PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550520

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550520

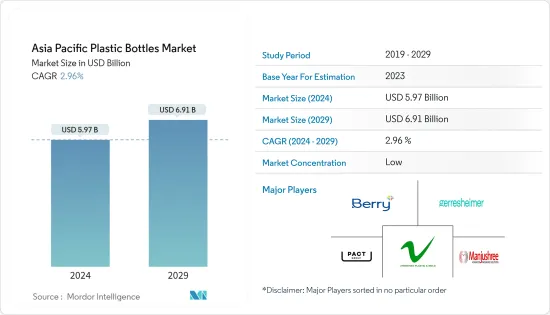

Asia Pacific Plastic Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Pacific Plastic Bottles Market size is estimated at USD 5.97 billion in 2024, and is expected to reach USD 6.91 billion by 2029, growing at a CAGR of 2.98% during the forecast period (2024-2029). In terms of production volume, the market is expected to grow from 6.5 million tonnes in 2024 to 7.49 million tonnes by 2029, at a CAGR of 2.87% during the forecast period (2024-2029).

Plastic bottles are crucial in various sectors, including the beverage, food, cosmetics, and pharmaceutical industries. New technologies and the emergence of heat-resistant PET bottles are opening new possibilities and options, which might push the market demand over the forecast period.

Key Highlights

- Consumers increasingly favor plastic packaging because it is lightweight and unbreakable, simplifying handling. Major manufacturers also gravitate toward plastic packaging because of its cost-effectiveness. The advent of polymers like polyethylene terephthalate (PET) and high-density polyethylene (HDPE) is broadening the horizons for plastic bottle applications, leading to a surge in PET bottle demand.

- End users predominantly choose plastic bottles and containers made from polyethylene terephthalate, polypropylene, and polyethylene. This preference stems from the materials' lightweight nature and recyclability. Furthermore, the cost-effectiveness of plastics, coupled with the growing reliance on packaged and processed foods and beverages, is set to shape the market dynamics.

- According to Oriental Green Materials Limited, Taiwan uses an average of 5 billion PET bottles yearly, half of which are recycled on Oriental's premises. The bottles are smashed, cleaned, and converted to pellets, which are then used to make bottles and other products.

- Further, the National Environment Agency and F&N Food Singapore launched an initiative to roll out smart Reverse Vending Machines (RVMs) across Singapore a few years ago. This aims to encourage Singaporeans to adopt an eco-conscious lifestyle by offering them a convenient recycling method for recycling drinks containers (plastic bottles) by depositing them in the RVMs. PET is preferred owing to its durability, cost-effectiveness, and versatility. As the end-user industries, such as food, beverage, pharmaceutical, and other sectors, expand and innovate, the need for plastic bottles and container packaging also rises.

- Plastic is a considered as significant pollutant, resulting in environmental degradation. Awareness regarding plastic's effects has been growing among users and across the industry ecosystem. Many public drives and initiatives are conducted by governments to increase this awareness. The consumption and production of plastics use large quantities of fossil fuels, which adversely impact the environment and climate. As a result, plastic packaging usage has notably declined over the past few years.

Asia Pacific Plastic Bottles Market Trends

Polyethylene Terephthalate (PET) To Witness Growth

- PET plastic bottles are increasingly supplanting traditional glass bottles, thanks to their lightweight nature and durability. This shift enhances the reusability of packaging for mineral water and other beverages and streamlines the transportation process, making it more cost-effective.

- With its clarity and natural CO2 barrier properties, PET has wide applications and can be easily blown into a bottle or molded into any other shape. PET's properties can be improved with colorants, UV blockers, oxygen barriers/scavengers, and other additives to develop a bottle to match a brand's specific needs.

- PET has become a vital packaging material among bottle manufacturers across the region. Its versatility in accommodating different shapes and sizes has provided unparalleled alternatives to conventional glass and metal containers, making it a highly desirable choice in the packaging industry.

- Polyethylene terephthalate (PET) bottles are gaining a presence in various product areas. PET bottles' low cost and low weight and ongoing developments in printing technology have led to their popularity among premium consumers. According to the National Bureau of Statistics of China, the production of plastic products in China was 6.3 million metric tons in May 2023. It increased to 6.82 million metric tons in September 2023. The rise in the production of plastics in China is expected to enhance the market for PET products.

- Closed-loop recycling refers to a process where plastic is recycled and utilized to manufacture a new product within the same category. This approach is commonly embraced by PET bottles, enabling businesses to prioritize it over alternative resin materials. Consequently, the recycling of plastic bottles is expected to have a favorable influence on the market. As per the report of Indorama Ventures, a sustainable chemical company, the demand for recycled polyethylene terephthalate (rPET) in Asia is expected to increase constantly from 0.6 million metric tons in 2018 to approximately 1 million metric tons in 2023.

The Beverage Sector is Expected to Drive Market Growth

- PET bottles are more prevalent in the water packaging market than glass and plastic bottles due to their durability and recyclability. The trend shows that lightweight, durable, and cost-effective PET is becoming the default packaging medium for water. Moreover, PET bottles can be molded in different shapes according to the packaging trend and the labels to be applied to the body.

- According to the UN University Institute for Water, Environment, and Health, more than 14 lakh tons of PET plastic, commonly used for bottled water, are consumed annually in India. Further, the region is also one of the fastest-growing mineral water markets. According to a report by the International Bottled Water Association, about 97% of bottled water bottles are plastic, and nearly 80% of that is from polyethylene terephthalate (PET).

- Companies also innovate different formats of bottled water. This provides opportunities for the companies to promote the bottles with unique strategies to create a market buzz. For instance, India introduced ISI-certified bottled water in December 2023, which can be branded by advertisers at the lowest cost, leveraging 80% of the branding space. Advertisers can set up an account for their brand, upload their design, and link it to the label template to tailor their marketing strategies for their target audience.

- Governments across the region are focusing on the recycling of single-use plastic bottles by incorporating various schemes, such as refilling a reusable plastic bottle from the consumer side, using biodegradable or recycled PET bottles for the manufacturing of plastic bottles, innovating eco-friendly designs, and setting up a different council to recycle plastic bottles generated by various end users. Manufacturers across the region innovate to introduce water bottles that fulfill the recyclability criteria under government laws and company guidelines to become sustainable manufacturers in the sector.

- India is one of the strongest markets in the region and has the highest population. There has been a significant increase in the consumption of bottled water in the country. The Indian Railway Catering and Tourism Corporation Limited launched a PET bottled water brand, "Rail Neer," which is majorly sold on trains and railway stations. With the rising consumption of water bottles and the growing railway sector, the corporation increased the production of bottles from 75.30 million bottles in 2021 to 357.70 million bottles in 2023.

Asia Pacific Plastic Bottles Industry Overview

The Asia-Pacific plastic bottles market is fragmented, with various domestic and international players such as Gerresheimer AG, Pact Group Holdings Limited, Berry Global Inc., Shenzhen Zhenghao Plastic & Mold Co. Ltd, Manjushree Technopack Limited, and others. The companies operating in the region are focused on expanding their businesses through collaborations, expansions, investments, and other strategies.

- December 2023: A new USD 50 million facility began operations in Melbourne, coinciding with the launch of Victoria's Container Deposit Scheme. This facility can recycle up to one billion 600 ml PET plastic beverage bottles annually. Operated by Circular Plastics Australia (PET), the plant transforms used beverage bottles into high-quality, food-grade resin. This resin is subsequently utilized to manufacture new recycled PET beverage bottles and food packaging items.

- November 2023: Berry Global highlighted its dedication to pioneering patient-centric packaging, dispensing solutions, and drug delivery devices tailored for India and the broader South Asian region at the CPHI India exhibition. Berry's stand featured various products from its vast portfolio, including bottles and other products. The exhibition showcase spotlighted the company's cutting-edge solutions, emphasizing enhanced usability, administration safety, next-gen digitalization for medical devices and primary packaging, and a commitment to circular design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Regulations, Policies, and Standards

- 4.5 Import and Export Analysis of Plastic Bottles for the Relevant HS Code

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Plastic Bottles

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Challenges

- 5.2.1 Growing Concerns Regarding Plastic Bottle Disposal

6 MARKET SEGMENTATION

- 6.1 By Resin

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Resin Types (Polystyrene, PVC, Polycarbonate, etc.)

- 6.2 By End-user Industries

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.2.1 Bottled Water

- 6.2.2.2 Carbonated Soft Drinks

- 6.2.2.3 Alcoholic Beverages

- 6.2.2.4 Juices and Energy Drinks

- 6.2.2.5 Other Beverages

- 6.2.3 Pharmaceuticals

- 6.2.4 Personal Care and Toiletries

- 6.2.5 Industrial

- 6.2.6 Household Chemicals

- 6.2.7 Paints and Coatings

- 6.2.8 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 Thailand

- 6.3.5 Australia and New Zealand

- 6.3.6 Indonesia

- 6.3.7 Vietnam

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerresheimer AG

- 7.1.2 Pact Group Holdings Limited

- 7.1.3 ALPLA Group

- 7.1.4 Berry Global Inc.

- 7.1.5 Alpha Packaging Pvt. Ltd

- 7.1.6 Greiner Packaging international GmbH

- 7.1.7 Retal Industries Limited

- 7.1.8 Zhejiang Xinlei Packaging Co. Ltd

- 7.1.9 Shenzhen Zhenghao Plastic & Mold Co. Ltd

- 7.1.10 Manjushree Technopack Limited

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players

8 RECYCLING AND SUSTAINABILITY LANDSCAPE

9 FUTURE OUTLOOK