PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550494

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550494

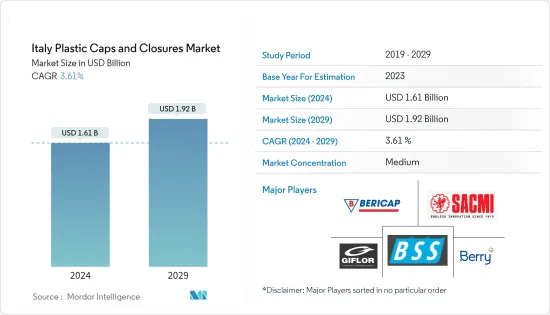

Italy Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Italy Plastic Caps And Closures Market size is estimated at USD 1.61 billion in 2024, and is expected to reach USD 1.92 billion by 2029, growing at a CAGR of 3.61% during the forecast period (2024-2029). In terms of shipment volume, the market is expected to grow from 40.10 billion units in 2024 to 46.95 billion units by 2029, at a CAGR of 0% during the forecast period (2024-2029).

Key Highlights

- Italy is the eighth-largest economy in the world and the third-largest in Europe. Italy depends on raw material imports from the United States. According to the United States Department of Agriculture (USDA), in 2023, the U.S. shipped $1.8 billion worth of agricultural products to Italy, contrasting with the $7.4 billion in imports it received from Italy. This trade dynamic underscores a trend: Italy predominantly exports consumer-oriented goods to the United States, whereas the United States leans towards exporting bulk commodities to Italy.

- According to the United States Department of Agriculture (USDA), the Italian food-processing sector is witnessing a trend of consolidation, with smaller companies increasingly merging. This shift is propelled by advancements in food technology, innovative marketing strategies, the allure of "Made in Italy" products, and a surge in exports of finished food items. Notably, Italian consumers persistently prefer baked goods, processed meats and seafood, and dairy products.

- Sacmi Imola S.C., among other Italian manufacturers, leads the charge in product innovation, particularly in crafting leakproof closures. Their strategic focus on R&D, specifically for cap and closure design and marketing, not only bolsters their market presence in Italy but also positions them as a frontrunner. Furthermore, their emphasis on sustainable solutions for caps and closures further propels market expansion.

- Yet, heightened environmental concerns in Italy, especially surrounding plastic packaging, present a significant hurdle. The escalating worry over plastic packaging pollution, with its direct threat to marine ecosystems, is a pressing issue that directly impacts market dynamics. Consequently, a notable trend emerges: a growing number of manufacturers are pivoting towards metal as a viable alternative for their caps and closures, fundamentally reshaping the market.

Italy Plastic Caps and Closures Market Trends

Polyethylene (PE) Segment is Estimated to Have the Largest Market Share

- Polyethylene (PE), derived from petroleum polymers, stands out as a highly durable plastic, boasting chemical resistance and cost-effectiveness. It's further segmented into high-density polyethylene (HDPE) and low-density polyethylene (LDPE), both known for their resilience against environmental hazards. The growing demand for Polyethylene (PE) polymer for making caps and closures for food, beverage, dairy products, and juice bottles bolsters the market growth in the country.

- HDPE and LDPE are the predominant materials used to produce caps and closures. HDPE variants are used primarily in water, dairy, and juice bottles. Given its robust chemical resistance, polyethylene, especially HDPE, has long been the go-to choice for bottle closures, particularly in industrial and chemical settings in Italy.

- Notably, HDPE is prized for its strength and longevity. This thermoplastic polymer, derived from petroleum, is highly versatile, rendering it a top pick for cosmetics, beverages, and various other applications. In Italy, manufacturers such as Giflor Srl, Bericap Holding GmbH, and Sacmi Imola S.A focus on producing caps made of PE material, available in various colors and sizes.

- The rising import of caps, closures, and lids into Italy, notably from France, Germany, China, Belgium, and Spain, caters to industries like cosmetics, beverages, healthcare, and chemicals, driving market expansion. Data from the International Trade Centre (ITC) reveals that Italy's imports of caps and closures reached USD 455.69 million in 2023, marking a 9.81% increase from the previous year.

Beverage Segment Expected to Dominate the Market

- Italy's surging beverage consumption owes much to its burgeoning tourism industry. Both locals and visitors are fueling a heightened appetite for both alcoholic and non-alcoholic drinks. Data from the World Travel and Tourism Council (WTTC) reveals that in the previous year, Italy's Travel & Tourism sector contributed EUR 215 billion (USD 233.05 billion), representing 10.5% of the nation's total economic output, firmly establishing it as a linchpin of the Italian economy.

- Italy's increasing focus on health and an aging demographic, as highlighted by the United States Department of Agriculture (USDA), is spurring demand for health and wellness products. This shift is evident in the popularity of functional foods and beverages, especially fermented foods, healthy juices, and probiotics, often sealed with threaded and unthreaded caps, driving market expansion.

- Key players such as Bericap Holding GmbH in Italy are tailoring caps and closures to ensure optimal packaging sealability. Furthermore, the rising practice of adorning these closures with vibrant colors, using cutting-edge digital printing, is not just enhancing brand recognition but also boosting the demand for plastic closures across the nation.

- Italy's rising thirst for bottled water can be traced to its reputation for high quality, purity, and a diverse range of sparkling options. Italian restaurants and cafes, favoring the convenience of threaded plastic caps, are notably contributing to this trend. Citing Gambero Rosso, a prominent Italian food and wine publication, Italy's bottled water market has seen consistent growth in recent years. In 2022, consumption reached nearly 15 billion liters, with a projected uptick to 15.4 billion liters in 2023, underscoring this upward trajectory.

Italy Plastic Caps and Closures Industry Overview

The Italy plastic caps and closures market is moderately consolidated, with players such as Berry Global Inc., Bericap Holding GmbH, Giflor Srl, and Bosisio Francesco & C. SpA. To solidify their footprint in the market, the players focus on new product development, partnerships, mergers and acquisitions, and collaborations in Italy. A strategic focus on customized caps and closures in the market is a competitive advantage for a few manufacturers in the country.

- February 2024: Giflor Srl, an Italy-based company, announced the launch of the Ring, a bi-color cap. These caps have unique designs, a glossy body, and a matte top, which gives the product a sophisticated and contemporary appearance. Additionally, the Ring is made with fully recyclable material, is patented, and is lightweight.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the Food and Beverage Industry

- 5.1.2 Increasing Product Innovation in the Market

- 5.2 Market Challenge

- 5.2.1 Growing Environmental Concerns Over Plastic Packaging

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded - Screw Caps, Vacuum, etc.

- 7.2.2 Dispensing

- 7.2.3 Unthreaded - Overcaps, Lids, Aerosol-based Closures

- 7.2.4 Child-resistant

- 7.3 By End-Use Industries

- 7.3.1 Food

- 7.3.2 Beverage

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices & Energy Drinks

- 7.3.2.5 Other Beverages

- 7.3.3 Personal Care & Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-Use Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Group GmbH

- 8.1.2 Bericap Holding GmbH

- 8.1.3 Berry Global Inc.

- 8.1.4 Aptar Group Inc.

- 8.1.5 Giflor Srl

- 8.1.6 Bosisio Francesco & C. SpA

- 8.1.7 Sacmi Imola S.C.

- 8.1.8 Wisecap Group

- 8.2 Heat Map Analysis

- 8.3 Competitor Analysis - Emerging vs. Established Players

9 RECYCLING & SUSTAINABILITY LANDSCAPE

10 FUTURE OUTLOOK