Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627184

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627184

LA Vibration Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

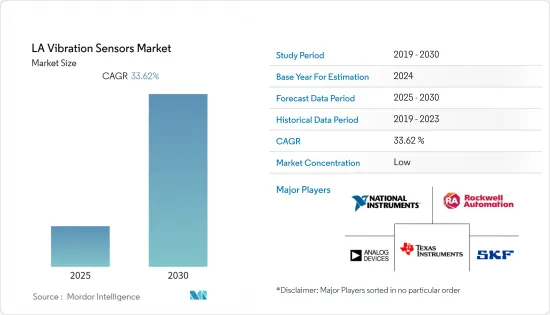

The LA Vibration Sensors Market is expected to register a CAGR of 33.62% during the forecast period.

Key Highlights

- Latin America's growth is mainly attributed to the developing economies in the region, such as Brazil and Argentina. Brazil is involved in adopting and promoting smart technology in various industries, such as consumer electronics, oil and gas, wind power, aerospace, and automotive, among others.

- The consumer electronics industry, especially smartphones, in countries like Brazil is exhibiting a moderate outlook. For instance, in 2019, the smartphone market in Brazil witnessed a boost in revenue, despite a 6% decline in the number of units sold.

- Their application in the oil and gas industry to handle the speed rotation of gears and turbines in high frequency ranges from 10 Hz to 10 kHz augments the demand further. BP PLC, an oil and gas company based out of London, United Kingdom, estimates that Brazil could attract about USD 22 billion worth of investment in the oil sector in each of the next five years. Owing to this, production is expected to increase to around 3.7 million BPD by 2025. This provides the scope for expansion, possibly in new projects. Such statistics highlight the rising demand for vibration sensors in the sector.

- Besides, owing to the ability of the sensor to be used in the wind power industry for slow rotation of turbines (1 Hz or less frequency), the scope of deployment is high in the country. The wind power sector is the largest initiative in the country and is the second-largest source in the energy matrix. According to ABEEolica (the Brazilian Wind Energy Association), the installed capacity of wind power in the country reached 16 GW, with about 637 wind farms and 7,738 wind turbines, by the first half of 2020.

- In August 2020, Dario Martinez, new energy secretary, announced the plan to promote oil and natural gas production in the country with a view to increasing exports. Such initiatives drive the demand for vibration sensors in the dominant sector. However, the COVID-19 pandemic has threatened the fracking project in the country and left the government of Argentina in a dilemma whether or not to continue support for the vast Vaca Muerta oil and gas fields in Patagonia.

LA Vibration Sensors Market Trends

Consumer Electronics to Show Significant Growth

- The rise in preference toward using smart electronic devices, growing middle-class, rising disposable income of consumers, and changing lifestyle preferences are some of the major factors driving the demand for consumer electronics, which has an indirect impact on the growth of vibration sensors.

- These sensors are used in consumer electronics for vibration detection to reduce noise and maintenance. When a PC Notebook falls, vibration and shock sensors are used to protect the data of HDDs.

- The sensors are used to detect changes in orientation and screen rotation and detect motion in three directions. The application of vibration sensors in consumer electronics is increasing as the sensors are used to calibrate the position, motion, and acceleration, with which the orientation of the phone and the changes in the screen rotation, images, and various features can be known for user purposes.

- For instance, in June 2021, Fluke Reliability, an operating company of Fluke Corporation, is proud to announce its newest product, the Fluke 3563 Analysis Vibration Sensor system. Vibration monitoring helps maintenance teams reduce unplanned downtime and prevent potentially catastrophic failures from occurring, but it has been difficult or cost-prohibitive to monitor every tier of an asset.

Accelerometers to Hold Maximum Market Share

- Accelerometers or acceleration sensors are primarily used to measure the acceleration or vibration of a moving device or system. The two main types of accelerometers used are Piezoelectric and MEMS accelerometers. The piezoelectric accelerometer is reliable, versatile, and unmatched for frequency and amplitude range. A MEMS sensor is a semiconductor that offers lower accuracy on frequency and amplitude but with improved power consumption.

- Accelerometers are used to measure the acceleration or vibration of a moving device or system. The adoption of accelerometers is increasing due to their applications in various end-user segments, such as aerospace and defense, industrial, consumer electronics, automotive, and other end-user industries, such as health care and energy.

- The increasing adoption of smart devices, such as smartphones, wearables, smart appliances, implantable or ingestible medical devices, among others that use accelerometers, is expected to drive the growth of the vibration sensors market over the forecast period.

- In April 2020, STMicroelectronics introduced a new 3-axis MEMS accelerometer device specially designed for vibration-sensing applications in smart maintenance applications. The IIS3DWB vibration sensor and the supporting STEVAL-STWINKT1 multi-sensor evaluation kit are designed to quicken the development of condition-monitoring systems.

- Also, ROHM Group company Kionix recently introduced a new set of accelerometers, KX132-1211 and KX134-1211, ideal for high accuracy, low power motion sensing applications in the industrial equipment and consumer wearable markets.

- The evolution and adoption of MEMS technology have resulted in the miniaturization of mechanical and electro-mechanical sensors and semiconductors using micro-fabrication and micro-machining techniques. This trend has further accelerated the rapid adoption of accelerometers in portable devices, as they offer enhanced capabilities in small unit sizes.

LA Vibration Sensors Industry Overview

The Latin America Vibration sensor market is highly competitive. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- Mar 2020: TE Connectivity Ltd has completed its public takeover of First Sensor AG. TE now holds 71.87% shares of First Sensor. In combination with First Sensor and TE portfolios, TE will be able to offer a broader product base, including innovative sensors, connectors, and systems, that supports the growth strategy of TE's sensors business and TE Connectivity as a whole.

- Aug 2020: Hansford Sensors Ltd launched a premium intrinsically safe triaxial range is the HS-173I Accelerometers, with PUR cable and conduit. The cable and conduit combination offers impressive compression, impact, and tensile strength. The HS-173I PUR Cable and Conduit is also available with round top design, available to order as HS-173IR. These Intrinsically Safe Triaxials are both certified for use in hazardous environments with European, the United States, and Australian approval. Sealed to IP68 and are available with a choice of options, including a range of operating sensitivities from 10mV/g to 500 mV/g and different mounting threads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50447

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dyanmics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Machine Monitoring and Maintenance

- 4.2.2 Longer Service Life, Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 4.3 Market Restraints

- 4.3.1 Compatibility With Old Machinery

- 4.3.2 Critical and Hazardous Implication on the Environment

- 4.4 Industry Attractiveness - Porter's 5 Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Threat of Substitute Products or ervices

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Bargaining Power of Buyers

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

5 Technology Snapshot

- 5.1 Type of Technology

- 5.1.1 Inductive

- 5.1.2 Piezoelectric

- 5.1.3 Magnetic

- 5.1.4 Capacitive

- 5.1.5 Optic Fiber Sensor

6 Latin America Vibration Sensors Market Segmentation

- 6.1 By Product

- 6.1.1 Accelerometers

- 6.1.2 Proximity Probes

- 6.1.3 Tachometers

- 6.1.4 Others

- 6.2 By Industry

- 6.2.1 Automotive

- 6.2.2 Helathcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Consumer Electronics

- 6.2.5 Oil And Gas

- 6.2.6 Metals and Mining

- 6.2.7 others

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

- 6.3.4 Others

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 SKF AB

- 7.1.2 National Instruments Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Emerson Electric Co

- 7.1.7 Honeywell International Inc.,

- 7.1.8 NXP Semiconductors N.V.

- 7.1.9 TE Connectivity Ltd.

- 7.1.10 Hansford Sensors Ltd.,

- 7.1.11 Bosch Sensortec GmbH (Robert Bosch GmbH)

8 Investment Outlook

9 Future of Latin America Vibration Sensors Market

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.