India's most trusted jewelry brand, Tanishq, announced the launch of new phygital features, a tech stack that would bridge the gap between bricks and clicks - incorporating features such as video calling, endless aisle, virtual jewelry try on, and real-time, live assisted chat in more than 200 stores across the country. Several other Retail end-users are implementing digital signage, which is further increasing the demand for in-store signage solutions in the country.

APAC Digital Signage Industry Overview

The Asia Pacific Digital Signage market is partially fragmented and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- September 2020 - The company made an online exhibition of its CPS/IoT Exhibition 'CEATEC 2020 ONLINE' ('CEATEC'). The company introduced many digital solutions and concept videos related to work styles and security for the new normal society utilizing videos, presentation materials, and real-time chat function in the 'General Exhibit Area.'

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth Of End-user Verticals, such as Retail and Healthcare

- 4.3.2 Increasing Adoption due to less operating cost and ease of change in signage

- 4.4 Market Restraints

- 4.4.1 High initial setup costs

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video Wall

- 5.1.2 Video Screen

- 5.1.3 Kiosk

- 5.1.4 Transparent LCD Screen

- 5.1.5 Digital Poster

- 5.1.6 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 LCD/LED Display

- 5.2.1.2 OLED Display

- 5.2.1.3 Media Players

- 5.2.1.4 Projector/Projection Screens

- 5.2.1.5 Other Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.1 Hardware

- 5.3 By Size

- 5.3.1 Below 32"

- 5.3.2 32"-52"

- 5.3.3 Above 52"

- 5.4 By Location

- 5.4.1 In-Store

- 5.4.2 Outdoor

- 5.5 By Application

- 5.5.1 Retail

- 5.5.2 Transportation

- 5.5.3 Hospitality

- 5.5.4 Corporate

- 5.5.5 Education

- 5.5.6 Government

- 5.5.7 Other Applications

- 5.6 By Country

- 5.6.1 China

- 5.6.2 Japan

- 5.6.3 India

- 5.6.4 South Korea

- 5.6.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NEC Display Solutions Co. Ltd

- 6.1.2 LG Display Co. Ltd

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 Panasonic Corporation

- 6.1.5 Sony Corporation

- 6.1.6 Stratacache

- 6.1.7 Planar Systems Inc.

- 6.1.8 Hitachi Ltd

- 6.1.9 Barco NV

- 6.1.10 Cisco Systems Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET