PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550303

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550303

Australia And New Zealand Plastic Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

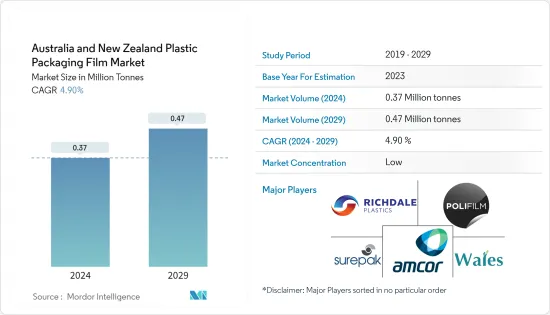

The Australia And New Zealand Plastic Packaging Film Market size is estimated at 0.37 Million tonnes in 2024, and is expected to reach 0.47 Million tonnes by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Key Highlights

- The plastic film packaging market in Australia and New Zealand is thriving due to a confluence of factors. These include a growing appetite for lightweight and convenient packaging, heightened consumer consciousness regarding sustainability, and technological advancements that enhance shelf life and product protection. Additionally, the market benefits from the increasing adoption of flexible packaging in various industries, such as food and beverage, pharmaceuticals, and personal care.

- Plastic film packaging's flexibility in adapting to diverse shapes and sizes, cost efficiency, and ease of transport bolster its growth. The flexible packaging sector is set for significant expansion, with industries emphasizing eco-friendly options and consumers valuing convenience. This growth is driven by the increasing demand for sustainable packaging solutions, advancements in material technology, and the rising popularity of e-commerce, which requires durable and lightweight packaging.

- Australia, a large and culturally diverse nation, boasts numerous business advantages for growth-minded companies. Its robust exports and stable financial system underscore why it is a prime choice for business owners. As one of the world's wealthiest nations, Australia maintains strong trade connections, particularly with Asia-Pacific countries. Geographically, its proximity to these vital markets further enhances its trade advantages. Australia's trade, investment, and cultural ties with the Asia-Pacific nations are long-standing and deeply entrenched. The country has secured crucial trade agreements with key players, such as China, Japan, and the United States, as well as with regional entities like ASEAN. Notably, Australia stands out as one of the fastest-growing packaging markets in the Asia-Pacific. Moreover, its processed food, fresh produce, and meat sectors are on the rise, driven by health-conscious consumer trends and growing ethical concerns.

- Australia set its 2025 National Packaging Targets, focusing on four key objectives: achieving 100% reusable, recyclable, or compostable packaging by 2025; ensuring 70% of plastic packaging is recycled or composted by 2025; and aiming for an average of 50% recycled content in all packaging by 2025. Various single-use plastic items, especially those used in food service, are being phased out across different Australian states and territories to achieve these goals. The country's environmental ministers have united to craft new packaging standards, aiming to accelerate Australia's shift toward a circular economy. This initiative includes establishing nationwide minimum recycled content mandates and banning the use of harmful chemicals in domestic packaging.

- Plastics constitute Australia's most significant and enduring portion of marine litter, with plastic packaging driving a substantial part of this production. Acknowledging the pivotal role of plastic packaging in driving plastic production will likely compel the packaging industry to pivot toward more sustainable practices. This shift could encompass moving to recyclable or biodegradable materials, redesigning packaging for enhanced recyclability, or exploring alternative packaging solutions.

Australia and New Zealand Plastic Packaging Film Market Trends

Food Segment to Hold Significant Market Share

- As consumer lifestyles evolve to accommodate busier schedules, the demand for convenient meal options, like frozen foods, has surged. Plastic film packaging is pivotal in this narrative, providing easy-to-open formats that align with the need for quick meal preparation. Additional features, such as resealable closures and portion-sized packs, further elevate the convenience factor for consumers. The growing frozen food market has consequently heightened the demand for plastic film packaging.

- Australia's urban customers increasingly favor convenient packaging, spurring demand for user-friendly and lightweight solutions. In response, vendors are pivoting their designs to stay ahead in the expanding organized retail landscape, adapting to evolving consumer preferences. This shift is driven by the need for packaging that enhances the consumer experience and aligns with sustainability goals. Embracing lighter materials, notably plastic film pouches, meets these demands and offers substantial energy-saving advantages. Additionally, these materials reduce transportation costs and environmental impact, making them a preferred choice for manufacturers and consumers.

- In 2023, Australia's food retail industry generated an annual revenue exceeding USD 111.8 billion, up from USD 101.5 billion in 2021, showcasing consistent year-on-year growth. This upward trajectory in food retail has underscored the demand for plastic film packaging, essential for preserving food quality, extending shelf life, and enhancing product presentation. The increased revenue highlights the sector's resilience and adaptability in meeting consumer needs and preferences.

- Food manufacturers increasingly demand lightweight, protective, visually appealing, and high-barrier packaging. This trend is expected to drive sales in the plastic film packaging sector. The multi-sensory experience associated with plastic film packaging entices purchases and bolsters the market's growth trajectory. Additionally, the versatility and cost-effectiveness of plastic film packaging make it a preferred choice among manufacturers, further enhancing its market appeal.

- Despite Australia's active efforts to reduce plastic packaging, its benefits compared to alternatives have allowed manufacturers to continue their production. The country has established ambitious 2025 National Packaging Targets, charting a sustainable path for packaging management. The Australian food industry and the government are behind these targets, pushing for a greener packaging approach. These comprehensive targets cover all packaging activities within the nation, signaling a substantial move toward a more sustainable future.

Polyethylene Segment Expected to Hold Significant Share in the Market

- Polyethylene is primarily used in packaging, including plastic bags, films, and geomembranes. This thermoplastic resin is lightweight and partially crystalline, boasting high chemical resistance, low moisture absorption, and sound-insulating properties. Within the polyethylene family, LDPE (low-density polyethylene) stands out for its flexibility, making it a preferred choice for film packaging and electrical insulation. LDPE is extensively utilized in various applications, ranging from packaging films, trash, and grocery bags to agricultural mulch, wire, and cable insulation. Its lower crystallinity than HDPE results in a softer, more flexible texture, albeit with a slightly reduced barrier capability.

- LDPE is widely used in flexible packaging and is prized for its affordability and chemical and oil resistance. Unlike HDPE, LDPE has a slightly cloudy appearance but offers better clarity. With a lower melting point, LDPE might not fare well in applications requiring high heat stability, but it is a boon in scenarios where lower melting points are preferred. LLDPE, a prevalent choice in the packaging sector, also stands out for its lower density and the inclusion of comonomers, which introduce branch-like structures on its primary chain, thereby reducing crystallinity. This alteration leads to a hazy appearance and a more pliable texture. Notably, when matched for density and thickness, LLDPE surpasses LDPE in impact strength, tensile strength, puncture resistance, and elongation.

- Consumers' growing preference for convenient shopping experiences is evident in the uptick in supermarket and grocery store sales. With shoppers turning to these outlets for their daily needs, the demand for plastic film packaging is surging. This packaging is favored for its user-friendly, portable, and storage-friendly nature. Additionally, polyethylene film offers benefits such as extended shelf life for perishable goods, reduced product damage during transportation, and enhanced visual appeal, further driving its adoption in the retail sector.

- Two major players, the Woolworths Group and the Coles Group, dominate Australia's supermarket and grocery retail market. The states of New South Wales and Victoria, being the most populous, host the highest number of supermarkets in the country. Alongside these giants, Australia boasts various grocery outlets, including the German chain Aldi and the independently owned IGA stores. The annual revenue of Australia's supermarket and grocery retail sector has seen consistent growth. In 2023, the industry's revenue surpassed USD 92.4 billion, up from USD 83 billion in 2021. This upward trajectory in Australia's supermarket sector not only underscores rising demand but also hints at opportunities in the plastic film market.

Australia and New Zealand Plastic Packaging Film Industry Overview

The plastic packaging film market in Australia and New Zealand is fragmented, comprising several global and regional players like Amcor Group GmbH, Surepak Pty Ltd, and Richdale Plastics Pty Ltd, who are vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- February 2024 - Cadbury, a leading food and beverage brand in Australia, partnered with Amcor, a global packaging company, to secure approximately 1000 tonnes of post-consumer recycled plastic. This move is part of Cadbury's broader strategy to reduce its reliance on virgin plastic. In 2022, Cadbury already transitioned 30% (on a mass balance basis) of the plastic used for its 160 g to 185 g Cadbury Dairy Milk family blocks in Australia to recycled materials. With this recent agreement, Cadbury is pushing further, targeting a 50% (on a mass balance basis) usage of recycled plastic across its entire range of chocolate blocks, bars, and pieces manufactured in Australia. This shift cuts Cadbury's virgin plastic requirements in half for these products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defintion

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Driver

- 5.1.1 Growing Demand for Lightweight Packaging Solution

- 5.1.2 Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 5.2 Market Challenges

- 5.2.1 Stringent Government Laws and Regulation toward Plastic

- 5.3 Industry Regulation, Policy, and Standards

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Polypropylene [PP] (Biaxially Oriented Polypropylene [BOPP], Cast Polypropylene [CPP])

- 6.1.2 Polyethylene (Low-density Polyethylene [LDPE], Linear Low-density Polyethylene [LLDPE])

- 6.1.3 Polyethylene Terephthalate (Biaxially Oriented Polyethylene Terephthalate [BOPET])

- 6.1.4 Polystyrene

- 6.1.5 Bio-based

- 6.1.6 Polyvinyl Chloride, Ethylene Vinyl Alcohol, and Other Film Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.1.1 Candy and Confectionery

- 6.2.1.2 Frozen Foods

- 6.2.1.3 Fresh Produce

- 6.2.1.4 Dairy Products

- 6.2.1.5 Dry Foods

- 6.2.1.6 Meat, Poultry, and Seafood

- 6.2.1.7 Pet Food

- 6.2.1.8 Other Food Products (Seasonings and Spices, Spreadables, Sauces, Condiments, etc.)

- 6.2.2 Healthcare

- 6.2.3 Personal Care and Home Care

- 6.2.4 Industrial Packaging

- 6.2.5 Other End-user Industry Applications (Agricultural, Chemical, Etc)

- 6.2.1 Food

- 6.3 By Country

- 6.3.1 Australia

- 6.3.2 New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Surepak Pty Ltd

- 7.1.3 POLYEM Pty Ltd

- 7.1.4 Richdale Plastics Pty Ltd

- 7.1.5 Polywrap (Australia)

- 7.1.6 Wales Industries Pty Ltd

- 7.1.7 POLIFILM PROTECTION AUSTRALIA PTY LIMITED

- 7.1.8 Dolphin Plastics

- 7.1.9 Polyprint Packaging Ltd

- 7.1.10 Allflex Packaging Ltd

- 7.1.11 Integrated Packaging Group (IPG)

8 RECYCLING & SUSTAINABILITY LANDSCAPE

9 FUTURE OF THE MARKET