PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627177

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1627177

MEA Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

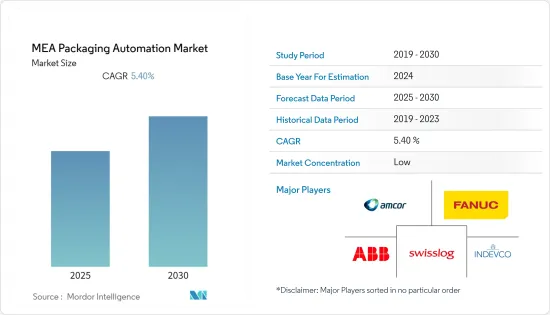

The MEA Packaging Automation Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- Many motion control systems are designed to package industrial products for safe and efficient use by consumers. Existing packaging automation industries include food and beverage processors, component manufacturers, and home and garden, suppliers. New users include the medical, laboratory, and pharmaceutical industries with special demands on accuracy and cleanliness.

- Businesses in the Middle East and Africa are looking for automated solutions to reduce labor costs and keep up with global supply trends. International food trends are entering the Middle East market much faster as people can see what is being offered elsewhere on social media. The company's RE shifted, for example, from providing simple trays or X-ray sealers to providing turnkey production lines with automatic feeders for assembling process equipment, conveyors, packaging machines, and cartons.

- Additionally, local governments, the UAE, are committed to addressing sustainability challenges, aiming to recycle 75% of UAE waste, and the 6th edition of the largest food and beverage processing and packaging trade fair in the Middle East and Asia and Africa at the Dubai World Trade Center (DWTC), providing a platform for manufacturers to demonstrate their commitment to creating packaging solutions to meet growing industrial and consumer demand.

- The growing demand for packaged food provides a significant market share for producers in the region. Most food companies are working to engage consumers with updated packaging better. Manufacturers are required to keep upgrading the products to the latest trends as the growth for packaging automation in this region is expected to grow during the forecast period.

- The global outbreak of COVID-19 significantly impacted the Middle East and Africa Packaging Automation; since the outbreak of the pandemic, the demand for certain packaging has increased. However, some sectors have experienced the negative impact of the imposed travel restrictions. For instance, in the UAE, the demand for alcoholic beverages in the beverage packaging market has declined sharply.

MEA Packaging Automation Market Trends

Demand for Food and Beverage Packaging on Rise

The Middle East and Africa are regions where food is emphasized with cultural and religious reasons for which technology is particularly important in primary and secondary packaging solutions production.

- According to Gulfood Manufacturing, a food and beverage processing, and packaging company, the volume of food trade has increased by 21%; despite the COVID-19 pandemic, the country achieved a 3% growth in food and beverage exports.

- The packaging machinery industry is rapidly shifting to technology to develop innovative solutions for future-ready packaging and advanced processing, manufacturing, and supply chain models. For instance, Jacob White supplies cartoning machines to Gulf Cooperation Council (GCC) area, working closely with clients to deliver and meet their requirements.

- With the increase in the food sector every year with new restaurants, delivery apps, and food chains across the region, the manufacturers and distributors require robust and reliable machinery for packaging trays, bags, and more. The packaging for frozen food is also considered, and unique challenges are met by the companies to meet the customer requirements.

- Companies are also concentrating on expanding their business across the regions and improving their products. For instance, in May 2021, Huhtamaki established a plant for its fiber packaging in South Africa. This new facility will allow it to better serve the growing textile packaging sector and future demand for sustainable packaging. This also greatly strengthens our position in this area.

- The increasing adoption of automation in the packaging industry will not only improve the efficiency of packaging lines but will also pave the way for the digital future of packaging machines over the forecast period, opening up new opportunities.

Saudi Arabia to hold highest market share

Saudi Arabia holds the highest market share in the packaging industry in various industries such as food, beverage, pharmaceutical, and more. The major player in this region is investing in the research and the development of new product innovations.

- The regional online food delivery and q-commerce platform Talabat in July 2021 launched a sustainable packaging program to reduce plastic waste and carbon emissions across the region, starting with pilot operations in the UAE and Qatar. This program will be available for restaurant partners and vendors to be adopted.

- According to research conducted by Delivery Hero, consumers wanted a more sustainable delivery ecosystem. 92% of UAE customers considered ordering from restaurants that offer organic packaging, and 2/3 of UAE customers order more from restaurants that offer organic packaging.

- New rules and regulations have been introduced in the plastic packaging by Saudi Standards, Metrology and Quality Organization (SASO), such as limiting the application of the technical regulations for biodegradable plastics to all products listed only in the first stage of the Regulation. This includes plastics that are once used, such as woven barley bags. The implementation of the second and third phases of the regulation has therefore been suspended.

- The government industrial packaging printing press makes investments in Saudi Arabia, an order of two new presses was placed in Riyadh. According to a survey conducted as a call for smart packaging for pharmaceutical products, about 95% said they were involved in storing medicines at home. Among them, 80.9% reported first aid and additional treatment, and 43.2% answered that they were treating chronic diseases. A little over 35% said that they store drugs because they don't know how to throw them away.

- Ball Corporation also adopts to refining and improving the technology that is suitable for the consumers and develops products such as new metal alloy that adds recyclable material to the products reducing its weight and is innovating new beverage products in the region.

MEA Packaging Automation Industry Overview

The Middle East and Africa Packaging Automation Market is highly competitive and fragmented due to the presence of key players such as Indevco Group, Amcor Worldwide, ABB Ltd, Swisslog Holding Ag, Fanuc Corporation, and more. These companies are focusing on innovating new products by adopting new technologies and equipment to meet the rising demand for packaging in the region.

- October 2020 - Fanuc Corporation and NTT Communications Corporation announced the establishment of DUCNET CO., Ltd, a new compnay that will offer a cloud service to support digital transformation first in the machine tool industry and subsequently in the broader manufacturing industry.

- October 2021 - Indevco and Napco National collaborated to showcase 100% sustainable packaging solutions. The sustainable brands include biodegradable packaging, lightweight and recycled content packaging, renewable packaging, and more. INDEVCO and Napco National minimize the environmental impact of operations by reducing carbon footprint through machinery optimization and less energy consumption.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Pressure on Manufacturers to Cut Down Operating Costs

- 5.2.2 Reduces Machine Downtime and Product Waste

- 5.2.3 Emerging Markets are Emerging as Low Cost Labor and Increased Competition

- 5.3 Market Restraints

- 5.3.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Businesses Type

- 6.1.1 B2B e-commerce retailers

- 6.1.2 B2C e-commerce retailers

- 6.1.3 Omni Channel Retailers

- 6.1.4 Wholesale Distributors

- 6.1.5 Manufacturers

- 6.1.6 Personal Document Shippers

- 6.1.7 Others

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Household

- 6.2.5 Beverages

- 6.2.6 Chemical

- 6.2.7 Confectionary

- 6.2.8 Warehouse

- 6.2.9 Others

- 6.3 By Product Type

- 6.3.1 Filling

- 6.3.2 Labelling

- 6.3.3 Horizontal/Vertical Pillow

- 6.3.4 Case Packaging

- 6.3.5 Bagging

- 6.3.6 Palletizing

- 6.3.7 Capping

- 6.3.8 Wrapping

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mitsubishi Electric Corporation

- 7.1.2 Rockwell Automation

- 7.1.3 Swisslog Holdings AG

- 7.1.4 Emerson Industrial Automation

- 7.1.5 ULMA Packaging

- 7.1.6 ATS Automation Tooling Systems

- 7.1.7 ABB Ltd.

- 7.1.8 Schneider Electric

- 7.1.9 DENSO-Holding GmbH & Co. KG

- 7.1.10 Fanuc Corporation

- 7.1.11 Gerhard Schubert GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET