Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626905

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626905

MEA Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

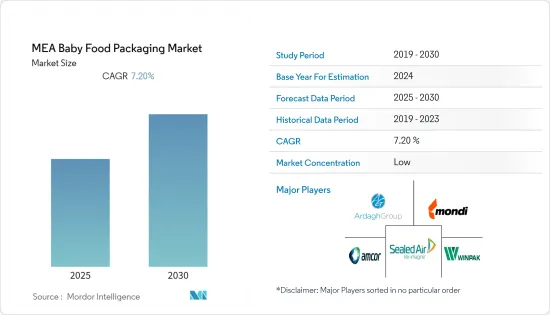

The MEA Baby Food Packaging Market is expected to register a CAGR of 7.2% during the forecast period.

Key Highlights

- High birth rates, increasing consumer awareness, and higher disposable income are the factors driving the demand for baby food packaging solutions in the region. Another factor that is augmenting the need for packaging solutions is an innovation, led by baby food manufacturers to meet varying consumer needs.

- Companies in the region are increasingly using sustainable and recyclable packaging materials. They are constantly looking for green, innovative, and recyclable alternatives to normal packaging.

- The significant growth in the middle class in this region has opened new opportunities in the baby food packaging market, as the need for products compatible with a working women's schedule is growing.

MEA Baby Food Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- The region is generally hot; baby foods are often stored in pouches or protective packages to reduce the chances of damage and staling. Moreover, they are easy to carry and small pouches which are for one-time use and throw, plastic packagings are cost-effective.

- Protective packaging, such as air pillows and bubble wraps, are expected to hold the prominent share in the forecast period as freight transit often includes rough handling or bumps in the road, thus, creating the imperative need for bubble wraps and air pillows in the baby food packaging industry supply chain forms a sturdy barrier against impact.

- In powder milk formula, the launch of single-serve plastic sachets, for instance, by the Enfamil brand, indicates the busy life of working parents and thus, increases the importance of ready nutrition products.

Saudi Arabia to Hold the Largest Market Share

- Saudi Arabia has a rapidly developing retail sector, and the market for baby food has grown steadily. The demand for baby food in Saudi Arabia has further potential for growth given the increased exposure to Western lifestyles, the underlying strength of the economy. As the baby food segment by volume grew, the packaging market also has seen heights.

- Saudi Arabia is one of the major economies in the Middle East and Africa. Growing disposable income in African countries has led to rising in the affordability of baby food products, which has resulted in improved quality food from the infant stage. The growth of the baby food/formula market is also being driven by the increasing number of migrants settling for employment purposes.

- The rise in the number of working women over the past five years is expected to favor the market for baby food packaging. According to the world bank, the working women population in the country is more than 48% till 2020.

- As the sector of baby food production grew in the region, the packaging market also grew as they are directly proportional. Post COVID-19 parents are preferring healthy, sustainable, eco-friendly, and one-time-use packaging for the safety of their babies and environment.

- Saudi Arabia is one of the largest consumers of plastic products in the GCC region. According to the recent estimates of GPCA, the country has over 95 kg per capita consumption of plastics, making it the largest consumer of plastic products in the entire GCC.

- Strict government targets have been set for annual collection and recycling over the next five years, and the EPR will see investment in collection infrastructure in the country. Any company or brand that makes or imports any form of packaging for distribution in South Africa will be required to pay an extended producer responsibility (EPR) fee per ton from May 2021. This has encouraged vendors to look for alternative packaging solutions such as paper and renewable plastic packaging.

MEA Baby Food Packaging Industry Overview

The baby food packaging market is highly fragmented, owing to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Ardagh Group, Amcor Ltd, Mondi Group, and Sealed Air Corporation, Winpak Limited, among others.

- July 2021- Al Bayader International, the packaging and cleaning solutions provider, has secured medium-term financing to build the region's largest food packaging industrial complex in Sharjah's Al Sajaa Industrial City. When completed in 2023, the facility will quadruple its total production capacity to over 120,000 tonnes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 48782

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand of Packaged Baby Food and Infant Formula

- 4.3.2 Increasing Working Women in Urban Areas residing Population

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations over Single-Use Plastic-based Packaging

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.2.6 Other Packaging Type

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.4 By Country

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ardagh Group

- 6.1.2 Amcor Ltd.

- 6.1.3 Sonoco Products Company

- 6.1.4 Mondi Group

- 6.1.5 Berry Global Inc.

- 6.1.6 Rexam PLC

- 6.1.7 Winpak Ltd.

- 6.1.8 AptarGroup

- 6.1.9 Uflex Ltd.

- 6.1.10 Hindustan National Glass

- 6.1.11 Constantia Flexibles

- 6.1.12 Tetra Laval

- 6.1.13 DS Smith Plc

- 6.1.14 Ball Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.