Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1624592

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1624592

Europe Push Buttons and Signaling Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

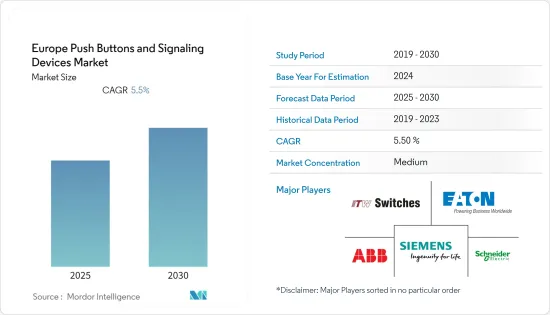

The Europe Push Buttons and Signaling Devices Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- Pilot devices such as push buttons and signaling devices control and monitor industrial equipment and machinery. These devices include several types of pushbuttons, indicating lights, and audible-visual signaling devices. These devices can be used as indicators to spot malfunctions and material shortages across facilities and alert operators to any hazard or fatality in the facility, reducing process downtime. The market for push buttons and signaling devices has expanded, as industrial safety standards for food and beverages, chemicals, and pharmaceuticals and the oil and gas industries have become more stringent.

- Further, In December 2021, the new Siemens SIRIUS ACT push buttons and signaling devices offered from APS Industrial matched all of these criteria, forming the perfect product line of food and beverage push buttons and signaling devices. The food and beverage business has high cleanliness, toughness, and quality standards. Equipment that does not fulfill these requirements wastes time due to avoidable breakdowns and downtimes. Such product developments may increase the demand for push buttons in this region.

- Signaling Devices and systems are used to convey simple messages concerning the operation of machinery, manufacturing lines, or individual industrial equipment. It is difficult to imagine a properly functioning industrial plant without appropriate low-level optical and audible signaling devices.

- The signaling devices are extensively used under STARS Project to develop a universal approach to predict the achievable GNSS performance in a railway environment, especially for safety-critical applications within ERTMS (The European Railway Traffic Management System).

Europe Push Buttons Signaling Devices Market Trends

Automotive Expected to Witness Significant Market Share

- The European automotive market is going through a huge transformation to curb the Carbon footprint. EV market has seen huge investment along with it the implementation of push buttons and have also increased for auto-start functions and other automated mechanisms in vehicles.

- Europe-connected car shipments have been increasing rapidly during the last five years. The top three automotive groups - Volkswagen, PSA, and Renault Nissan Alliance - account for almost half of the connected car shipments in Europe, primarily because they have been leading the passenger car sales in the region.

- The connected car system is only implemented on passenger cars with embedded connectivity. The vast majority of connected cars will continue to have a 4G-enabled Telematics Control Unit (TCU) by 2025 in Europe. But with 5G network deployment maturing, the share of 4G will start declining after 2022.

- Across the region, the repercussions of the COVID-19 crisis are immense and unprecedented, as many auto-retail stores have remained closed for a month or more, resulting in the decline in profit by the automotive manufacturer compared to the last two years. It may take years to recover from this plunge in profitability.

United Kingdom Expected to Witness Significant Market Share

- Push buttons have been used for implementing keyless access in vehicles. Many automobile companies widely adopt Push-button ignition due to its comfort and reliability in the country.

- The panel lights and horns are the most commonly used signaling devices in vehicles. Automotive manufacturers also focus on providing additional features, such as video surveillance and strobes. The emergency lighting is also being included in all the newly manufactured vehicles. This is also anticipated to drive the market's growth during the forecast period in the country.

- Large-scale industries prefer and opt for automation of push-button and signaling devices, primarily to avoid the human error factor. The emergence of industrial control systems, such as SCADA, PLC, and IT control, aided the market growth. The primary factor that drives the demand in the country is the flexibility in control and functionality that devices offer in the industrial space and the enhancement in the safe work environment on the industry floors.

- In the long run, the demand for renewable energy across the United Kingdom accelerated by the pandemic is also expected to boost the market's growth. However, the uncertainty in the supply chain and demand brought by the short-term repercussions is expected to stall the market's growth as the pandemic impacted all end-user industries.

Europe Push Buttons Signaling Devices Industry Overview

The Europe Push Button and Signaling Device Market are moderately competitive. An increasing number of players are boosting their share through strategic mergers and acquisitions and partnerships with several small players. Some of the key players in the market include Rockwell Automation Inc., ABB Ltd, Schneider Electric SE, Siemens AG, and Federal Signal Corporation.

- February 2022 - Siemens AG has agreed to sell Valeo its 50% ownership in the joint venture Valeo Siemens e-Automotive (VSeA). In the second quarter of fiscal 2022, a profit effect of EUR 300 million will be recognized, with the transaction set to close in July 2022.

- February 2022 - Eaton's Vehicle Group announced that it now offers a range of low-voltage electrical components, including conversion, protection, and distribution for commercial vehicles and off-highway applications, to meet expanding power and control requirements. The technologies are intended for various uses, including commercial vehicles, military, construction, and agriculture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 46642

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Increasing use of fire alarm management systems and safety systems

- 4.3.2 Signaling devices used to improve The European Railway Traffic Management System

- 4.4 Market Restraints

- 4.4.1 Lack of skilled lobor and capital intensive projects.

- 4.5 Value Chain Analysis

- 4.6 Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Round or Square Body Type

- 5.1.2 Non-lighted Push Button

- 5.1.3 Other Products

- 5.2 By Type

- 5.2.1 Audible

- 5.2.2 Visible

- 5.2.3 Other Types

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Energy and Power

- 5.3.3 Manufacturing

- 5.3.4 Food and Beverage

- 5.3.5 Transportation

- 5.3.6 Other End-user Industries

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Russia

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ITW Switches

- 6.1.2 Siemens AG

- 6.1.3 ABB Ltd

- 6.1.4 Schneider Electric

- 6.1.5 Carling Technologies

- 6.1.6 Omron Industrial Automation (Omron Corporation)

- 6.1.7 Eaton Corporation

- 6.1.8 NKK Switches

- 6.1.9 Panasonic

- 6.1.10 Littelfuse

- 6.1.11 Wurth Electronics

- 6.1.12 Nihon Kaiheiki

- 6.1.13 Marquardt Mechatronik

- 6.1.14 Kaihua Electronics

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.