PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626333

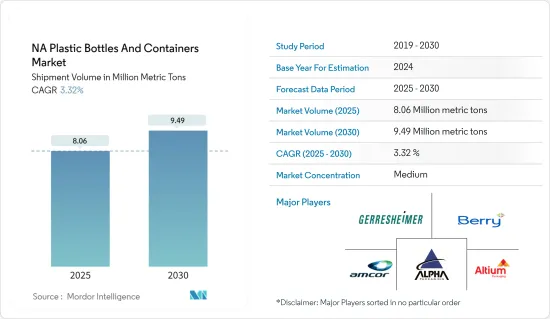

NA Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The NA Plastic Bottles And Containers Market size in terms of shipment volume is expected to grow from 8.06 million metric tons in 2025 to 9.49 million metric tons by 2030, at a CAGR of 3.32% during the forecast period (2025-2030).

Well-established manufacturing capabilities and a resilient export sector mark North America's plastic bottles and containers market landscape. Packaging plays a pivotal role in the consumption of both consumer and industrial products. In North America, the rising demand for sustainable and convenient packaging solutions is propelling the market's growth.

Key Highlights

- While several emerging nations are making their mark, the United States remains a dominant player in the global pharmaceutical arena. Home to major pharmaceutical companies, the United States not only commands a significant market share but also provides its consumers with access to cutting-edge products. This robust pharmaceutical landscape is spurring innovations and advancements in the plastic bottles and containers market.

- For example, in February 2023, Berry Global, a US company, unveiled a comprehensive solution tailored for the pharmaceutical and herbal markets. This new offering, known as the Berry Healthcare bundle, includes a diverse range of 28 mm neck PET bottles spanning sizes from 20 ml to 1,000 ml and features eight closures with tamper-evident and child-resistant attributes.

- The North American beauty and personal care industry, which includes everything from cosmetics to skincare, is witnessing a surge in demand for premium and innovative products. This trend is driving leading brands to enhance their offerings.

- The rising demand for personal care products is significantly boosting the plastic bottles and containers market. This surge is largely due to the practicality, cost-effectiveness, and versatility of plastic packaging. As consumers lean toward convenience and innovative designs in cosmetics and personal care, plastic containers are emerging as the go-to solution. Plastic bottles can adeptly cater to the diverse needs of the beauty and personal care industry, including lotions, creams, shampoos, and serums.

- The expanding functional beverage industry in North America is fueling market growth. This can be attributed to the convenience and portability of plastic packaging, resonating with consumers' increasing preference for on-the-go and health-centric beverages.

- In March 2024, Roar Organic, a beverage company based in the United States, secured a USD 10 million investment from a local firm. This funding aims to broaden Roar's product lineup, helping the company introduce flavored, non-carbonated "functional" drinks in both ready-to-drink and powdered formats. Such strategic investments are poised to bolster the market's growth in the coming years.

- In the United States, PET and HDPE dominate the market. With manufacturers favoring plastic for its cost-effectiveness and ease of use, PET bottles are expected to hold a significant market share.

- However, as environmental awareness grows, the momentum behind plastic usage is expected to decline. A notable shift is evident in the United States and Canada, where consumers are gravitating toward eco-friendly packaging solutions. Recognizing the environmental hazards linked to plastic, both countries have enacted stringent regulations, leading to a tempered growth rate for plastic compared to alternative materials.

- Nevertheless, the rising demand for sustainable plastic bottles is opening new avenues for companies in the market, particularly in terms of developing recycled materials.

Key Highlights

North America Plastic Bottles & Containers Market Trends

Rising Demand for Beverage Packaging Attributes is Increasing the Usage of Polyethylene Terephthalate (PET)

- Polyethylene terephthalate (PET) is a preferred choice for beverage packaging owing to its robust barrier properties against water vapor, gases, dilute acids, oils, and alcohol. Beyond its protective qualities, PET boasts shatter resistance, moderate flexibility, and recyclability. Its durability and steadfastness make PET an ideal choice for food-grade products, including individual drink bottles and containers.

