PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550273

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550273

France Surveillance Analog Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

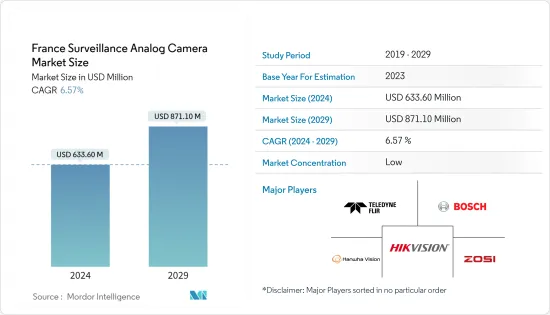

The France Surveillance Analog Camera Market Size Industry is expected to grow from USD 633.60 million in 2024 to USD 871.10 million by 2029, at a CAGR of 6.57% during the forecast period (2024-2029).

Key Highlights

- The adoption of surveillance cameras in private settings is on the rise, notably in France. An increasing number of residences and small enterprises are turning to security cameras. Given that many households favor cost-effective options, analog cameras have emerged as a popular choice, being more affordable than their IP counterparts. This cost disparity translates into notable savings, especially when deploying multiple cameras. Moreover, these savings are further amplified when pre-existing wiring is in good condition and can be utilized for the installation.

- Technological advancements, notably in video monitoring, have significantly reshaped the public safety arena in recent years. What was once primarily a tool for post-incident analysis, these systems are now taking a more proactive stance in crime prevention and safety oversight. While initially deployed as deterrents, the ubiquity of video cameras has diminished their effectiveness in dissuading criminal activities. Notably, the safety and security landscape in France is witnessing a notable uptick in emphasis, further propelling the market's growth.

- Amid escalating safety concerns, both businesses across sectors and individuals are increasingly turning to video surveillance. In response to heightened crime rates, many rural communities are embracing CCTV and video surveillance technologies. These communities are witnessing a surge in the installation of surveillance cameras, particularly in areas grappling with vandalism and violence.

- Highlighting this trend, rural mayors in southeastern France are spearheading the adoption of video surveillance. Plans are underway for a centralized surveillance hub, enabling simultaneous monitoring of multiple locations. The urgency for such measures is underscored by recent events: over 300 locations nationwide reported violence in 2023, a fallout from the riots in Paris triggered by a police shooting. Furthermore, rural mayors, including those in Indre, central France, have faced a concerning rise in both verbal and physical assaults recently.

- Government spending has significantly bolstered the security market. Government data reveals an expenditure of around EUR 24.2 billion (USD 26.39 billion) on security measures in 2023. This heightened investment in security infrastructure directly translates to a surge in surveillance camera installations.

- However, challenges loom, with privacy emerging as a primary concern. Heightened public apprehensions regarding data privacy and the misuse of surveillance recordings are impeding broad acceptance. The prevalent view of surveillance as a violation of personal privacy is fueling public resistance.

France Surveillance Analog Camera Market Trends

Small and Medium-Sized Enterprises Fuel Market Demand

- The surge in shoplifting incidents poses a grave challenge for businesses in France, amplifying the demand for surveillance cameras. Recent reports highlight a stark rise of over 14% in shoplifting cases nationwide. While food items top the list of pilfered goods, clothing also remains a favored target. A study from a few years back estimated that shoplifting annually costs French retailers billions of euros in losses. Thus, SMEs, often constrained by tighter budgets, gravitate toward cost-effective security solutions. Analog cameras, while modest in cost, meet the fundamental surveillance needs of many SMEs, including retail outlets, eateries, and small offices.

- What sets analog cameras apart is their user-friendly installation and maintenance, making them particularly attractive to businesses with limited technical know-how or resources. Not only are the operational costs of analog cameras lower than their digital counterparts, but SMEs can also sidestep expenses tied to network infrastructure, high bandwidth demands, and specialized IT support, rendering analog cameras a prudent, long-term investment.

- SMEs, often situated in community settings, leverage visible surveillance cameras to deter local crime. Analog cameras strategically placed in and around business premises bolster neighborhood safety and dissuade criminal activities.

- Analog surveillance cameras, supported by surveillance footage, play a crucial role in aiding law enforcement in France with crime investigations and identifying perpetrators. SMEs in France are at the forefront of fueling the demand for these analog cameras. Their appeal lies in their affordability, simplicity, and well-documented effectiveness, making them a cost-effective choice. With SMEs representing over 99% of all businesses in France, the market for traditional surveillance systems, especially designed for these enterprises, remains robust.

Government Sector to Witness Demand

- Government initiatives are significantly boosting the demand for surveillance equipment. This surge is a direct response to escalating crime rates and security concerns, prompting a heightened focus on public safety.

- Specifically, the French government has intensified its push to install CCTV cameras in public areas like streets, transport hubs, and governmental premises. These measures form a crucial component of their broader strategy to combat and deter crimes like theft, vandalism, and terrorism.

- In 2023, France witnessed a surge in violent crimes, with reported offenses reaching approximately 384,100, marking a stark increase from the 353,600 offenses recorded in 2022. In response to this concern, the French government has intensified its security measures.

- Aligned with its counter-terrorism strategy, France's Vigipirate plan underscores the necessity of robust surveillance. In response to recent terrorist incidents, the government is strategically placing cameras in sensitive zones. Concurrently, municipal bodies nationwide are ramping up security measures, particularly targeting urban crime, with theft rates standing out as a significant concern.

- Privacy concerns arise as high-tech facial recognition AI cameras come into play, leading to a public backlash against real-time surveillance. Consequently, governments may revert to traditional cameras to avoid compromising privacy, especially in light of cyber threats.

France Surveillance Analog Camera Industry Overview

France's surveillance analog camera market is fragmented, with major domestic and international players competing by offering technologically advanced products. The market features a wide range of manufacturers offering various technologies and solutions. Chinese manufacturers are major contenders and provide tough competition. Many global and domestic companies compete in the market, offering various surveillance camera types and integration services.

July 2024: The Clearway Group ("Clearway") announces the acquisition of the SECONTEC Group. Founded in 2016 and headquartered in London, Clearway is a leading European security services provider specializing in protecting people, property, and assets. Clearway delivers tailored security solutions utilizing an extensive range of specialist services integrated with market-leading technology. Clearway's technology-led security solutions include CCTV and alarms for both temporary and permanent applications, supported by highly accredited alarm and video monitoring stations.

October 2023: Bosch Building Technologies has announced a strategic realignment, revealing plans to divest most of its product divisions, including video surveillance, access control, intrusion detection, and communications. The company will retain its fire alarm business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of Impact of Macroeconomic Trends on The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Crime Rates in France

- 5.1.2 Increasing demand from SMEs

- 5.2 Market Restraints

- 5.2.1 Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Government

- 6.1.2 Banking

- 6.1.3 Healthcare

- 6.1.4 Transportation & Logistics

- 6.1.5 Industrial

- 6.1.6 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teledyne FLIR LLC

- 7.1.2 Hangzhou Hikvision Digital Technology Co., Ltd.

- 7.1.3 Hanwha Vision

- 7.1.4 Bosch Sicherheitssysteme GmbH

- 7.1.5 Zosi Technology Ltd.

- 7.1.6 Zhejiang Uniview Technologies Co.,Ltd.

- 7.1.7 IDIS Ltd.

- 7.1.8 Honeywell International Inc.

- 7.1.9 Zhejiang Dahua Technology Co., Ltd

- 7.1.10 Dahua Technology Co. Ltd

- 7.1.11 Axis Communications AB

- 7.1.12 Onix Systems USA

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET