Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627208

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627208

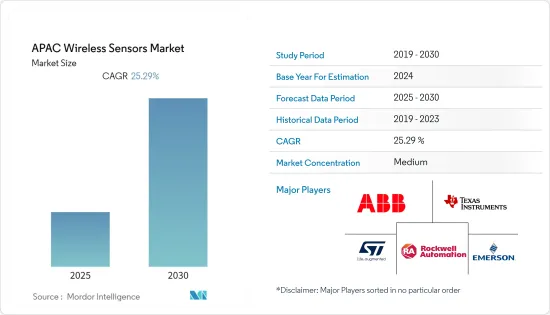

APAC Wireless Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The APAC Wireless Sensors Market is expected to register a CAGR of 25.29% during the forecast period.

Key Highlights

- The Asia Pacific market is expected to augur significant growth in the coming years. It is growing at the fastest pace, as compared to the other regions, owing to the presence of emerging countries such as India and China, which offer huge potential for growth.

- Wireless sensors are used in factory settings for data monitoring, the flow of production, and other similar functions, as well as in building automation, defense, and other industries like materials handling and food and beverage. The increasing quest for new energy sources, renewable energy development, government regulations, and rapid technological advancements are the key drivers which are making the wireless sensors market grow lucratively.

- Their usage has also increased as they are a vital component in smart grids for remote monitoring of transformers and power lines where they are put into service to monitor line temperature and weather conditions.

APAC Wireless Sensors Market Trends

Increasing Adoption of Smart Factories

- The Asia Pacific is one of the largest region in the electrical and electronics manufacturing market. The region is also a significant vendor of wireless sensor technologies, especially in China and Japan.

- Countries, such as China and Japan, are also embracing smart manufacturing, which includes the use of control systems, such as PLC, and SCADA, among others, for various purposes, such as asset monitoring and remote process monitoring. For instance, China aims to establish its intelligent manufacturing system and complete the key industries' transformation by 2025.

- Significant demand for consumer electronics devices like smartphones from countries such as China, India, Japan, and Singapore, are encouraging many vendors to set up production establishments in the region. The availability of raw materials and the low establishment and labor costs have also helped companies launch their production centers in the region.

- Moreover, the increase support and investment by the state governments for smart factories also aids their growth and, in turn, the usage of wireless sensors.

Increasing adoption of smart sensors in the region's automobile sector

- China is one of the world's largest car markets and the world's largest production site for cars, including electric cars, with much growth potential. According to the China Association of Automobile Manufacturers (CAAM), in September 2021, approximately 317,000 commercial vehicles were sold in China. Sales in China accounted for about 32.56% of global motor vehicle sales. In 2020, around 0.25 million plug-in hybrid cars had been sold in China, which increased from less than 0.1 million a few years back.

- As these industries account for a significant portion of the wireless sensor market, the region offers an excellent opportunity over the forecast period. The growing concept of connected cars and regulations regarding automotive safety is also expected to drive the adoption of wireless sensors in the region.

- The standardization of autonomous driving and advanced driver assistance systems (ADAS) in the region is expected to boost the market. Supportive government regulations aimed at passenger safety, industrial automation, environment monitoring, etc., also make the Asia Pacific substantial buyers of wireless sensors. The Chinese auto market was affected by regulations that mandate the use of TPMS for new vehicles, starting in 2019. The region houses prominent automakers, such as Toyota, Nissan, Honda, Mazda, Mitsubishi, Subaru, and Suzuki, which are potential buyers of the market.

APAC Wireless Sensors Industry Overview

The competitive landscape within the Asia Pacific Wireless Sensor market is moderately saturated as the region is home to multiple players.

- May 2020: China is expected to invest an estimated USD 1.4 trillion up till 2025, calling on urban governments and private tech giants like Huawei Technologies Co. to lay fifth-generation wireless networks, install cameras and sensors, and develop AI software that will underpin autonomous driving to automated factories and mass surveillance. Such investments are expected to develop the wireless sensor market in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51052

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of Wireless Technologies (especially in harsh environments)

- 4.3.2 Emergence of Smart Factory Concepts (Industrial Automation)

- 4.4 Market Restraints

- 4.4.1 Bandwidth Contraints and Compatibility Issues due to Variety of Standards

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Market

- 4.7 Technology Snapshot

- 4.7.1 Type of Technology

- 4.7.1.1 Bluetooth

- 4.7.1.2 WiFi and Wlan

- 4.7.1.3 ZigBee

- 4.7.1.4 Wirelessshart

- 4.7.1.5 RFID

- 4.7.1.6 EnOcean

- 4.7.1.7 Others

- 4.7.1 Type of Technology

5 MARKET SEGMENTATION

- 5.1 Type of Sensor

- 5.1.1 Pressure

- 5.1.2 Temperature

- 5.1.3 Image

- 5.1.4 Flow

- 5.1.5 Chemical and Gas

- 5.1.6 Position and Proximity

- 5.1.7 Others

- 5.2 Industry

- 5.2.1 Automotive

- 5.2.2 Healthcare

- 5.2.3 Aerospace and Defense

- 5.2.4 Energy and Power

- 5.2.5 Oil and Gas

- 5.2.6 Food and Beverage

- 5.2.7 Others

- 5.3 By Country

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 STMicroelectronics

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Rockwell Automation Inc.

- 6.1.5 Emerson Electric Co

- 6.1.6 Honeywell International Inc.

- 6.1.7 Schneider Electric SA

- 6.1.8 Endress+Hauser SA

- 6.1.9 Yokogawa Electric Corporation

- 6.1.10 Siemens AG

- 6.1.11 General Electric

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.