PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906864

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906864

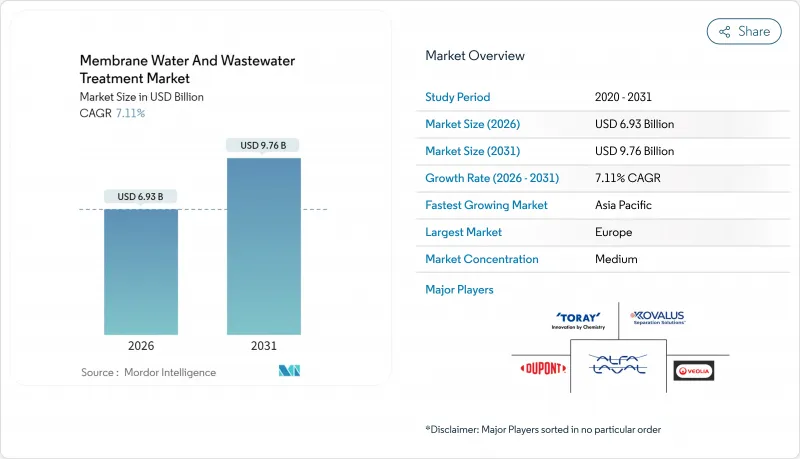

Membrane Water And Wastewater Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Membrane Water And Wastewater Treatment Market was valued at USD 6.47 billion in 2025 and estimated to grow from USD 6.93 billion in 2026 to reach USD 9.76 billion by 2031, at a CAGR of 7.11% during the forecast period (2026-2031).

Growth is underpinned by stricter discharge mandates, accelerating water scarcity, and continual advances in reverse osmosis (RO) stacks that cut energy consumption by up to 35%. Digital twins and AI-enabled predictive maintenance further lower operating expenditures while raising plant uptime, making the membrane water and wastewater treatment market increasingly attractive across municipal and industrial arenas. Europe retains leadership through a comprehensive policy framework that prioritizes PFAS and micropollutant removal, whereas Asia-Pacific is racing ahead on capacity additions. Competitive rivalry is moderate; incumbents rely on strategic acquisitions and service-heavy bundles to protect share while nimble specialists leverage graphene, zwitterionic, and other next-generation chemistries to disrupt.

Global Membrane Water And Wastewater Treatment Market Trends and Insights

Increasing Adoption of Low-Pressure Membrane Systems

Low-pressure ultrafiltration and microfiltration units now run at 40-60% lower pressures than legacy alternatives, translating into 15-31% electricity savings for municipal and industrial operators. These gains resonate most in decentralized or energy-constrained settings because lower hydraulic requirements allow membrane skids to pair seamlessly with rooftop solar or micro-grids. Suppliers are releasing high-flux, low-pressure variants that maintain rejection performance despite reduced driving force, effectively expanding the economic envelope of the membrane water and wastewater treatment market. Capital outlays also decline because pumps and pressure vessels can be downsized, further lifting project viability for small communities. As net-zero commitments intensify, utilities view low-pressure modules as an expedient pathway to cut Scope 2 emissions without overhauling entire plants.

Stricter Discharge Norms for Micropollutants and PFAS

The U.S. EPA's newly finalized PFAS Maximum Contaminant Levels, coupled with similar thresholds in Europe's revised Drinking Water Directive, trigger immediate retrofit spending across existing facilities. Utilities are migrating from conventional media filtration to nanofiltration and RO trains that achieve sub-nanogram removal efficiencies, supporting a +2.1% uplift in the membrane water and wastewater treatment market CAGR. Pharmaceutical residues and endocrine disruptors are also entering regulatory crosshairs, further broadening the compliance scope. The tight timelines-many become enforceable between 2026 and 2027, compress procurement cycles, and favor solution providers with stocked inventories and proven references. The regulatory push is especially acute in Europe and North America, but is spilling into APAC, where exporters must meet destination-market water quality standards.

Persistent Membrane Fouling and Cleaning Chemical Costs

Fouling forces operators to spend 15-25% of their total OPEX on cleaning reagents and downtime, eroding the economic case for some low-margin installations. Biofouling, scaling, and organic accretion interlock in unpredictable combinations, complicating chemical selection and clean-in-place scheduling. Harsh oxidants shorten membrane lifespans and generate brines that must be disposed of under tightening environmental rules. While advanced surface coatings and novel backwash regimes show promise, implementation costs and uncertain longevity slow uptake. Until breakthroughs reach commercial scale, the membrane water and wastewater treatment market faces a 1.4% drag on CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth of Decentralized "Off-Grid" Treatment Installations

- AI-Enabled Predictive Maintenance Lowering OPEX

- Capital-Intensive Ceramic Membrane Manufacturing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reverse osmosis contributed 36.62% of the membrane water and wastewater treatment market share in 2025, outpacing ultrafiltration, nanofiltration, and microfiltration peers. The segment's 7.62% CAGR through 2031 reflects vigorous retrofits in desalination and industrial water reuse as energy-recovery turbines and low-fouling membranes cut operating intensity. Ultrafiltration's pretreatment clout delivers dependable revenues because most seawater RO trains now mandate dual-barrier design for regulatory assurance. Nanofiltration expands rapidly where partial softening with organics retention is desired, while microfiltration holds a niche terrain in biotech and beverages.

Emergent chemistries lengthen replacement cycles, yet digital monitoring and predictive diagnostic suites stimulate refresh demand every five to seven years. DuPont's WAVE PRO modeling platform permits transparent sizing trade-offs, improving bid accuracy and cycle times. Clean TeQ's graphene modules, now WaterMark-certified, promise higher flux at lower pressures and may compress capital footprints. These dynamics keep the membrane water and wastewater treatment market size in technology turnover buoyant, rewarding OEMs able to package membranes with automation, design software, and lifecycle services.

The Membrane Water and Wastewater Treatment Report is Segmented by Technology (Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis), End-User Industry (Municipal, Pulp and Paper, Chemical, Food and Beverage, Healthcare, Power, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe's 33.84% share in 2025 reflects early regulatory adoption of micropollutant discharge ceilings and an entrenched upgrade cycle across Germany, France, and the Nordics. Capital subsidies and low-interest loans catalyze membrane upgrades that push permeate quality beyond EU Drinking Water Directive thresholds. Plants retrofit aging sand filters with ultrafiltration cartridges to meet 2027 PFAS limits while conserving footprints. This maturity shifts supplier revenue toward refurbishments, monitoring software, and chemical optimization services, fostering a stable base for the membrane water and wastewater treatment market.

Asia-Pacific, rising at a 7.73% CAGR, commands the fastest expansion as megacities in China, India, and Southeast Asia tackle chronic shortages. China's coastal provinces retrofit brackish groundwater wells with RO, whereas Indonesia pioneers direct nanofiltration for centralized drinking water at costs below USD 0.40/m3. Competitive local fabrication of pressure vessels and spacers compresses equipment costs, widening access for mid-tier utilities and manufacturing clusters. Decentralized solar-hybrid containerized plants flourish in off-grid islands, embedding future upgrade revenue.

North America, though mature, registers healthy retrofit spending on PFAS removal, notably in the Carolinas and Michigan. Desalination gains mindshare in California and Texas as drought intensifies, buoying the regional membrane water and wastewater treatment market. Middle East and Africa harness record-scale RO contracts: Energy Recovery secured USD 27.5 million for Moroccan plants and USD 12 million in the UAE. South America lags but exhibits mining-led pockets of demand in Chile and Peru where zero-discharge mandates elevate membrane adoption.

- ALFA LAVAL

- Aquatech

- Asahi Kasei Corporation

- AXEON Water

- DuPont

- Hydranautics - A Nitto Group Company

- Kovalus Separation Solutions

- LG Chem

- MANN+HUMMEL Water & Fluid Solutions GmbH

- NX Filtration BV

- Pall Corporation

- Pentair

- TORAY INDUSTRIES, INC.

- Toyobo Co., Ltd.

- Veolia

- Vontron Technology Co., Ltd.

- Xylem

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Low-Pressure Membrane Systems

- 4.2.2 Stricter Discharge Norms for Micropollutants And PFAS

- 4.2.3 Rapid Growth of Decentralized "Off-Grid" Treatment Installations

- 4.2.4 Desalination Retrofits Shifting to Energy-Efficient RO Stacks

- 4.2.5 AI-Enabled Predictive Maintenance Lowering OPEX

- 4.3 Market Restraints

- 4.3.1 Persistent Membrane Fouling and Cleaning Chemical Costs

- 4.3.2 Capital-Intensive Ceramic Membrane Manufacturing

- 4.3.3 Skills Gap in Advanced Membrane Plant Operation

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Microfiltration

- 5.1.2 Ultrafiltration

- 5.1.3 Nanofiltration

- 5.1.4 Reverse Osmosis

- 5.2 By End-User Industry

- 5.2.1 Municipal

- 5.2.2 Pulp and Paper

- 5.2.3 Chemical

- 5.2.4 Food and Beverage

- 5.2.5 Healthcare

- 5.2.6 Power

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ALFA LAVAL

- 6.4.2 Aquatech

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 AXEON Water

- 6.4.5 DuPont

- 6.4.6 Hydranautics - A Nitto Group Company

- 6.4.7 Kovalus Separation Solutions

- 6.4.8 LG Chem

- 6.4.9 MANN+HUMMEL Water & Fluid Solutions GmbH

- 6.4.10 NX Filtration BV

- 6.4.11 Pall Corporation

- 6.4.12 Pentair

- 6.4.13 TORAY INDUSTRIES, INC.

- 6.4.14 Toyobo Co., Ltd.

- 6.4.15 Veolia

- 6.4.16 Vontron Technology Co., Ltd.

- 6.4.17 Xylem

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment