PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628711

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628711

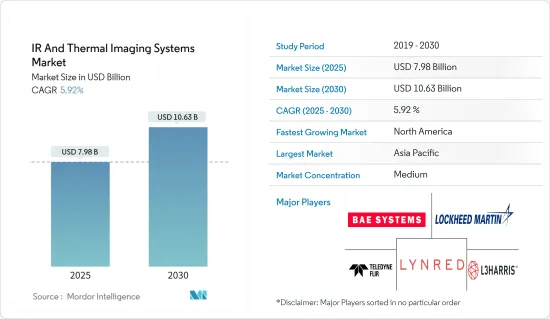

IR And Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The IR And Thermal Imaging Systems Market size is estimated at USD 7.98 billion in 2025, and is expected to reach USD 10.63 billion by 2030, at a CAGR of 5.92% during the forecast period (2025-2030).

Infrared and thermal imaging technology enables users to detect objects or individuals in complete darkness and in difficult and distinct conditions. Unlike other methods, thermal imaging works in environments without any ambient light. Like near-infrared illumination, thermal imaging can penetrate obscurants like smoke, fog, and haze.

Key Highlights

- The global demand for infrared (IR) and thermal imaging is growing due to the increased use of these technologies in military and defense applications. Armed forces worldwide rely on IR and thermal imaging for enhanced situational awareness, surveillance, target acquisition, and night-vision capabilities.

- Military and defense R&D programs prioritize infrared (IR) wavelengths, given that many surveillance and targeting operations occur at night. The military primarily uses infrared technology in night vision goggles, missile guidance systems, and aerial forward-looking infrared (FLIR) scanners. The rising demand for IR imaging technology in the military and defense sectors is further accelerating the growth of the market.

- The emergence of affordable solutions had a considerable impact on the global market for infrared and thermal imaging systems. Previously dominated by high-end, costly equipment mostly utilized in the industrial and military sectors, the landscape changed because of cost reductions brought about by advances in sensor technology, mass production, and miniaturization. Due to these advancements, thermal imaging is used in several industries, including consumer electronics, healthcare, and public safety.

- Technological advancements are promoting the adoption of IR and thermal imaging systems by enhancing their efficiency, accessibility, and versatility. Innovations such as higher-resolution sensors, improved image processing capabilities, and the miniaturization of devices have increased their accuracy and usability across various industries. These advancements enable better heat detection, more detailed imaging, and the integration of thermal cameras into smaller and more portable devices.

- Thermal imaging and infrared systems are extremely specialized technologies that need to be installed, operated, and maintained by professionals. Operational inefficiencies are caused by a shortage of qualified personnel to perform routine support tasks, such as system calibration and maintenance. The accuracy and dependability of thermal imaging systems might deteriorate in the absence of prompt support, which can impact their performance.

IR & Thermal Imaging Systems Market Trends

Industrial Applications Hold Major Share

- Industrial sectors are increasingly utilizing thermal imaging to maintain, inspect, and monitor equipment and processes. In manufacturing, energy, and construction industries, thermal cameras detect issues like overheating, energy loss, and equipment malfunctions, preventing costly repairs and downtime. This trend drives significant demand for thermal imaging systems in predictive maintenance and quality control as companies aim to enhance efficiency and safety while reducing operational risks.

- According to UNECE, in 2023, Albania had the biggest construction industry relative to its GDP in Europe. The construction industry in the United Kingdom accounted for 6.2% of its GDP, which is equal to Germany's.

- One of the main factors fueling the expansion of the industrial segment is the use of thermal imaging and infrared technologies in predictive maintenance. Thermal cameras are frequently utilized to find hotspots, leaks, and electrical problems in machinery and equipment before they cause failure. By being proactive, companies may cut down on scheduled downtime and save money on expensive repairs.

- Thermal imaging systems are becoming more crucial in industrial quality control and process monitoring applications. Manufacturers use these systems to monitor temperature-sensitive processes, identify flaws, and guarantee product uniformity. This is especially important in sectors where exact temperature control is essential, like the processing of metals and polymers and the creation of electronic products.

- Another significant use of infrared and thermal imaging devices in the industrial sector is energy auditing. Businesses are using thermal cameras more often to do energy audits in their buildings. These audits help detect areas of energy loss, such as inadequate insulation, leaks, and inefficient heating systems. Growing concerns about sustainability and energy efficiency, especially in heavy industries like cement, steel, and chemical production, are the driving force behind this movement.

Asia-Pacific to Register Major Growth

- Several Chinese firms, such as InfiRay and Hikmicro, have continued to experience growth, propelled by strategies emphasizing volume, resulting in their expanding influence in both industrial and consumer markets. The thermal imaging sector in China has achieved a noteworthy milestone, capturing a substantial portion of global thermal imager shipments. The rising demand for this technology across diverse industries is anticipated to enhance the region's market presence.

- IR and Thermal Imaging systems are significantly gaining popularity across industrial applications. The growing investments and increasing productivity are expected to increase the demand for this technology across the region's industrial sector. According to the World Economic Forum, China is intensifying its initiatives to enhance its manufacturing capabilities, as evidenced by a 10.9% increase in investments aimed at technological transformation within the manufacturing sector during the first seven months of 2024, maintaining a trend of double-digit growth.

- Technological advancements have created microbolometers, which are anticipated to offer numerous growth prospects throughout the forecast period. The pandemic increased the demand for thermal imaging solutions in multiple sectors, such as transportation, manufacturing, and public safety in Japan. For example, airports in the Asia-Pacific region, including Japan, are utilizing thermal cameras to monitor travelers. This considerable uptake is projected to propel market growth in the region.

- Thermal imaging cameras have been positioned prior to the security gates in both domestic terminals of the airport, where airline personnel are performing the assessments. As part of efforts to mitigate the transmission of Covid-19 from the capital, Japan initiated mandatory temperature screenings on Friday for all passengers departing on domestic flights at multiple airports. The extensive implementation of thermal imaging technology within the region's transportation sector is anticipated to enhance the market's prospects.

IR & Thermal Imaging Systems Market Competitive Landscape

The IR and thermal imaging systems market is semiconsolidated, with many regional and global players. The players, such as Teledyne FLIR LLC, L3Harris Technologies Inc., Lynred, Lockheed Martin, and BAE Systems PLC, are attempting to increase their market share through product innovation.

The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency. The sustainable competitive advantage through innovation in the market studied is high, as the buyers in the market look for more efficient solutions to optimize the process.

Barriers to exit are high due to significant research and development investments, long-term contracts, and brand identity, making it difficult for firms to leave the market easily. Competitive strategies such as product differentiation, M&A, and strategic collaboration make competition fierce in the market studied.

The market consists of long-standing established players who have made significant investments to improve product technology. Some of the vendors include Teledyne FLIR LLC, L-3 Communications, BAE Systems, and others. For instance, in October 2023, Skydio released its X10 UAV, which features a customized Teledyne FLIR Boson+ thermal camera module. As a result of the collaboration, professional public safety and critical infrastructure inspection pilots can now easily access uncooled thermal imaging technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Low Cost Solutions

- 5.1.2 Increasing Usage Across Industries

- 5.1.3 Low Impact on the Environment

- 5.2 Market Challenges

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Applications

- 6.2.1 Industrial

- 6.2.2 Security

- 6.2.3 Research and Development

- 6.2.4 Construction Industry

- 6.2.5 Maritime

- 6.2.6 Transportation

- 6.2.7 Law Enforcement Agencies

- 6.2.8 Other Applications

- 6.3 By Form Factor

- 6.3.1 Handheld Imaging Devices and Systems

- 6.3.2 Fixed Mounted (Rotary and Non-Rotary)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.5.3 Argentina

- 6.4.6 Middle East and Africa

- 6.4.6.1 Saudi Arabia

- 6.4.6.2 United Arab Emirates

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teledyne FLIR LLC

- 7.1.2 L3Harris Technologies Inc.

- 7.1.3 Lynred

- 7.1.4 Lockheed Martin

- 7.1.5 BAE Systems PLC

- 7.1.6 Leonardo DRS

- 7.1.7 Elbit Systems Ltd

- 7.1.8 RTX Corporation

- 7.1.9 Sofradir Group

- 7.1.10 Thermoteknix Systems Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS