PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550314

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550314

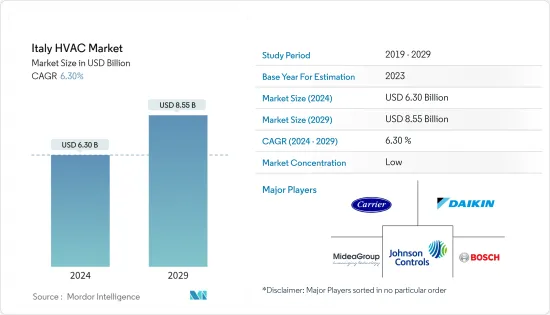

Italy HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Italy HVAC Market size is estimated at USD 6.30 billion in 2024, and is expected to reach USD 8.55 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

Key Highlights

- The demand for the HVAC market will increase in Italy due to the rising expansion of industrial sectors, such as food and beverage factories, and growing investments in the healthcare and power generation sectors. According to Eurostat, the revenue from the manufacture of food products in Italy is projected to amount to approximately USD 28.59 billion by 2025.

- Furthermore, the rising expansion by food & and beverages industry players will create high growth opportunities for the service vendors operating in the country. For instance, in September 2024, Lulu Group announced opening its sourcing, food processing, and export hub in Italy. The company focuses on sourcing, processing, storing, packaging, and exporting top-quality food products from Italy to more than 255 LuLu Hypermarkets through this facility.

- Moreover, various commercial buildings in the country are replacing old HVAC systems with new ones, further expected to complement the demand for HVAC services in the market. For instance, in August 2023, Daikin announced that it had supplied three heat pump units featuring screw inverter compressors to an Italian airport-the project aimed at replacing the old HVAC system with a more modern and efficient one. A Daikin Modular P air handling unit has been installed to provide the airport with the proper ventilation.

- Energy price fluctuations directly impact HVAC system operating costs, swaying consumer choices. For many, these systems' maintenance and repair expenses are a significant deterrent. With a reluctance to embrace energy-efficient technologies, the high initial cost of HVAC equipment can be challenging for its demand. The high price may deter some customers from purchasing or upgrading the systems, impeding market expansion.

- Macroeconomic factors significantly influence market dynamics, particularly sectors like construction, government regulations, and regional initiatives to bolster infrastructure, industrial, and manufacturing domains. Notably, commercial and industrial growth fluctuations directly correlate with HVAC equipment demand. Moreover, as inflation escalates, the costs of materials, labor, and energy for HVAC system production and installation rise, often translating to higher prices for new HVAC installations.

Italy HVAC Market Trends

Residential Sector to Witness a Significant Growth

- The Italian government's increasing efforts to promote energy-efficient solutions in the residential sector are anticipated to stimulate the market further. For instance, the government is currently offering to cover 110% of the expenses incurred by its residents to transform homes into eco-friendly and energy-efficient spaces. A comprehensive policy review by the IEA reveals that Italy is on track to achieve its national targets for reducing emissions and improving energy efficiency by 2030.

- Italy's focus on energy conservation and sustainability is fueling a rising demand for HVAC solutions that are both high-performing and eco-friendly, aiming to slash energy usage and carbon footprints. For instance, financially struggling property owners in Italy were granted the opportunity to modernize their homes at minimal costs, owing to government initiatives. Subsidies from the state frequently covered the entire expense, leading to a surge in modernization efforts across Italy, with heat pumps emerging as a critical player in this transformation.

- The country's growing number of healthcare facilities will drive the need for HVAC equipment during the projected timeline. For instance, in February 2024, Italy and the Vatican announced a partnership for a new children's hospital in Rome.

- The Italian government is set to approve a partial extension of the expensive "super bonus" subsidies for home improvements. Forza Italia, the party championing this move, has confirmed that the 110% tax credits will persist, explicitly targeting low-income households that have yet to finish the renovations this year. Thus, government subsidies encourage homeowners to invest in modern homes, which drives the demand for energy-efficient HVAC systems.

HVAC Equipment is Expected to Hold Significant Market Share

- Italy's regulatory framework emphasizes reducing energy consumption and greenhouse gas emissions. Compliance with these regulations often requires upgrading to more efficient HVAC systems. In addition, a large portion of Italy's building stock is old and energy-inefficient-renovation projects aimed at improving energy performance typically include upgrading the HVAC systems.

- In Italy, home bonuses continue to play a pivotal role in incentivizing the renovation and purchase of residential properties. For instance, in April 2024, home bonuses aim to incentivize energy efficiency upgrades, elevate building standards, and bolster safety measures. Moreover, the home bonuses catalyze Italy's construction sector and its associated satellite activities.

- Italy is witnessing a surge in innovative heat pump technologies, fueling the demand for the market studied. For instance, in May 2024, Italian researchers discovered that integrating residential air heat pumps with air-geothermal heat exchangers could slash power usage by as much as 30%. The study in Valtellina, northern Italy, involved testing this hybrid system on a passive single-family dwelling, with Matlab as the primary tool.

- Moreover, in November 2023, Aira, a heat pump company, expanded its operations into Italy after acquiring the Italian contractors T5 Group earlier this year. Specializing in direct-to-consumer sales, Aira offers heat pumps through a unique monthly subscription model. The company's initial focus will be on six critical regions in Italy: Lombardy, Piedmont, Lazio, Marche, Abruzzo, and Umbria. Such developments will propel Italy's HVAC market growth in the coming years.

Italy HVAC Industry Overview

The Italy HVAC market is fragmented, with the presence of significant players like Carrier Corporation, Daikin Industries, Ltd., Midea Group Co., Ltd., Johnson Controls International PLC, and Robert Bosch GmbH, among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance product offerings and gain sustainable competitive advantage.

- June 2024: L.G. Electronics Inc. has partnered with universities in Italy to form a European consortium dedicated to advanced heat pump research. The initiative aims to bolster the performance of L.G.'s HVAC products, particularly in low-temperature climates. In Italy, attaining optimal heating efficiency poses a challenge, primarily stemming from the complexities of compressing refrigerants at lower pressures. In response, L.G. spearheaded a consortium to design heat pumps that excel in heating, even in the harshest cold climates.

- September 2023: BDR Thermea Group, the innovative indoor climate solutions provider, is set to acquire a 25% stake in G.I. Holding, renewable energy-driven climate solutions for commercial and industrial sectors provider. BDR Thermea Group has already been marketing G.I. Holding's medium- to high-capacity heat pumps across Italy, Spain, and Portugal under its BAXI brand. This strategic move bolsters BDR Thermea Group's portfolio in heating and cooling solutions for industrial, commercial, and multi-residential buildings and extends G.I. Holding's new technology to a broader customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs

- 5.1.2 Growing Demand For Replacement and Retrofit Activity

- 5.1.3 Increasing Demand For Energy Efficient Devices

- 5.2 Market Challenges

- 5.2.1 Skilled Labor Shortages

- 5.2.2 High Initial Cost of Energy Efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 HVAC Equipment

- 6.1.1.1 Heating Equipment

- 6.1.1.2 Air Conditioning /Ventilation Equipment

- 6.1.2 HVAC Services

- 6.1.1 HVAC Equipment

- 6.2 By End User Industry

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Carrier Corporation

- 7.1.2 Daikin Industries, Ltd.

- 7.1.3 Midea Group Co., Ltd.

- 7.1.4 Johnson Controls International PLC

- 7.1.5 Robert Bosch GmbH

- 7.1.6 System Air AB

- 7.1.7 LG Electronics Inc.

- 7.1.8 BDR Thermea Group

- 7.1.9 Danfoss Inc.

- 7.1.10 Mitsubishi Electric Hydronics & IT Cooling Systems S.p.A.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET