PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626309

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626309

North America Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

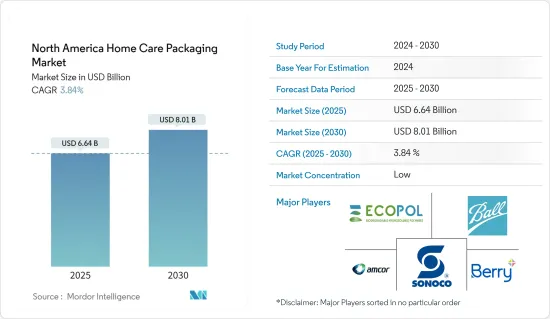

The North America Home Care Packaging Market size is estimated at USD 6.64 billion in 2025, and is expected to reach USD 8.01 billion by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

Key Highlights

- The North American homecare market is experiencing significant growth and evolution. Store shelves are filled with a diverse range of household cleaning products, from laundry detergents to spray cleaners. The homecare market covers a broad spectrum of products focused on cleaning and hygiene. This includes dishwashing agents, insecticides, laundry care items, toiletries, polishes, air care products, and others. These products frequently feature innovations such as easy-to-open caps, resealable closures, and ergonomic handles. When packaging home care products, key considerations extend beyond just appealing design to include safety, functionality, and user-friendliness.

- Packaging trends, such as low cost, ease of use, and easy storage, have remained the major consumer trends in the home care packaging market. Small pack sizes, offering affordability to the entire consumer base, have emerged as more favorable alternatives among brand owners seeking a competitive edge in the market.

- Additionally, companies are increasingly adopting refill solutions. Refill pouches for soaps, cleaners, and detergents enable consumers to reuse their existing bottles, sprayers, and dispensers at home. These lightweight pouches, which are easy to ship, cater to the growing trend of purchasing refill products online. Furthermore, customizable stand-up pouches not only provide an intuitive dispensing system but also offer enhanced protection, ensuring they endure the challenges of e-commerce fulfillment. Notably, Amcor's range of refill-ready home care pouches aligns with the new e-commerce standard, ISTA6A.

- Plastic and metal dominate as the preferred packaging materials for toiletries and home care products, including detergent bottles and polish storage items in the region. As this product category continues to expand, the demand for these materials is projected to rise in tandem. In North America, 73% of P&G's fabric care packaging, encompassing brands like Tide, Gain, and Downy, is recyclable. P&G has set an ambitious target, aiming to elevate this figure to over 99% recyclability by the close of 2023. These initiatives are poised to bolster market growth.

- However, rising oil prices are inflating the cost of plastic resins throughout the supply chain, driven by unprecedented surges in energy prices. Additionally, the glass industry faces challenges due to energy supply concerns, as processes like melting sand, soda ash, and limestone are energy-intensive. Consequently, fluctuations in raw material prices are poised to impede market growth.

- Nevertheless, manufacturers are developing packaging solutions that minimize the use of virgin materials and enhance the rates of post-consumer (PCR) and post-industrial (PIR) recycling. Beyond the emphasis on consumer recycling, numerous vendors have adeptly focused on collecting and recycling waste generated during the manufacturing process. Additionally, companies are exploring bioplastics (bio-based plastic resins) as a strategy to further diminish their carbon footprint.

- Furthermore, many North American packaging manufacturers, including Puracy, a company specializing in plant-based cleaning products, are increasingly adopting sustainable packaging solutions. Puracy has transitioned through several packaging stages: starting from disposable plastic, moving to a refillable bottle, then a pouch, and finally settling on the Clean Can system, which features a refillable aluminum can. This evolution in packaging choices is poised to drive up the demand for home care packaging in the region.

- In addition to this, Craft Naturals, a Canadian company, is introducing hand soaps and shampoos packaged in recyclable cans, merging convenience with sustainability. Customers can either transfer the contents of the can into a refillable bottle or directly attach a pump dispenser to the top of the recyclable aluminum can. This move underscores the rising trend of prioritizing sustainability in household products.

North America Home Care Packaging Market Trends

Dishwashing is expected to Hold a Significant Share

- Urbanization and rising consumer spending are key drivers behind the growing demand for dishwashing products in the region. Heightened awareness of health and hygiene, coupled with increased consumer spending, has spurred a robust demand for home care products, particularly dishwashing items. Data from the United Nations Human Settlements Programme (UN-HABITAT) highlights this trend: In 2020, 82.6% of North America's population resided in urban areas, with projections suggesting this figure will climb to 89% by 2050. This urban population surge is poised to boost the demand for home care products further.

- Growing awareness of the harmful chemicals in conventional dishwashing products is driving a surge in demand for organic dishwashing detergents and liquids. In response, leading brands are promoting their offerings with appealing labels like "100% Natural," "Chemical-Free Formulations," and "Dermatologically Tested," aiming to attract eco-conscious consumers. For example, in January 2023, Tru Earth unveiled a new addition to its household cleaning lineup. Their dishwasher detergent tablets, touted as eco-friendly, aim to minimize single-use plastic waste. Designed for versatility, these tablets effectively clean dishwashers, flatware, and cookware. Each tablet tackles grease and stains and features an integrated rinse aid, ensuring dishes come out sparkling clean-all while being gentle on the environment.

- Moreover, numerous brands in the region are offering high-quality products at competitive prices. These brands focus on delivering dishwashing soaps and liquids in visually appealing packaging formats. Several industry players collaborate to launch fully recyclable, mono-material flexible plastic packaging.

- For instance, in 2022, Mondi partnered with Reckitt Benckiser Group to unveil a fully recyclable, mono-flexible plastic packaging for their Finish Dishwasher Tablet Quantum Ultimate. Mondi supplied the BarrierPack recycled packaging for RB's premium Finish dishwasher tablet line. In contrast, RB's Finish dishwasher tablet range previously utilized a non-recyclable, multi-layered, multi-pouch, multi-material laminate. This shift to new recycled packaging aligns with RB's commitment to achieving 100% recyclable plastic packaging by 2025.

- These developments underscore the growth of the home care packaging industry, driven by the surging demand for dishwashing products in the region.

Plastic Packaging is Driving the Market

- Plastic's prevalent use in key packaging forms, including bottles, pouches, and jars, has established a robust market for the material. Its inherent flexibility, strength, and durability make plastic the preferred choice for packaging a diverse range of products, from liquids to creams and powders. Unlike many other materials, plastic's malleability allows it to be easily molded into various shapes.

- Key drivers fueling the demand for plastic products include the expansion of the retail sector, the rise of dual-income households, and a growing appetite for PET bottles in home care products. Beyond its advantageous properties, innovations such as tamper-evident caps and closures are gaining traction, adding significant value for brand owners. Consequently, this trend has bolstered the adoption of plastics in many home care products.

- Additionally, companies are prioritizing recycling initiatives in North America as a key strategy to combat ocean-borne plastic pollution and tackle poverty. The initiative seeks to enhance recycling awareness and advocate for responsible plastic usage. Each recycled bottle symbolizes a fresh revenue stream or economic chance for those involved in the program. For instance, SC Johnson, a US-based firm, has unveiled the globe's inaugural 100% recycled ocean plastic bottle under its Windex brand, a testament to its commitment to curbing oceanic plastic pollution.

- Moreover, Henkel has partnered with Plastic Bank to integrate social plastic into the packaging of its beauty care products and those from its consumer business units. Both companies are committed to reducing plastic waste in oceans and uplifting impoverished communities. In a notable move, Henkel has joined forces with Plastic Bank, a social enterprise focused on intercepting plastic waste before it reaches oceans and waterways. Through its laundry and beauty care divisions, Henkel has rolled out product packaging made entirely from recycled plastic. Additionally, up to half of this packaging will feature social plastic, sourced proactively to prevent it from entering oceans or waterways.

- As reported by Happi Magazine, in 2023, all-purpose cleaners and disinfectants topped the list of household cleaning products in the U.S., achieving sales surpassing USD 1.70 billion. Toilet bowl cleaners followed, with sales nearing USD 669.44 million. This surge in sales is expected to drive market growth during the forecast period.

- However, concerns regarding the environmental impact of plastics, combined with the easy access to eco-friendly alternatives such as paper, metal, and glass, have slowed market growth over the last decade. Nevertheless, with the emergence of biodegradable plastics and improved recycling initiatives, plastics are poised to retain their presence in home care packaging.

North America Home Care Packaging Industry Overview

The North American home care packaging market is competitive and has several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share are expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase market share and profitability. Home care packaging manufacturers are equipped with diverse solutions, assisting brands in achieving retail-ready packaging. Whether brands need transit packaging or promotional bundles, these manufacturers prioritize each brand's specific needs.

Furthermore, home care product makers ensure their bottles grab attention and boast attractive, sustainable, and functional designs. With an emphasis on sustainability, packaging experts offer custom multi-layer options to help products shine on the shelf. For instance, U.S.-based Graham Packaging, a manufacturer specializing in home care packaging, utilizes technologies such as AccuStrength. This enables them to produce lightweight containers that not only maintain performance but also reduce plastic consumption and freight expenses. Furthermore, these recyclable packages have the capability to include post-consumer resin (PCR), supporting brands in meeting their ambitious sustainability goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Surging Demand Of Refillable Light Weight Pouches

- 4.4.2 Growing Demand for Plant-based Cleaning Products

- 4.5 Market Restraints

- 4.5.1 Growing Oil Prices to Hinder Market Growth

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Cartons

- 5.2.4 Pouches

- 5.2.5 Other Products Types

- 5.3 By Home Care Products

- 5.3.1 Dishwashing

- 5.3.2 Insecticides

- 5.3.3 Laundry Care

- 5.3.4 Toiletories

- 5.3.5 Polishes

- 5.3.6 Air Care

- 5.3.7 Other Home Care Products

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Berry Global Inc.

- 6.1.3 Ball Corporation

- 6.1.4 AptarGroup Inc

- 6.1.5 Sonoco Products Company

- 6.1.6 Silgan Holdings

- 6.1.7 Constantia Flexibles Group GmbH

- 6.1.8 DS Smith Plc

- 6.1.9 Can-Pack SA

- 6.1.10 Ecopol America Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS