PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550519

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550519

United Kingdom Surveillance IP Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

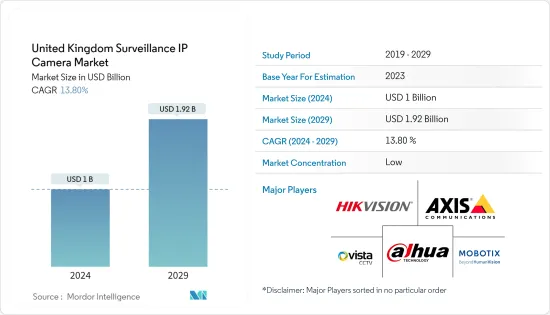

The United Kingdom Surveillance IP Camera Market size is estimated at USD 1 billion in 2024, and is expected to reach USD 1.92 billion by 2029, growing at a CAGR of 13.80% during the forecast period (2024-2029).

Key Highlights

- Government authorities in the United Kingdom are making substantial investments in smart city projects. These initiatives leverage IoT technologies like IP cameras to bolster urban infrastructure, public services, and city management. The primary goals include enhancing traffic management, public safety, environmental monitoring, and citizen engagement. Consequently, there is a rising demand for advanced surveillance IP camera solutions.

- Surveillance IP cameras with edge computing are gaining traction in the country. These cameras facilitate real-time video processing and analytics directly at the camera level. This means they may autonomously conduct sophisticated video analytics like facial recognition, object detection, and behavior analysis without relying on continuous cloud connectivity. They bolster the responsiveness and efficiency of surveillance systems. The infusion of artificial intelligence (AI) and machine learning (ML) algorithms into these cameras amplifies their surveillance capabilities, making them more intelligent and automated, propelling their adoption in the United Kingdom.

- In the United Kingdom, government agencies are engaging in robust collaborations among themselves and with private-sector entities, leading to several investments in the market. These partnerships and investments aim to exchange best practices, technological insights, and experiences in deploying and overseeing Surveillance IP Camera systems. For instance, in July 2024, the Metropolitan Police secured a substantial government investment of GBP 230 million (about USD 292.4 million) for drones and facial recognition technology. London and South Wales are already utilizing live facial recognition, while Essex is gearing up to implement it regularly following successful trials in public spaces in October 2023. Such instances are pivotal in promoting a unified and well-informed stance toward integrating these surveillance technologies within the public sector.

- The deployment of surveillance IP cameras in public spaces has ignited significant concerns among the public and privacy advocates. Their primary apprehension revolves around the protection of individual privacy and civil liberties. Concurrently, government agencies and solution providers grapple with adhering to data protection laws, particularly the nation's Data Protection Act and the General Data Protection Regulation. Addressing these privacy issues necessitates a commitment to transparency, obtaining appropriate consent, and implementing robust data security measures.

- The Russia-Ukraine conflict has cast a long shadow over foreign-owned and local companies in the region. The technology sector stands out as the most affected. Companies are navigating the repercussions of stringent trade and financial sanctions, heightened cyber-attack risks, and challenges in retaining talent. The conflict has exacerbated supply chain inefficiencies, leading to delays, labor shortages, transportation bottlenecks, and prolonged customs procedures. Such inefficiencies escalate costs, ultimately affecting end consumers.

United Kingdom Surveillance IP Camera Market Trends

Increasing Concerns Regarding Public Safety and Security Across the Industries are Expected to Drive the Market

- In recent years, the United Kingdom has witnessed significant terrorist incidents, including the Manchester Arena bombing and the London Bridge attack. Such events highlight the pressing need for enhanced surveillance and security measures in public areas, transportation centers, and vital infrastructure. These measures aim to prevent and promptly respond to terrorist threats and other unlawful activities. Law enforcement and security teams increasingly depend on surveillance cameras. These cameras boast advanced analytics, facial recognition features, and smooth integration with other security systems. This technology facilitates the rapid identification and monitoring of potential suspects, fostering an environment conducive to the growth of the studied market.

- In the United Kingdom, property-related crimes, such as burglaries and vandalism, are on the rise, impacting both residential and commercial properties. The Office for National Statistics (United Kingdom) reported that for the 2023/24 period, England and Wales recorded the UK's highest crime rate, at 89.7 crimes per 1,000 individuals. In response, homeowners and businesses are increasingly adopting surveillance cameras equipped with advanced features like motion detection, license plate recognition, and cloud-based storage. These sophisticated cameras deter criminal activities, protect assets, and assist law enforcement in their investigations. Consequently, such trends are driving the growing demand for IP cameras.

- Heightened concerns regarding employee safety, workplace violence, and campus security are driving a surge in the deployment of IP camera systems. These systems, prevalent in offices, factories, schools, and various institutions, monitor, record, and potentially prevent untoward incidents. They offer crucial evidence of security breaches or criminal activities.

- Criminal activities, like cargo theft and smuggling, are increasingly targeting the UK's transportation and logistics networks, encompassing ports, warehouses, and delivery vehicles. To prevent this, businesses are turning to advanced IP cameras. These cameras, equipped with features such as object tracking and video analytics, bolster security and visibility within the supply chain, safeguarding the movement of goods.

Government End-User Industry is Expected to Hold a Significant Market Share

- In the United Kingdom, government agencies, including law enforcement, intelligence services, and local authorities, play a pivotal role in upholding public safety. A notable trend is their increasing adoption of IP cameras equipped with cutting-edge video analytics. These analytics encompass features like facial recognition and license plate identification. By leveraging these tools, agencies may conduct real-time monitoring, swiftly detect threats, and identify potential suspects, bolstering the efficiency of their operations. Facial recognition stands out as a crucial tool for UK government bodies. It aids in tracking down criminals, overseeing individuals in sensitive zones, and bolstering overall security measures.

- Several government agencies in the country are setting up centralized command centers. These centers amalgamate various IP camera systems alongside other security and communication technologies. By consolidating these tools, officials gain a holistic perspective on security and operational data. This empowers them to make well-informed decisions, streamline responses, and enhance resource allocation, especially in times of crisis.

- Government agencies are bolstering their security measures by melding IP camera systems with various other solutions, including access control, alarms, and emergency response systems. This comprehensive integration offers a unified perspective on security incidents, streamlines data sharing, and fosters a synchronized reaction to looming dangers.

- As government agencies increasingly adopt IP camera systems, they are placing a heightened emphasis on robust cybersecurity measures. These measures aim to safeguard the integrity and confidentiality of video data and related information. According to Gov.UK, the nation's cybersecurity firms are actively securing funding through multiple deals, thereby exerting a significant influence on the market under study.

- In 2023, dedicated cybersecurity firms raised GBP 271 million (approximately USD 345.2 million) across 71 deals. Government agencies are investing in secure network infrastructures, encryption technologies, and access control mechanisms to uphold the privacy and security of sensitive surveillance data. These efforts align with regulations like the UK's Data Protection Act. Consequently, such trends are poised further to bolster the market's growth during the forecast period.

United Kingdom Surveillance IP Camera Industry Overview

The UK surveillance IP camera market is fragmented, with several global and local players. To remain competitive, these players prioritize product innovation, strategic partnerships, collaborations, mergers, and acquisitions. The companies are focused on expanding their geographic reach to acquire a significant number of consumers across several industries. Some of the key players include Axis Communications AB, Dahua Technology, Hangzhou Hikvision Digital Technology Co. Ltd, Vista-CCTV, and Mobotix AG.

- April 2024 - Ajax Systems unveiled its latest offering: wired security IP cameras. These state-of-the-art video surveillance devices deliver high-definition monitoring and prioritize robust privacy protections. Ajax cameras are designed for versatility and excel in indoor and outdoor settings, boasting an IP65 rating. Their installation process is seamless and secure, owing to the innovative passwordless authentication feature. With a range of matrix types and lenses, these cameras cater to a wide spectrum of video surveillance requirements.

- April 2024: The UK government granted local authorities the green light to deploy surveillance cameras produced by Chinese state-owned firms. This move starkly contrasts with the ban enforced in Westminster over national security apprehensions. In a subtle announcement, the government clarified that councils and local government establishments retain the liberty to employ surveillance IP cameras from Hikvision, despite the earlier prohibition on these devices in "sensitive sites" within all government departments since November 2022. Numerous government entities have been utilizing cameras from Hikvision and Dahua, both of which are under Chinese state ownership.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Concerns Regarding Public Safety and Security Across the Industries

- 5.1.2 Advancements in Surveillance IP Camera Technologies

- 5.2 Market Restraint

- 5.2.1 Data Privacy and Security Concerns

- 5.2.2 High Installation Costs for Budget Constraint Projects

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Government

- 6.1.2 Banking

- 6.1.3 Healthcare

- 6.1.4 Transportation and Logistics

- 6.1.5 Industrial

- 6.1.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Axis Communications AB

- 7.1.2 Dahua Technology

- 7.1.3 Lorex Corporation

- 7.1.4 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.5 Vista-CCTV

- 7.1.6 Avigilon Corporation

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 Bosch Security and Safety Systems (Robert Bosch Ltd)

- 7.1.9 Milesight

- 7.1.10 Mobotix AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET