Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628724

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628724

NA Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

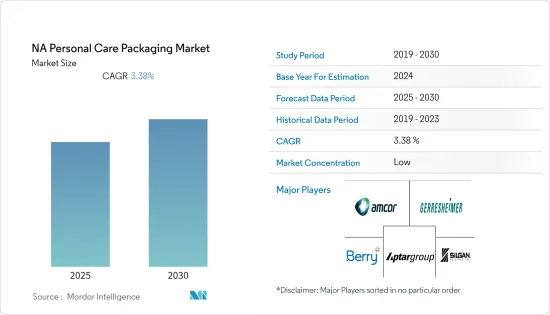

The NA Personal Care Packaging Market is expected to register a CAGR of 3.38% during the forecast period.

Key Highlights

- According to the Bureau of Labor Statistics, in 2020, American consumers spent between 64.7 U.S. dollars in a year on hair care products. Such spending on hair products will drive the demand for the sustainable personal care packaging market.

- For Instance, in August 2021, Garnier, a subsidiary of L'Oreal, introduced Whole Blends Shampoo Bars in the United States. The debut is part of the brand's greater sustainability effort, as they are made with less water than their liquid counterparts and have no plastic packaging.

- Further, according to a survey conducted by the Nail Magazine, a prominent magazine based in California, the United States, more than 74% of the women who visit nail salons buy their own supplies, tools, and equipment rather than using salon supplies.

- In order to cater to the increasing demand for tubes, various suppliers have come up with different collaborations and innovations in the market. For Instance, in November 2021, Albea Tubes, one of the major providers of plastic and laminate tubes for the cosmetic, skincare, personal care, and oral care markets, partnered with U.T.C.G and eXpackUSA to offer Made in America tubes made from post-consumer recycled (PCR) plastics to beauty and personal care businesses.

- The increasing demand from consumers for practical and user-friendly dispensing solutions and products is prompting cosmetic companies to adopt innovative packaging solutions such as the use of recyclable plastic and compostable and biodegradable plastics, thereby driving the innovations in cosmetic packaging.

North America Personal Care Packaging Market Trends

Haircare Will Observe a Significant Growth

- Haircare brands use packaging to their advantage, both in the salon and beyond. Haircare for the retail segment is highly competitive, and hair care brands are relying on packaging differentiation to forge a connection with consumers. After skincare, hair care commands a significant share of the cosmetic market.

- Most hair care brands experiment with the interplay of matte and gloss printing techniques and are increasingly incorporating sensory elements into their packaging. The use of treatment oils for added heat styling protection, imparting shine, or decreasing frizz has led to the increased use of dropper packaging as a dosing and precision application method.

- Oribe Hair Care, based in New York, recently cultivated a distinctive shelf presence with its angularly lined, boldly-hued, custom packaging since its inception. The brand also has innovative packaging, which blends old-world intricacy with sleekly modern engineered elegance, and all the bottles, upright tubes, and sophisticated jars deliver a cohesive display suggestive of perfume bottle silhouettes.

- Companies dedicated to the development of shampoos and hair care products have also been looking to expand into retail stores to maximize any possible revenue. For instance, in November 2021, Olaplex Holdings, Inc. formed a distribution partnership with Ulta Beauty Salons, designed around increasing retail channels for their products by using the salons as stores. The Company's retail products will be available in more than 1,250 Ulta stores and on ulta.com from January 2022.

- Many hair care brands are entering into partnerships to provide better packaging alternatives. Companies are increasingly engaging in refilling initiatives that encourage consumers to bring back their bottles and refill them at a subsidized price, compared to if they would have purchased the product independently. In October 2020, P&G Beauty announced its first-ever refillable aluminum bottle system to launch at-scale, with its Head & Shoulders, Pantene, Herbal Essences, and Aussie brands in Europe. The refill system uses a new reusable 100% aluminum bottle and recyclable refill pouch, made using 60% less plastic (per mL versus standard brand bottle). It is expected to pave the way in changing the way consumers buy, use and dispose of their shampoo bottles.

Plastic to Hold Major Market Share

- Plastic is a prominent material in personal care product packaging due to its low cost, lightweight, flexibility, durability, and other factors. For personal care products, plastics are a material of choice for manufacturing shatterproof and 'no-spill' bottles, jars, tubes, caps, and closures.

- According to the Packaging Machinery Manufacturers Institute (PMMI), at 61% market share, plastic packaging, such as bottles, jars, compacts, and tubes, dominate in beauty and other personal care products, where bottles are the most commonly used containers, accounting for 30% of the market.

- Personal care product bottles produced from HDPE are the most common and least expensive, which are economical, impact-resistant, and maintain a good moisture barrier. Lotion bottles come in all different shapes, sizes, and forms, whereas some lotions are kept in capped tubes. These tubes are usually made from plastic, depending on their size. However, there are lotion bottles that are also made of plastic, but instead of the capped tops, they have pump dispensers. This is helpful for many people who do not want to have to screw a top on and off or not want to flip up a cap.

- Gerresheimer Plastic Packaging, which is committed to environmental concerns, offers PET ranges with different mixtures of post-consumer recycled materials. It can produce cosmetic bottles made of up to 100% R-PET. Besides using recycled materials, Gerresheimer is also motivated to help its customers reduce greenhouse gas emissions by using biomaterials. Biomaterials are renewable alternatives to conventional PE/PET. Sugarcane is one of the substances used to make biomaterials, where ethanol is taken from the sugarcane plant, and after converting into green ethylene, it goes to the polymerization plants, where it is converted into green PE/PET.

- Moreover, to fully eliminate the use of virgin plastic, companies are exploring other materials, including bioplastic made primarily from sugarcane, which will very soon provide viable alternatives to virgin petro-based plastics.

North America Personal Care Packaging Industry Overview

The North America Personal Care Packaging Market is highly fragmented due to the presence of players, like Amcor, AptarGroup Inc., Gerresheimer AG, RPC Group Plc (Berry Global Group) Silgan Holdings Inc. are up-scaling the market with substantial R&D investments, drive towards the sustainability and digitization of the packaging industry in North America.

- June 2021- Amcor launched new machines that will produce ultra-clear and heat resistance films. The AmPrima line uses machine-direction orientation technology to produce films that can run at speeds that competitors are unable to match in a recycle-ready solution.

- Jan 2021- Silgan Holdings Inc. partnered with Bondi Sands on the brand's newly launched self-tanning range, Pure. It makes use of Silgan Dispensing's EZ'R foamer, which features a first-to-market foam application that is 100% recyclable in polypropylene (PP) streams and made entirely from plastic components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 52282

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 5.1.2 Growing Focus on Innovative and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs of R&D and Manufacturing of New Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Container

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.2.10 Other Packaging Types

- 6.3 By Product Type

- 6.3.1 Oral Care

- 6.3.2 Hair Care

- 6.3.3 Color Cosmetics

- 6.3.4 Skin Care

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

- 6.3.7 Other Products Types

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group Plc (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging Company

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Packaging Systems Ltd

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.