PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550525

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550525

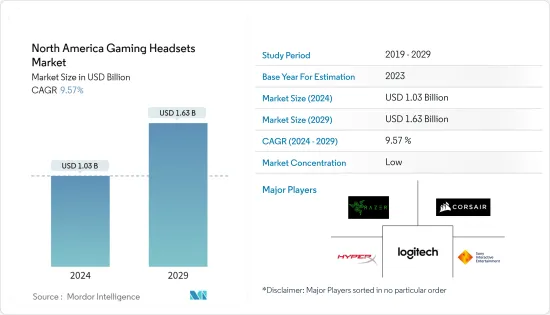

North America Gaming Headsets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Gaming Headsets Market size is estimated at USD 1.03 billion in 2024, and is expected to reach USD 1.63 billion by 2029, growing at a CAGR of 9.57% during the forecast period (2024-2029).

Key Highlights

- North America's gaming industry is experiencing increased demand, propelled by rising internet connectivity, increasing smartphone adoption, and the advent of high-bandwidth networks like 5G.

- The rising popularity of video games, particularly eSports and online multiplayer games, is a key driver of the North American gaming headset market. As gamers increasingly prioritize immersive experiences and effective team communication, the demand for high-quality audio equipment, including advanced headsets, has surged.

- Technological advancements have spurred the creation of advanced headsets, boasting features such as noise cancellation, surround sound, and wireless connectivity. These upgrades are particularly appealing to gamers seeking increased performance and comfort, driving the market growth opportunities significantly.

- Furthermore, the surge in popularity of live streaming and content creation platforms like Twitch and YouTube has spurred an increased need for top-tier audio equipment among streamers and creators. This trend has broadened the market's scope, attracting casual gamers and professional and aspiring streamers. Moreover, the rising interest in virtual reality (VR) gaming has heightened the need for specialized headsets, enhancing audio immersion.

- Collaborations between gaming headset manufacturers and game developers aimed at tailoring audio experiences for specific games have bolstered market growth. Additionally, rising disposable incomes and a growing inclination to invest in premium gaming accessories are fuelling the market's expansion in North America.

- The overall competitive rivalry in the market is high, driven by a mix of established and emerging players. To stay ahead, industry participants are blending organic and inorganic strategies, enhancing the market's growth prospects. For instance, in August 2023, Sony Interactive Entertainment LLC announced its acquisition of Audeze, an audio technology brand and a provider of high-end gaming headphones. The acquisition will bolster SIE's commitment to innovating the audio experience in PlayStation games. Audeze would maintain its independent operations, focusing on multi-platform product development, now with added advantages from its integration into the PlayStation ecosystem.

- In August 2023, the Network of Academic and Scholastic Esports Federations (NASEF) unveiled a strategic partnership with AVID Products, appointing them as the official headset partner. Through this partnership, AVID will support NASEF, a group focused on education, and its competitive counterpart, the United States Esports Federation, by donating high-quality gaming headsets.

- However, the gaming headset market faces growth constraints from intense competition, the steep prices of enhanced models, tech compatibility challenges, economic downturns impacting consumer outlays, swift technological obsolescence, limited awareness in emerging markets, supply chain interruptions, and health worries linked to prolonged headset usage.

North America Gaming Headsets Market Trends

Console Headset Segment Holds Significant Market Share

- The console gaming headset segment's growth contributes significantly to the overall gaming headset market in North America. The introduction of next-generation consoles like the PlayStation 5 and Xbox Series X has spurred demand for compatible, high-quality headsets to enhance the overall gaming experience. These new consoles offer advanced audio capabilities, encouraging gamers to invest in premium headsets to fully utilize these features.

- Also, the increasing popularity of multiplayer and online cooperative games on consoles has heightened the need for clear communication, making headsets an essential accessory. Games like "Fortnite" and "Call of Duty" heavily rely on effective teamwork, driving demand for reliable headsets. The rise of console-based eSports and competitive gaming has also fueled the market. Professional and amateur gamers alike seek high-performance headsets for better in-game communication and sound quality, which are crucial in competitive settings.

- As console gaming remains a dominant platform, the demand for high-quality headsets extends to various gaming setups, influencing the broader market in North America. Moreover, the social dimension of console gaming, characterized by interactions with friends and online communities, drives the need for robust communication tools. Console gaming headsets play a pivotal role in enabling smooth interactions and enhancing the overall gaming experience.

- In April 2024, Razer launched the Razer BlackShark V2 Pro esports headset, designed exclusively for PlayStation and Xbox gamers. These versions, tailored for consoles, address the distinct requirements of PlayStation and Xbox esports fans. The primary focus is on delivering quality audio precision, crystal-clear vocals, extended battery life, and uncompromised comfort.

- In April 2024, Meta collaborated with Microsoft's Xbox to develop a special "limited edition Meta Quest" headset. Additionally, Meta unveiled its decision to rename the Quest software platform as Meta Horizon OS. Moreover, Meta is extending the platform to third-party hardware manufacturers like ASUS and Lenovo, allowing them to produce headsets running on it.

The United States is Expected to Hold a Major Market Share

- The surge in the US gaming headset market is propelled by the rising prominence of video gaming, notably eSports and online multiplayer games. This surge has, in turn, heightened the need for top-tier audio gear. The rise of remote work and virtual communication has broadened the utility of gaming headsets, extending their appeal beyond gaming. Users increasingly seek headsets that seamlessly transition between gaming and professional tasks.

- The US gaming headsets market is witnessing accelerated growth, propelled by factors like a rising younger population, increased disposable incomes, and the emergence of new gaming genres. This surge is further fueled by technological innovations in headsets, including features like true surround sound, noise cancellation, and ergonomic designs, catering to gamers seeking to elevate their gaming encounters.

- Online distribution channels have surged, granting consumers easy access to a diverse array of gaming headsets from various brands, often at competitive prices. The US headset industry is witnessing growth, propelled in part by the rising fame of squad games such as Fortnite, PUBG, and Overwatch. With gaming's increasing mainstream appeal, players are increasingly prioritizing equipment that promises quality sound, comfort, and durability, especially for prolonged gaming experiences.

- In December 2023, Logitech G, a gaming technology innovator under the Logitech umbrella, introduced the Logitech G ASTRO A50 X LIGHTSPEED Wireless Gaming Headset and Base Station. This launch marks the fifth iteration of the highly acclaimed ASTRO A50 Series, tailored specifically for console gaming, delivering the ultimate gaming audio experience.

North America Gaming Headsets Industry Overview

North America's gaming headset market, primarily due to the presence of various players, is highly competitive in nature. Market players are increasingly adopting strategies such as service innovation and forming strategic partnerships. These moves are designed to broaden their client base and augment their competitive edge in the industry. Key industry players include Logitech, Razer Inc., and HyperX (HP Inc.).

April 2024: Turtle Beach launched the Stealth 600 Multi-platform Gaming Headset as a follow-up to its predecessor, the wireless model priced at USD 99.99. In a strategic move, the brand also introduced the Stealth 500 at a discounted price of USD 79.99 without compromising on its wireless gaming audio quality. Turtle Beach's Atlas Air emerges as a standout in the realm of wireless open-back PC gaming headsets, offering robust support for high-fidelity 24-bit audio.

February 2024: Gaming and esports accessories and peripheral company SteelSeries announced that it partnered with CAPCOM CUP X and it earned the title of the official headset for CAPCOM CUP X, the event of the 2023 Capcom Pro Tour esports season, showcasing Street Fighter 6. As part of the partnership, all 48 competitors in the CAPCOM CUP X will have access to the SteelSeries Arctis Nova Pro headset. These players earned their spots through standout performances in events held during the 2023 Capcom Pro Tour season.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Gaming Industry Landscape in North America

- 4.3 Industry Ecosystem Analysis

- 4.4 Demographic Trends Related to Gaming-based Consumers in North America

- 4.4.1 Age & Income-related Demographics

- 4.4.2 Key Considerations for Purchasing Gaming Peripherals Including Headsets

- 4.5 Impact of Recent Developments Such as Move Toward VR Gaming Giving Rise to VR Headsets

- 4.6 Market Drivers

- 4.6.1 Growing Popularity of Virtual Reality

- 4.6.2 Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 4.7 Market Challenges

- 4.7.1 Fluctuation in the Production of Silicon Chips Leading to Shortage in Demand of Gaming Accessories

- 4.8 Market Opportunities

5 MARKET SEGMENTATION

- 5.1 Compatibility Type

- 5.1.1 Console Headset

- 5.1.2 PC Headset

- 5.2 Connectivity Type

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 Sales Channel

- 5.3.1 Retail

- 5.3.2 Online

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Analysis of Major Domestic Gaming Headset Manufacturers Operating in North America

- 6.2 Analysis of Major International Gaming Headset Vendors Operating in North America

- 6.3 Comparative Analysis of Pricing and Features of Key Models in North America

- 6.4 Company Profiles

- 6.4.1 Logitech International S.A.

- 6.4.2 Razer Inc.

- 6.4.3 Corsair Gaming

- 6.4.4 Sony Interactive Entertainment

- 6.4.5 HyperX (HP Inc.)

- 6.4.6 ASUSTeK Computer Inc.

- 6.4.7 Microsoft Corporation

- 6.4.8 Harman International Industries, Incorporated

- 6.4.9 SteelSeries

- 6.4.10 Turtle Beach Corporation

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS