PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550331

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550331

Europe Discrete Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

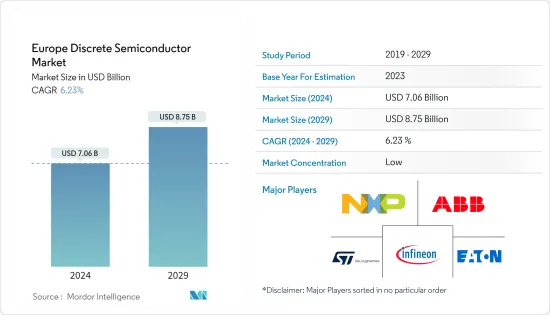

The Europe Discrete Semiconductor Market size is estimated at USD 7.06 billion in 2024, and is expected to reach USD 8.75 billion by 2029, growing at a CAGR of 6.23% during the forecast period (2024-2029).

Key Highlights

- Europe hosts various discrete semiconductor companies and vendors, including ABB Ltd, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, Nexperia, and Eaton Corporation. It also serves as a major manufacturing hub, leading to a strong demand for industrial and automotive-grade discrete semiconductors within the area.

- The discrete semiconductor market in the region shows promising potential due to government initiatives promoting electric vehicles. The European Union has set a target to decrease CO2 emissions by 55% from 1990 levels by 2030, while the United Kingdom plans to reduce carbon emissions by 70% by 2035. These initiatives are expected to boost the adoption of EVs in the region, thereby stimulating the market's growth.

- According to the European Automobile Manufacturers' Association (AECA), Europe witnessed approximately 757,800 electric vehicle sales in the second quarter of 2023, encompassing both battery electric vehicles and plug-in hybrid electric vehicles.

- Additionally, the region is experiencing rapid growth during the projected timeline thanks to significant investments in data centers, cloud computing, and AI and VR technologies. Europe is witnessing a substantial need for data centers from small and medium-sized organizations that do not have the means to establish their in-house IT operations, leading to a demand for discrete semiconductors in communication infrastructure.

- In February 2024, Germany led all European countries with the highest number of data centers and was actively engaged in the race for cloud adoption. According to CloudScene, Germany is home to 522 data centers, outpacing its European counterparts.

- Rising demand for integrated circuits (IC) or microchips may further hamper the market's growth. Integrated circuits (IC), or microchips, are electronic components that integrate multiple electronic circuits onto a single semiconductor substrate. In contrast, discrete semiconductors are electronic components designed to carry out specific functions like regulating current flow, amplifying signals, and switching.

- Several macroeconomic trends affect market growth, economic growth, inflation, government spending priorities, global trade, and geopolitical dynamics. The inflation rates in European countries rose, with Germany, Sweden, France, and the United Kingdom witnessing a significant increase compared to January 2022. By August 2023, the inflation rate in the United Kingdom reached 6.7%, up from 5.5% in January 2022. These developments were anticipated to impede the market's growth in 2023.

Europe Discrete Semiconductor Market Trends

Power Transistor Segment Holds the Significant Market Share

- A MOSFET, also known as a metal-oxide-semiconductor field-effect transistor, is frequently utilized in discrete semiconductors, digital logic, integrated circuits (ICs), and thin-film transistor (TFT) LCDs. This particular type of transistor is designed for amplifying or switching electronic signals.

- MOSFET power transistors are essential for the optimal operation of electric vehicles (EVs). They are used in motor drive systems, battery management systems, and DC-DC converters for auxiliary systems. The increasing popularity of EVs in the country is expected to propel the expansion of the market.

- The automotive sector depends significantly on silicon MOSFET discrete semiconductors for various purposes. These MOSFETs are utilized in electronic control units (ECUs), battery management systems, motor control units, and automotive lighting systems. Their capacity to manage high voltages and currents and their durability position them as the top choice in challenging automotive conditions.

- In 2023, the European Union car market witnessed a notable increase of 13.9% from 2022, leading to a total sales volume of 10.5 million units for the whole year, as per the European Automobile Manufacturers' Association (ACEA) report.

- Furthermore, the market has witnessed a notable increase in product launches due to the numerous advantages of incorporating SiC in MOSFETs, significantly impacting the segment. For instance, in November 2023, Nexperia introduced its initial silicon carbide (SiC) MOSFETs through the launch of two 1200 V discrete devices in 3-pin TO-247 packaging with RDS(on) values of 40 mΩ and 80 mΩ. This product caters to the growing market need for a wider range of high-performance SiC MOSFETs in various industrial applications, such as electric vehicle charging stations, uninterruptible power supplies, and inverters in solar energy storage systems.

Germany is Expected to Hold Significant Market Share

- Germany has been identified as the leading semiconductor production center in Europe, according to Germany Trade & Invest (GTAI). The sector holds the second position in terms of employment figures. Germany aims to strengthen its semiconductor manufacturing sector to establish a substantial portion of the global semiconductor production in Europe by 2030, as outlined in an official government document. The goal is to reach at least 20% of global semiconductor production.

- Furthermore, Germany's Federal Minister has rolled out the Industrial Strategy 2030, a comprehensive blueprint to bolster the nation's manufacturing sector's competitiveness. These new policies and initiatives are set to boost industrial production and paint a positive outlook for the market under study.

- Moreover, Germany, in particular, stands out globally as a significant automotive hub, thanks to the presence of key manufacturing companies like Volkswagen AG and Daimler AG. The German automotive industry has been leading technological innovations in the global automotive industry, integrating smart technologies.

- Companies are focusing on electric vehicle technologies, expecting the rise of hybrid and electric vehicles to fuel the expansion of the country's automotive sector. This is expected to positively affect the European discrete semiconductors market's growth.

- Similarly, the VDA reported that approximately 4.12 million German vehicles were manufactured in 2023, a rise from the 3.4 million cars produced in 2022. These trends are fueling an increase in market demand.

Europe Discrete Semiconductor Industry Overview

The Europe discrete semiconductor market is fragmented and consists of several players. Companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic acquisitions and mergers, partnerships, and collaborations. Some of the major vendors include ABB Ltd., Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, Eaton Corporation PLC, and many more.

In June 2024, Onsemi planned to invest a maximum of USD 2 billion over several years to strengthen the advanced power semiconductor supply chain for its European and global customers. The company intends to construct a vertically integrated silicon carbide (SiC) manufacturing facility in the Czech Republic. This plant is expected to specialize in producing Onsemi's essential intelligent power semiconductors, which are vital in improving energy efficiency in electric vehicles, renewable energy systems, and AI data centers.

In May 2024, Infineon Technologies broadened its SiC MOSFET development to cover voltages under 650 V. The CoolSiCMOSFET 400 V family's latest addition is based on the second-generation (G2) technology and was launched earlier this year. This new lineup of MOSFETs is tailored explicitly for the AC/DC stage of AI servers, which aligns with Infineon's recent PSU roadmap. Apart from server applications, these devices are also suitable for inverter motor control, solar and energy storage systems, SMPS, and solid-state circuit breakers in residential environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment

- 5.1.2 Increasing Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Challenges

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Diode

- 6.1.2 Small Signal Transistor

- 6.1.3 Power Transistor

- 6.1.3.1 MOSFET Power Transistor

- 6.1.3.2 IGBT Power Transistor

- 6.1.3.3 Other Power Transistors

- 6.1.4 Rectifier

- 6.1.5 Thyristor

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices and Storage Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Diodes Incorporated

- 7.1.8 Nexperia BV

- 7.1.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 7.1.10 Eaton Corporation PLC

- 7.1.11 Hitachi Energy Ltd. (Hitachi Ltd.)

- 7.1.12 Texas Instrument Inc.

- 7.1.13 Wolfspeed Inc.

- 7.1.14 Microchip Technology

- 7.1.15 Renesas Electronics Corporation

- 7.1.16 Mitsubishi Electric Corporation

- 7.1.17 Analog Devices, Inc.

- 7.1.18 Vishay Intertechnology Inc.

- 7.1.19 Rohm Co. Ltd

- 7.1.20 Littelfuse Inc

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS