Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550511

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550511

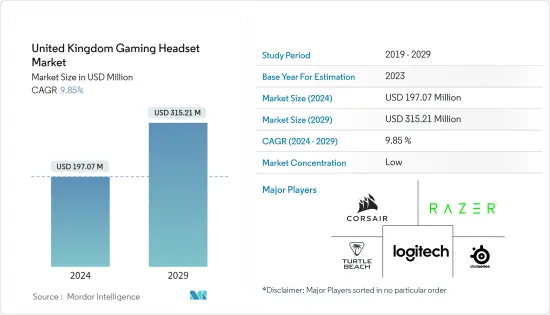

United Kingdom Gaming Headset - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The United Kingdom Gaming Headset Market size is estimated at USD 197.07 million in 2024, and is expected to reach USD 315.21 million by 2029, growing at a CAGR of 9.85% during the forecast period (2024-2029).

Key Highlights

- The UK gaming headset market has seen robust growth in recent years, fueled by the surging popularity of gaming across diverse platforms and the escalating appetite for immersive audio. Given the United Kingdom's vibrant gaming culture and expanding gamer base, the market is set for further growth.

- The gaming headset market is being driven by the rise of online gaming and the flourishing esports sector. Both competitive gamers and casual players are increasingly demanding top-tier audio quality to elevate their gaming experiences, fueling the need for cutting-edge gaming headsets.

- Technological advancements in audio, such as virtual surround sound, noise-canceling microphones, and wireless connectivity, are at the forefront of this market's growth. These innovations immerse gamers in richer soundscapes and enhance their communication, ultimately elevating their gameplay.

- As virtual reality (VR) gaming gains traction, there's a surging demand for specialized gaming headsets that can deliver the full immersive package. Given that VR gaming heavily relies on high-fidelity audio to complement its visuals, sales of premium headsets are on the rise.

- Moreover, the gaming demographic is diversifying, with more female and older gamers joining the experience. This shift has created a varied demand for gaming headsets tailored to meet a spectrum of preferences and requirements.

- Within the United Kingdom, the gaming headset market is fiercely competitive, characterized by both established players and new contenders fighting for their market share. This highly competitive environment often triggers price battles and squeezes profit margins, posing a challenge for companies striving to balance innovation with profitability.

United Kingdom Gaming Headset Market Trends

Wireless Headsets is Expected to Drive the Market

- Wireless gaming headsets empower gamers with the freedom to move, unhampered by cables, thereby elevating the gaming experience. This feature is especially coveted in VR and active gaming scenarios, where physical movement is integral to gameplay.

- Recent strides in wireless tech, like low-latency connections and extended battery life, have notably bolstered the performance and reliability of wireless gaming headsets. These tech upgrades ensure that wireless models now deliver top-notch audio and seamless gameplay, often outpacing their wired counterparts.

- The surge in multiplayer online gaming and the proliferation of social gaming platforms have heightened the need for superior audio and communication tools. Wireless gaming headsets, equipped with noise-canceling microphones and immersive surround sound, are now pivotal for effective communication and enhanced audio experiences during multiplayer engagements.

- In 2023, UK consumers splurged GBP 402 million (USD 510.59 million) on console game accessories, driven by a wave of hardware upgrades and new investments. This marked a modest 3% uptick from the preceding period. With the UK's gaming industry gaining traction, the wireless gaming headset market is poised for a parallel surge.

- While wireless gaming headsets offer a technological edge, they come at a premium compared to their wired counterparts, primarily due to the added tech and components. This higher price tag can pose a challenge for some consumers, especially in a market teeming with brands and options. Hence, companies must strike a delicate balance between advanced features and affordability to widen their customer base.

PC Headset is Expected to Hold a Major Share

- While global console gaming revenue currently surpasses that of PC gaming, the latter is rapidly closing the gap. As per industry experts, notably, PC gaming saw a year-on-year growth of 3.9%, significantly outpacing console gaming's 1.7%. Projections suggest that PC gaming is on track to overtake console gaming, a shift that will likely extend to the PC headset market as well.

- Given the preference of gaming experts and e-sports players for PCs, the PC headset market is witnessing significant R&D and technological advancements. PC headsets are now equipped with advanced audio features, including surround sound, customizable sound profiles, and noise-cancelling microphones. These features elevate the gaming experience, offering immersive soundscapes and crystal-clear communication, crucial for both competitive and cooperative gaming.

- PC gaming headsets often boast seamless integration with leading gaming platforms like Steam and communication tools like Discord. This integration allows gamers to tailor audio settings, collaborate with team members, and leverage game-specific audio enhancements, cementing PC headsets as the go-to for avid gamers.

- The UK's gaming sector is witnessing a notable rise. In 2023, as per Ukie, UK consumers splurged a staggering GBP 3.16 billion (USD 4.01 billion) on digital console and PC games, marking a significant surge from the GBP 2.64 billion (USD 3.35 billion) spent the year before. Digital gaming has emerged as the dominant format in the United Kingdom, surpassing both boxed and second-hand sales. With the rising popularity of digital gaming, expenditures on gaming accessories are also set to escalate, paving the way for a burgeoning gaming headset market.

- The PC gaming headset market brims with competition as a multitude of brands vies across diverse price points. This intense rivalry often leads to price and margin pressures, posing hurdles for manufacturers striving to set their products apart and stay profitable. Moreover, budget-conscious consumers might veer toward more affordable options, directly affecting the sales of high-end PC headsets.

United Kingdom Gaming Headset Industry Overview

The UK Gaming Headset market is fragmented, with the presence of major players and numerous regional companies. Key players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain a sustainable competitive advantage.

- August 2024: Sony plans to introduce a PC adapter tailored for its PlayStation VR 2 headset. This adapter, slated for an August release, will enable PSVR 2 users to delve into Steam's expansive VR game catalog, featuring popular titles like Half-Life: Alyx and Fallout 4 VR.

- July 2024: Chinese electronics company OXS introduced its newest product, the budget-friendly OXS Storm G2 Wireless gaming headset. Although OXS is a newcomer to Western markets, the Storm G2 serves as its entry into the gaming headset segment, with a focus on the US and UK markets. Despite its cost-effectiveness, the headset boasts impressive features: a 1000 mAh battery, virtual 7.1 surround sound, various EQ presets, and flexible connectivity options such as Bluetooth, wired, and 2.4GHz.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003054

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Gaming Industry Landscape in Europe

- 4.3 Industry Ecosystem Analysis

- 4.4 Demographic trends related to Gaming-based Consumers in the Country

- 4.4.1 Age & Income-related Demographics

- 4.4.2 Key Considerations for Purchasing Gaming Peripherals Including Headsets

- 4.5 Impact of Recent Developments, Such As Move Toward VR Gaming Giving Rise to VR Headsets

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Challenges

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 Compatibility Type

- 6.1.1 Console Headset

- 6.1.2 PC Headset

- 6.2 Connectivity Type

- 6.2.1 Wired

- 6.2.2 Wireless

- 6.3 Sales Channel

- 6.3.1 Retail

- 6.3.2 Online

7 COMPETITIVE LANDSCAPE

- 7.1 Analysis of Major Domestic Gaming Headset Manufacturers Operating in United Kingdom

- 7.2 Analysis of Major International Gaming Headset Vendors Operating in United Kingdom

- 7.3 Comparative Analysis of Pricing and Features of Key Models in United Kingdom

- 7.4 Company Profiles

- 7.4.1 Logitech International S.A.

- 7.4.2 Corsair Gaming, Inc.

- 7.4.3 Razer Inc.

- 7.4.4 SteelSeries

- 7.4.5 Turtle Beach Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.