PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626906

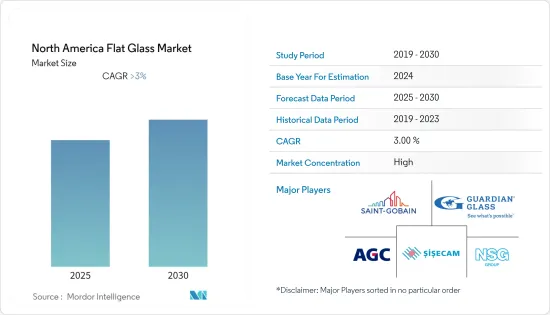

North America Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Flat Glass Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 pandemic significantly impacted the North American flat glass market's growth in 2020 and 2021 due to several factors, such as nationwide lockdowns and a decline in investments. However, the post-COVID-19 pandemic, ease in the travel ban, rise in transportation activities, and mass vaccination program in 2021 have aided the automotive industry, fueling automobile sales. So, the demand for flat glass in the region is being fueled by the growth of the auto industry.

Key Highlights

- Growing demand for electronic displays and increasing demand from the construction industry are driving the market.

- On the flip side, fluctuating raw material prices are hindering the growth of the market.

- In the near future, the growth of the market is likely to benefit from the progress in the automotive industry.

- The United States is expected to account for the largest share of the North American flat glass market.

North America Flat Glass Market Trends

Construction Industry to Drive the Demand for Flat Glass

- The construction industry is the largest end-user segment of the market studied. Moreover, the ongoing trend of smart city projects in Canada and Mexico is also anticipated to drive flat glass demand.

- Over the past decade, the construction industry in Canada has experienced high growth. For instance, in 2021, the total value of building permits in Canada jumped 14.1% in November to USD 11.0 billion.

- Moreover, the growing healthcare investments in Canada have been driving the growth of the market studied. The QEII New Generation Project is one of the largest healthcare projects. Under this, the Department of Healthcare and Wellness, along with others, is planning to provide specialized healthcare services to the citizens. The projects include Hants Community Hospital, Dartmouth General Hospital, QEII Cancer Center, Hospice Halifax, and others. The recent one includes the construction of Bayer's Lake Community Outpatient Center in Halifax, Canada, by Ellisdon Infrastructure Healthcare (EDIH). The construction is expected to cost USD 197.3 million and be operational by 2023.

- Glasses are being used extensively in the construction industry in windows, facades, doors, interior partitions, balustrades, shop fronts, and railings for stairs and balconies, among other building parts, providing a potential opportunity for flat glasses.

- In 2021, the construction industry in Mexico recovered from a sharp decline due to COVID-19, recording a growth of 32.5% in 2021. Therefore, the increase in investments in the construction industry in the country is estimated to create demand for flat glass in the country.

- Flat glass was previously used for smaller windows in domestic housing because larger windows required toughened glass.Currently, flat glass can also be toughened by putting it through a heating process, which very nearly melts it, and then cooling it to ambient temperatures using a jet of cold air. This glass requires greater pressure to break. This characteristic makes the glass suitable for use in building applications.

- Due to all of these things, the market for flat glass is expected to grow over the next few years.

United States to Dominate the Market

- The US construction industry kept growing thanks to a strong economy, good market fundamentals for commercial real estate, and more money from the federal government and states for public works and institutional buildings.

- The construction industry in the United States is the largest in North America. For instance, the new construction put in place in the United States in 2021 was valued at almost USD 1.6 trillion, which shows an increase of 8.25 percent compared with 2020. Moreover, construction spending has been growing steadily over the last couple of years. Therefore, this has created upside demand for the flat glass market in the country.

- According to the U.S. Census Bureau, the value of public residential construction spending in the United States has significantly risen from 2002 to 2021. In 2021, the public sector spent over $9 billion on residential construction projects, which was a slight decrease in comparison to 2020. Moreover, the overall value of new residential construction put in place in the U.S. is expected to increase over the coming years.

- In the United States, due to the ongoing chip and semiconductor shortages, the production of passenger cars in the country has been declining for the past 7 years. Other reasons that have significantly contributed to the decline of automotive manufacturing are a slowdown in innovation, an increase in the cost of raw materials, and supply chain management issues. For instance, in 2021, approximately 1,563,060 units of passenger cars were produced, which shows a decline of 19% from 2020 and a decline of 38% when compared to 2019. Therefore, this is likely to affect the flat glass market in the country.

- However, as the logistics and e-commerce industries grow, so does the demand for LCVs. Furthermore, rapid urbanization has created new retail and e-commerce platforms, which require efficient logistics, leading to the growth of light commercial vehicles. For instance, even though in 2020, light commercial vehicle production in the United States declined by 16.8%, it reached 73,15,903 units in 2021, which shows a recovery of 10% compared to 2020. Therefore, this has created upside demand for the flat-glass market in the country from the light commercial vehicle segment.

- Some of the upcoming projects that are in the pipeline for the construction sector to boom in the country are:

- Due to all of these things, it is expected that the demand for flat glass in the region will rise over the next few years.

North America Flat Glass Industry Overview

The North American flat glass market is consolidated in nature. The major companies include (in no particular order) Saint-Gobain, AGC Inc., Guardian Glass LLC, Nippon Sheet Glass Co. Ltd., and Sisecam Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Electronic Displays

- 4.1.2 Increasing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Annealed Glass (Including Tinted Glass)

- 5.1.2 Coater Glass

- 5.1.3 Reflective Glass

- 5.1.4 Processed Glass

- 5.1.5 Mirrors

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive

- 5.2.3 Solar

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 CPS

- 6.4.3 BY CARDINAL GLASS INDUSTRIES, INC

- 6.4.4 China Glass Holdings Limited

- 6.4.5 Fuyao Glass Industry Group Co., Ltd

- 6.4.6 Guardian Industries Holdings

- 6.4.7 Nippon Sheet Glass Co. Ltd

- 6.4.8 Saint-Gobain

- 6.4.9 SCHOTT

- 6.4.10 Sisecam

- 6.4.11 Vitro

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in the Automotive Industry