PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1626304

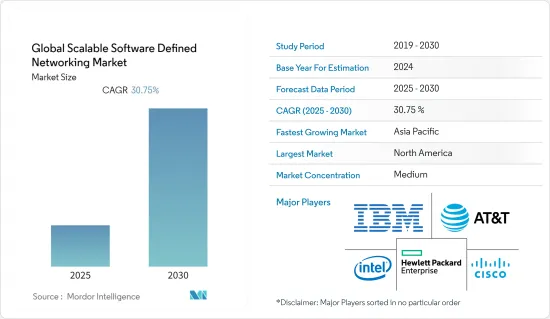

Global Scalable Software Defined Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Scalable Software Defined Networking Market is expected to register a CAGR of 30.75% during the forecast period.

Key Highlights

- A software-defined Network creates and maintains a virtual network or uses software to command conventional hardware. Businesses of all sizes and industries are embracing SDN as a means to boost the efficiency and intelligence of their networks while decreasing complexity.

- Enterprises are being compelled to re-evaluate their traditional network architectures by the emergence of cloud computing technologies, the proliferation of mobile devices, server visualization, and other AI-enabled technologies. Using SDN networking allows control of these app flows from one centralized hub. Network engineers can therefore manage the network using the SDN controller without the need to access individual networking devices.

- The growing demand for user and business traffic in the telecom industry is urging for a more secure and centralized system for smooth functioning. SDN is the technology that will help telcos manage energy demands and their carbon footprint. Based on anticipated traffic and the most power-efficient devices that can fulfill the need, the SDN control plane might determine the maximum number of devices necessary. The remaining are subsequently switched to standby mode.

- The COVID-19 pandemic has increased demand for cloud-based solutions as companies adopted remote working strategies. For the employees to work remotely, networking infrastructure has been relocated. Scalable Software Defined Networking Technology played an important role in efficiently working these IT infrastructures, as there was a higher use of VPNs (virtual private networks).

- Security Concerns and cyber attacks are restraining the growth of the SDN market. Attackers need to get access to one node, i.e, the SDN controller to take over control of the security of the entire network.

Scalable Software Defined Networking Market Trends

BFSI Sector is Benefitting from the Studied Market

- The financial sector is moving towards rapid digital advancements and urging customers to adopt the DIY model for significant activities. Using SDN technologies, infrastructure management will be automated, and it will not only assist in decreasing risk but will also pave the way for future technological and commercial innovation. SDN reduces the number of human touchpoints and, in some situations, eliminates people from the process, thereby reducing operational risk.

- To gain a competitive edge in the market, 32% of banks now use AI technologies, including speech recognition, predictive analytics, and others.

- March 2022 - UCB Bangladesh (United Commercial Bank Limited), in partnership with UiPath, implemented Robotic Process Automation (RPA) to switch to a digital platform for its banking operations. With this adaptation, it will become easy for the bank to detect and close customers' accounts failing to provide KYC documents, send automated notifications, and schedule calls for the required document submissions.

- September 2022 - AI-powered financial intelligence company Banking Labs signed a partnership with Anaplan, the provider of a cloud-native platform. Through this partnership, the duo will assist Financial Institutions in improving business planning for better execution in sales, operations, and finance through sophisticated scenario modeling capabilities, data-driven insights, and intelligence-enabled solutions

North America to Account for a Major Share

- As per a study by Global Data, in Q2 2022, North America continued to dominate the hiring of artificial intelligence (AI) specialists in the private banking sector. There were 48.2% total AI jobs in Q2 2022 compared to 42.8% in the same period in 2021. United States contributed 41.9% towards AI roles in the private banking industry.

- June 2022 - Kyndryl and Cisco teamed up to develop new private cloud services, network, and edge computing solutions, software-defined networking (SDN) solutions, and multi-network wide area network (WAN) options that will provide organizations with high-level security capabilities. The duo further plans to collaborate with various companies to support and deliver digital transformation initiatives on a global scale.

- September 2022 - Juniper and IBM partnered to combine and present pre-integrated, validated components for ready usage. This integration will result in the combination of services from both companies. Juniper's intent-based management, cloud-native software-defined networking (SDN) solution and cloud-native routing will be combined with IBM's Cloud Pak for a network automation solution for lifecycle management and orchestration. The partnership aims to support digital transformation and AI adoption by providing clients with ready-to-use services. Clients can decrease the complexity of operations, quicken time to value, and cut total ownership costs, by choosing this integrated package.

Scalable Software Defined Networking Industry Overview

Market concentration for scalable software-defined networking is moderate. Big firms, especially in the telecom sector, buy up startups working on SDN technology. These companies invest a lot of effort into integrating multiple open-source SDN systems with their cloud computing platforms for network infrastructure optimization and customization. Some key players include Cisco Systems Inc., HPE, Intel Corporation, Big Switch Network, AT&T Inc., Pluribus Network, Plexxi Inc., Huawei Technologies Co. Ltd., NEC Corporation, Arista Network, and IBM Corporation, among others.

- February 2022 - The Open Networking Foundation (ONF), in partnership with Microsoft, Google, and Intel, introduced an SDN solution to its software for open networking in the cloud (SONiC) for data centers. The new P4 Integrated Network Stack (PINS) will work independently, allowing users to adapt to an SDN solution without needing an SDN controller.

- October 2022 - To reinvent the fiber broadband deployment, Nokia and American Tower developed SDN virtualization. Nokia is the sole supplier of the FTTH network in Argentina. The Altiplano Open Access SDN solution from Nokia provides a more flexible service design adapted to the requirements of both large and small operator tenants. It would give various network-sharing options to assist infrastructure builders, and the virtual network operators get specialized tools to support their operations and enhance the subscriber experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions &and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Cloud

- 5.1.2 Trend of BYOD devices

- 5.2 Market Restraints

- 5.2.1 Concerns related to security

- 5.3 Industry Value Chain Analysis

- 5.4 Impact of COVID-19 on the Scalable SDN Market

- 5.5 By Use Case

- 5.5.1 Mobile Core, EPC, IMS Virtualization

- 5.5.2 Operation Support System and Business Support System (OSS/BSS)

- 5.5.3 Radio Access Networks

- 5.5.4 Wireline Fixed Access Networks

- 5.5.5 Customer Premises Equipment (CPE)

- 5.5.6 Mobile Backhaul

- 5.6 By Solution

- 5.6.1 SDN Switching

- 5.6.2 SDN Controllers

- 5.6.3 Cloud Provisioning

- 5.6.4 Orchestration

- 5.6.5 Security Technologies

- 5.6.6 Other Solutions

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Cloud Service Providers

- 6.1.2 Enterprises

- 6.1.3 Telecommunications Service Providers

- 6.2 By Industry Vertical

- 6.2.1 Academia and Research

- 6.2.2 BFSI

- 6.2.3 Consumer Goods and Retail

- 6.2.4 Government and Defense

- 6.2.5 Manufacturing

- 6.2.6 Telecom and IT

- 6.2.7 Other Industry Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 HPE

- 7.1.3 Intel Corporation

- 7.1.4 Big Switch Network

- 7.1.5 AT&T Inc.

- 7.1.6 Pluribus Network

- 7.1.7 Plexxi Inc.

- 7.1.8 Huawei Technologies Co. Ltd.

- 7.1.9 NEC Corporation

- 7.1.10 Arista Network

- 7.1.11 IBM Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS