Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627197

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627197

Europe Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

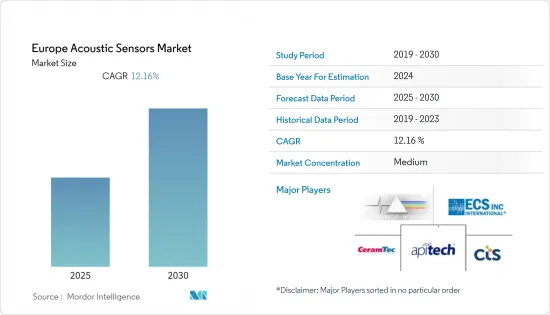

The Europe Acoustic Sensors Market is expected to register a CAGR of 12.16% during the forecast period.

Key Highlights

- The acoustic sensors are expected to have high growth during the forecast period due to their implementation in television transmitters and radios to generate signals for broadcasting. SAW devices are indispensable as filters in radio frequency applications and are essential components used in the terminals and base stations for satellite communication.

- With advancements in the communication sector, SAW and bulk-acoustic-wave (BAW) resonators, filters, oscillators, and delay lines have gained traction. Apart from being passive and wirelessly interrogated, SAW sensors are competitively priced, intrinsically rugged, highly responsive, and intrinsically reliable.

- The automotive, defense and aerospace industries are also attracting vendors in the market studied in recent years. As these sensors are insensitive to Magnetic Fields, many automotive applications require torque-sensing close to electric motors and solenoids. This is problematic for some other types of sensor technology. For instance, a UK-based company, Transense, has designed its SAW torque sensor technology for electric power-assisted steering (EPAS) in specialized vehicles and with partners McLaren for Motorsport torque-sensing products.

- In the initial phase of the COVID-19, the studied market witnessed the disruption in the supply chain owing to nationwide lockdown and closure of many manufacturing capacities. However, after the 2nd Q of 2020, the market started witnessing a recovery in demand and production; the semiconductor industry trend was also reflected in the studied market.

Europe Acoustic Sensors Market Trends

Consumer Electronics to hold the highest market share

- Consumer electronics is one of the significant investors and adopters of the SAW sensors in the past, which has played a substantial role in developing the SAW sensors and devices. The SAW sensors have played a significant role in developing RF filters across various consumer and communication applications. For instance, SAW devices are relatively simple in their composition. Due to the wide adoption of SAW filters in the smartphone industry, the sensor materials cost has dropped in the past three decades.

- There is a significant surge in RF sensors and other RF-related equipment sales due to the increasing smartphone sales and the increasing adoption of emerging RF technologies in consumer electronics, expanding the scope of the market studied.

- More than a billion acoustic wave filters, typically SAW devices, are produced, primarily for smartphones. The SAW devices act as band-pass filters in the transceiver electronics' RF and intermediate-frequency sections. This technology is also the most common for touchscreen input on smartphones or personal digital assistants. The shape of the IDT directly determines the transmission function; therefore, the design and easy fabrication of IDTs makes SAW devices widely used as filters in transceivers and other signal processing modules in consumer electronic devices like smartphones and TV sets.

- With growing advancement and functionality in the consumer electronic industry, the production and demand for SAW sensors will continue to increase in RF identification technologies. SAW technology provides a small form factor using wafer-level packaging (WLP) that improves power handling, lowers insertion loss with high rejection, and makes temperature performance dependable, making it reliable for Wi-Fi and Bluetooth applications, wireless mobile device handsets, tablets, laptops, and smartwatch, among others.

Automotive Segment to register fastest growth

- The modern automobile is witnessing rapid growth in sensor systems, fueled by the growing need for higher efficiency and reduced emissions. Surface acoustic wave sensing technology provides new opportunities for sensing pressure, torque, and temperature within the automotive safety environment, especially on rotating components.

- Europe's dominance in advanced automotive manufacturing, and now in EV, is a significant factor driving the growth of acoustic sensors in the region. According to IEA, For the first time in 2020, Europe overtook China as the center of the global electric car market. Electric car registrations in Europe more than doubled to 1.4 million, while they increased 9% to 1.2 million in China.

- Researchers around the world are actively investing in these product developments. For instance, the Germany-based University of Darmstadt developed SAW tire sensors to measure tire pressure and friction by leveraging its miniature structure and no power requirement. Siemens also announced its cooperation in this research to integrate it into the actual tire tread.

- Emerson Electric Co acquired the company's InteliSAW temperature sensing product in 2015. Moreover, in June 2020, the company's iTrack technology, used for monitoring the tire and vehicle performance of heavy-duty off-road vehicles, was licensed to Bridgestone Corporation for a ten-year term commencing.

- In December 2020, the company also formed its SAW Commercial Advisory Panel ("SAWCAP") to provide advice to the Board and Management in support of the development of commercial strategy, the implementation of marketing and sales activities to promote revenue growth, and to forge strategic alliances that enhance long term shareholder value in the SAW market.

Europe Acoustic Sensors Industry Overview

Acoustic sensors are a relatively simple device to manufacture. Consequently, the market is highly fragmented, with many global and local manufacturers contributing to the market dynamics. The MEMS market is seeing steady growth, but companies have to face cut-throat competition leading to brutal price declines and low margins. The market is continually adding new entrants into the market.

- April 2020 - In order to expand the document solutions business in Europe, Kyocera Document Solutions Inc., a domestic consolidated subsidiary, purchased 97% of the common stocks of OPTIMAL SYSTEMS GmbH, a Germany-based company that conducts enterprise content management business, and made it a consolidated subsidiary.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50727

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Telecommunications market

- 4.2.2 Low Manufacturing costs

- 4.2.3 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Use of alternatives like SAW sensors

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness- Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Wave Type

- 5.1.1 Surface Wave

- 5.1.2 Bulk Wave

- 5.2 By Sensing Parameter

- 5.2.1 Temperature

- 5.2.2 Pressure

- 5.2.3 Mass

- 5.2.4 Torque

- 5.2.5 Humidity

- 5.2.6 Viscocity

- 5.2.7 Chemical Vapor

- 5.2.8 Others

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defence

- 5.3.3 Consumer Electronics

- 5.3.4 Healthcare

- 5.3.5 Industrial

- 5.3.6 Others

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 API Technologies Corp.

- 6.1.2 ASR&D Corporation

- 6.1.3 Boston Piezo-optics Inc.

- 6.1.4 Ceramtec

- 6.1.5 CTS Corporation

- 6.1.6 ECS Inc. International

- 6.1.7 Epcos

- 6.1.8 Epson Toyocom

- 6.1.9 Honeywell International Inc.

- 6.1.10 Kyocera

- 6.1.11 Murata Manufacturing Co. Ltd.

- 6.1.12 Panasonic Corp.

- 6.1.13 Phonon Corporation

- 6.1.14 Rakon

- 6.1.15 Raltron Electronics Corporation

- 6.1.16 Senseor

- 6.1.17 Shoulder Electronics Ltd.

- 6.1.18 Teledyne Microwave Solutions

- 6.1.19 Triquint Semiconductor, Inc.

- 6.1.20 Vectron International

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers and Acquisitions

- 7.2 Investment Opportunities

8 FUTURE OUTLOOK

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.