Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628730

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628730

Dairy Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

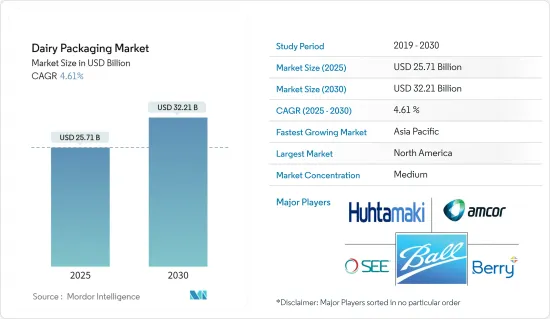

The Dairy Packaging Market size is estimated at USD 25.71 billion in 2025, and is expected to reach USD 32.21 billion by 2030, at a CAGR of 4.61% during the forecast period (2025-2030).

Key Highlights

- The shift toward healthy snacking, increased consumption of ready-to-eat foods, and the rise of online and mobile shopping are transforming food purchasing and consumption patterns. These trends, combined with a growing focus on health-conscious eating, are expected to impact the dairy market significantly.

- The expanding availability of packaged dairy products through various retail channels, driven by population growth and changing diets, will likely boost market growth. Additionally, increasing consumer preference for protein-based products is expected to enhance the adoption of dairy-based items globally.

- Global trends in the dairy industry reveal that manufacturers are increasingly focusing on packaging to set their products apart. Today's dairy product packaging often boasts eye-catching designs and aseptic features. End users are adopting innovative packaging strategies for dairy products due to intense competition in key markets such as Japan, the broader Asia-Pacific region, Western Europe, and North America.

- Dairy manufacturers increasingly focus on capturing a larger share of the global dairy trade through improved international export capabilities and local production. This trend has fueled the demand for more advanced dairy packaging solutions.

- The diversification of packaging types has been a key factor in the expansion of dairy product sales. For example, milk, once available primarily in gable-topped cartons, is now often sold in portable, brand-friendly PET bottles, appealing to time-constrained consumers.

- However, the dairy packaging market faces challenges. Price fluctuations in packaging materials, influenced by food prices, may hinder market growth. Additionally, concerns about the potential health risks associated with plastic packaging, including fears of toxins linked to cancer or reproductive health issues, pose obstacles to market expansion.

Dairy Packaging Market Trends

Milk Occupies the Largest Market Share

- Milk is the most consumed dairy product globally. Its high moisture and mineral content pose significant storage challenges for vendors, leading to the prevalence of milk powder and processed milk in the trade. These characteristics make fresh milk highly perishable, necessitating advanced preservation and packaging techniques to maintain quality and extend shelf life.

- Current milk processing technology allows liquid milk to be bottled and stored at 4-8°C to maintain a shelf life of 10 to 21 days. Advanced processes like ultra-high temperature (UHT) treatment have extended packaged milk's shelf life up to a year without refrigeration. This technological advancement has revolutionized milk distribution, allowing for broader market reach and reduced waste.

- There has been a trend toward encouraging local production in recent years, particularly in Asia. This shift aims to reduce dependency on imports and support domestic dairy industries. A notable supply-demand gap persists despite countries like India contributing approximately 16% of global milk production. This discrepancy highlights the need for improved infrastructure and distribution networks in developing markets.

- Moreover, the rise of innovative and eco-friendly milk packaging is boosting the market's top line. This trend spans multiple packaging formats, such as bottles, cartons, and pouches. For example, in July 2024, Delamere Dairy unveiled its CartoCan Flavoured Milk range, targeting on-the-go consumers. The fully recyclable CartoCan reduces plastic waste and offers a handy alternative to the conventional 500 ml glass bottle.

- According to the USDA Foreign Agricultural Service, global cow milk production has steadily increased. Worldwide cow milk production rose from 511.6 million metric tonnes in 2017 to approximately 549.48 million metric tonnes in 2023. This growth reflects increasing global demand for dairy products and improvements in dairy farming practices and technologies.

- The dairy industry is witnessing a surging demand for aseptic packaging. Rising global milk output is set to unlock new market opportunities. Also, there has been a remarkable shift in consumer behavior, highlighted by the soaring consumption of UHT milk. As consumers aim to reduce their trips to the store, the demand for UHT milk boasting an extended shelf life has surged. Notably, there has been a discernible shift in consumer preference within dairy solutions, moving from loose milk to packaged offerings from major brands, especially those supplying in bulk.

North America Occupies the Largest Market Share

- North America holds the largest share of the global dairy packaging market, driven by increased production and sales of dairy products such as milk, cheese, and yogurt. In the United States, dairy product consumption has risen, particularly for cheese varieties like parmesan, provolone, and mozzarella, which is expected to boost the dairy packaging market. The region's advanced dairy industry infrastructure, stringent food safety regulations, and consumer demand for convenient and innovative packaging solutions further reinforce its dominance.

- The US dairy packaging market is significantly affected by rapidly changing consumer preferences toward packaged food and economic conditions. The market is expected to grow further due to the substantial expansion of the dairy product portfolio, especially in sports nutrition, and increasing casual users.

- Factors such as health consciousness, sustainability concerns, and the rise of e-commerce also shape packaging trends in the dairy industry. As consumers increasingly seek protein-rich products and packaged dairy goods become more accessible through diverse retail channels, the nationwide acceptance of dairy products is set to rise, driving the market forward.

- According to the US Department of Agriculture, milk production for human consumption in the United States rose from GBP 215.4 billion (USD 267.91 billion) in 2017 to GBP 226.6 billion (USD 281.84 billion) in 2023. This higher milk production necessitates greater packaging solutions for retail, bulk, and distribution purposes to handle and distribute the increased volume. The growth in milk production has spurred investments in packaging technologies that ensure product freshness, extend shelf life, and meet diverse consumer preferences across various distribution channels.

- Constant launches of dairy products in the North American market would also create a huge opportunity for packaging manufacturers to strengthen their presence in the region. In September 2023, Ornua Foods North America unveiled its latest offering, Kerrygold Cheese Snacks, featuring ready-to-eat cheese sticks designed for convenience and snacking ease. Constant innovations like this will drive up demand for dairy product packaging options in the market.

Dairy Packaging Industry Overview

The dairy packaging market is semi-consolidated, owing to several significant players. With innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and tapping new markets. Some of the major players in the market are Amcor Group GmbH, Sealed Air Corporation, Berry Global Inc., and Ball Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 52403

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Product

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Preference Towards Protein-based Products

- 5.1.2 Increasing Adoption of Packages Incorporating Small Portion Size

- 5.2 Market Challenges

- 5.2.1 Rising Raw Material Costs Could Hinder Growth for Packaging Product Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.2 By Product

- 6.2.1 Milk

- 6.2.2 Cheese

- 6.2.3 Frozen Foods

- 6.2.4 Yogurt

- 6.2.5 Cultured Products

- 6.3 By Package Type

- 6.3.1 Bottles

- 6.3.2 Pouches

- 6.3.3 Cartons and Boxes

- 6.3.4 Bags and Wraps

- 6.3.5 Other Package Types

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki Group

- 7.1.2 Berry Global Inc.

- 7.1.3 Amcor PLC

- 7.1.4 Ball Corporation

- 7.1.5 Altium Packaging

- 7.1.6 Saudi Basic Industries Corporation

- 7.1.7 International Paper Company

- 7.1.8 Winpak Ltd

- 7.1.9 Sealed Air Corporation

- 7.1.10 Stora Enso Oyj

- 7.1.11 Greiner Packaging international GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.