- According to Earth Day Organizers, the United States sees a staggering sale of about 1 million plastic bottles every minute, primarily fueled by the region's demand for packaged drinking water.

- While the carbonated soft drinks (CSD) segment has seen a surge in plastic bottle usage, it is now reaching saturation in North America. Industry giants, including Pepsi, Coca-Cola, and Keurig Dr Pepper, reported stagnant sales in their North American CSD divisions. Coca-Cola's annual report estimated that these three companies commanded over 80% of the North American market share. This dominance suggests a continued demand for plastic bottles in the CSD segment.

- In March 2024, Roar Organic, a United States-based beverage company, attracted a USD 10 million investment from local firm Factory LLC to expand its product range, including flavored, non-carbonated "functional" drinks in ready-to-drink and powdered formats. Such investments are expected to create opportunities for the market during the forecast period.

- Soft drink packaging is predominantly led by polyethylene terephthalate (PET) bottles due to PET's superior CO2 retention. However, the versatility of PET packaging is not limited to soft drinks; it also encompasses fruit juices, energy drinks, sports drinks, and a range of alcoholic beverages, including wine, spirits, and beer. With the United States witnessing a surge in spirits sales, the demand for 100% PET bottles is projected to boost the regional market growth.

Plastic Packaging Adoption is Set to Surge in the Cosmetics Industry

- Plastic stands out as the preferred material for cosmetics packaging. Its flexibility enables detailed designs, and its protective nature ensures the safety of the products within. Consequently, plastic bottles and containers dominate the cosmetics industry's packaging landscape, securing a substantial market share.

- According to data from the Packaging Machinery Manufacturers Institute (PMMI), plastic packaging, including bottles, jars, compacts, and tubes, commanded a dominant 61% share in the cosmetics and personal care industries. Among these, plastic bottles were particularly prominent, accounting for a notable 30% of the market independently.

- The United States is a leading market for cosmetics, personal care items, and fragrances. A significant segment of the US millennial population fuels the market demand. As the dominant force in the nation's workforce, millennials prioritize personal care products-like deodorants, perfumes, and cosmetics-underscoring the importance of physical appearance. Consequently, as the demand for cosmetics surges, there is a parallel uptick in the demand for packaging, including plastic containers, across the region.

- In a concerted effort toward sustainability, cosmetic companies are increasingly pursuing eco-friendly plastic packaging solutions. Highlighting this dedication, in August 2020, L'Oreal USA, in collaboration with 60 other brands, government representatives, retailers, and NGOs, made a commitment to have all plastic packaging in the US be either reusable, recyclable, or compostable by 2025.

North America Plastic Bottles & Containers Market Overview

The North American plastic bottles and containers market is fragmented and consists of several players. In terms of market share, a few major players currently dominate the market. These players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Geopolitical Developments on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging

- 5.1.2 Plastic Packaging Adoption Set to Surge in the Cosmetics Industry

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Materials Prices

- 5.2.2 Growing Environment Concerns Over the Use of Plastics

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Polyethylene Terephthalate (PET)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 low-density polyethene (LDPE)

- 6.1.4 high-density polyethene (HDPE)

- 6.1.5 Others Materials Types

- 6.2 By End-user Vertical

- 6.2.1 Beverage

- 6.2.1.1 Alocholic Beverages

- 6.2.1.2 Non-Alocholic Bevearges

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other End-user Verticals

- 6.2.1 Beverage

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alpha Packaging Inc.

- 7.1.2 Altium Packaging (Loews Corporation)

- 7.1.3 Gerresheimer AG

- 7.1.4 Graham Packaging Company LP

- 7.1.5 Berry Global Group Inc.

- 7.1.6 Plastipak Holdings Inc.

- 7.1.7 Amcor Plc

- 7.1.8 Graham Packaging

- 7.1.9 AptarGroup Inc.

- 7.1.10 Comar LLC

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET