PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550270

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550270

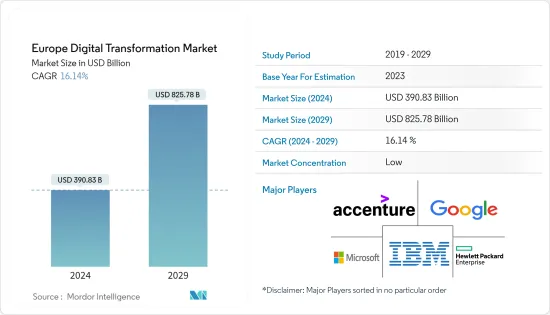

Europe Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Digital Transformation Market size is estimated at USD 390.83 billion in 2024, and is expected to reach USD 825.78 billion by 2029, growing at a CAGR of 16.14% during the forecast period (2024-2029).

Key Highlights

- Europe is experiencing significant growth in digital transformation, fundamentally altering industries and economic dynamics. This evolution involves the widespread integration of digital technologies across business functions, reshaping operational paradigms and customer value propositions. Key drivers behind Europe's digital transformation include technological advancements, evolving consumer behaviors, and strategic governmental initiatives, all aimed at enhancing innovation and competitiveness.

- European governments are actively promoting digital transformation through various policies and initiatives. The European Union's Digital Strategy aims to make Europe fit for the digital age by fostering innovation, improving infrastructure, and ensuring a fair and competitive digital economy. Initiatives such as the Digital Europe Programme and the General Data Protection Regulation (GDPR) create a conducive environment for digital innovation while protecting consumer rights. In December 2023, The European Commission 2024 approved an amendment to the EU Digital Europe Program, allocating a substantial USD 829.09 million. This funding is specifically earmarked to drive digital transformations across Europe, focusing on enhancing citizens' lives, bolstering public services, and empowering businesses within the member states.

- Further, various sectors in Europe are witnessing an adoption of digitalization. For instance, the European retail industry has substantially shifted towards e-commerce. Online shopping platforms, digital payment systems, and personalized marketing strategies are transforming retail. Retailers use data analytics to understand consumer behavior better and optimize supply chains. The rise of online marketplaces and direct-to-consumer brands is changing the sector's competitive dynamics.

- In March 2024, German retailer REWE Group partnered with Israeli startup Catch to trial Catch AI, a versatile platform spanning smart carts, smartphones, and self-checkout kiosks. This innovation empowers shoppers to scan handwritten lists or seamlessly transfer digital lists via a tablet. Notably, the system prioritizes user anonymity, eliminating the need for registrations or app downloads.

- Moreover, Europe's digital transformation is poised for a bright future. With technology's relentless evolution, fresh avenues are set to open up for both businesses and public sector entities. To maintain this digital momentum, it's imperative to consistently invest in emerging technologies, enhance workforce skills, and prioritize cybersecurity. Moreover, fostering partnerships among governments, industries, and academia is pivotal to tackling hurdles and amplifying this transformation's gains. Given Europe's dedication to nurturing a digital economy and its deep-rooted innovative legacy, the continent stands primed to take the helm in the worldwide digital arena.

Europe Digital Transformation Market Trends

Growing Demand of Artificial Intelligence

- The adoption of AI is analyzed to be a significant trend in Europe. Europe is home to an advanced research and development (R&D) ecosystem. Innovations in machine learning, natural language processing, and robotics are accelerating the adoption of AI. The continent's strong academic institutions and collaboration between public and private sectors are fueling these technological advancements.

- Further, according to Amazon, the growth of AI in European business is continiously growing. European businesses have seen a 32% surge in AI adoption over the past year, with approximately one-third now leveraging AI technologies. This trend, if sustained, is poised to cater an estimated USD 652 billion in gross value added (GVA) into the European economy by 2030. Highlighting this shift, Growy, a Netherlands-based AWS scale-up, exemplifies the trend. Utilizing AI alongside the Internet of Things (IoT), Growy manages its fully automated, robotized farms, showcasing the potential of AI in fostering sustainability. These advancements underscore a broader trend in Europe, propelling the region's AI market forward.

- Also, European governments recognized the strategic importance of AI and have initiated various policies to foster its development. In January 2024, the European Commission announced a new package of AI measures. Alongside these measures, the Commission also announced the creation of the European AI Office, which is due to begin formal operations in February 2024. With this, the Commission intends for the AI Innovation Strategy to help the European Union to fullfill its potential of becoming a global frontrunner in advanced AI models, systems, and applications. Such initiatives are designed to position Europe as a growing region in AI.

- Moreover, the industry 4.0, is driving the integration of AI in manufacturing and production processes. European industries are increasingly adopting AI to enhance operational efficiency, reduce costs, and innovate products and services. The digital transformation of businesses is a key driver. Also, there has been a growing investment in research and innovation. According to Research Ministry Germany, Germany promises to invest almost USD 543.5 million in AI research and innovation with investments in supercomputing infrastructure, skills development, and others.

- As the demand grows there has been several innitiatives taken by the public and private sector to increase the adoption of AI. For instance, in July 2024, Germany established a consortium to create the Robotics Institute Germany, serving as the nation's primary hub for robotics. The initiative is set to receive a substantial USD 21.7 million in funding from the German Federal Ministry of Education and Research over the next four years, with backing from the German Research Center for Artificial Intelligence.

United Kingdom to Hold Significant Market Share

- The United Kingdom is witnessing significant growth in digital transformation, fundamentally reshaping its economic and social landscape. The UK's commitment to digital transformation is evident across various sectors, driven by technological advancements, consumer behavior changes, and the need for competitive advantage in a globalized economy. Also, the proliferation of advanced technologies such as artificial intelligence (AI), machine learning, blockchain, and the Internet of Things (IoT) is at the forefront of the UK's digital transformation. These technologies are enabling businesses to optimize operations, enhance customer experiences, and innovate new products and services.

- Further, the proliferation of advanced technologies such as artificial intelligence (AI), machine learning, blockchain, and the Internet of Things (IoT) is at the forefront of the UK's digital transformation. These technologies are enabling businesses to optimize operations, enhance customer experiences, and innovate new products and services.

- In addition, the UK is witnessing a surge in the adoption of wearable devices. According to a survey conducted by YouGov, half of the respondents agreed that they currently own a wearable device. More people are expected to adopt wearable devices, which will boost the country's digital transformation.

- Also, the digitalization of banking, insurance, healthcare, and business services in the United Kingdom is the key driver for the growth of AI and ML in the country. The country also has a well-developed infrastructure of ICT, and the increasing number of start-ups will significantly contribute to the growth of digital transformation in the country. In June 2024, Accel, a venture capital firm, examined 221 GenAI startups, revealing that 30% of these innovative ventures originated in the UK. These startups specialize in creating content be it text, images, videos, or other data leveraging models trained on vast datasets. This trend is poised to significantly propel the market's growth in the near future.

Europe Digital Transformation Industry Overview

The Europe Digital Transformation Market is highly fragmented due to the presence of many players. Several key players in the Digital Transformation market are in constant efforts to bring advancements. A few prominent companies enter collaborations and expand their footprints in developing regions to consolidate their positions. Accenture PLC, Google LLC (Alphabet Inc.), IBM Corporation, Microsoft Corporation, and others are the major players in the market.

- July 2024 : AMD has finalized a deal to acquire Silo AI, Europe's leading private AI lab, in a cash transaction totaling around USD 665 million. This move underscores AMD's commitment to providing comprehensive AI solutions built on open standards and fostering collaborations within the global AI community.

- June 2024 : The EU Digital Twin Ocean platform (EDITO-Infra) was recently launched by VLPF. Backed by EUR10 million (USD 10.93 million) investment from the European Commission, this initiative aims to revolutionize ocean resource management, enhancing the sustainability of blue economies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS (Detailed Coverage of Key Stakeholders in Digital Transformation Industry Product/Solution Providers, System Integrators/VARs, Connectivity Providers, Regulatory Bodies, End-users, Service Providers, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the adoption of big data analytics and other technologies in the region

- 5.1.2 The rapid proliferation of mobile devices and apps

- 5.2 Market Restraints

- 5.2.1 Concerns about the Privacy and Security of Information

6 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

7 KEY METRICS

- 7.1 Technology Spending Trends

- 7.2 Number of IoT Devices

- 7.3 Total Cyberattacks

- 7.4 Technology Staffing Trends

- 7.5 Internet growth and penetration in the region

- 7.6 Digital Competitiveness Ranking

- 7.7 fixed and mobile broadband coverage

- 7.8 Cloud adoption

- 7.9 AI adoption

- 7.10 E-commerce penetration

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Artificial Intelligence and Machine Learning

- 8.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.1.3 Use Case Analysis

- 8.1.1.4 Market Outlook

- 8.1.2 Extended Reality (VR & AR)

- 8.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.2.3 Use Case Analysis

- 8.1.2.4 Market Outlook

- 8.1.3 IoT

- 8.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.3.3 Use Case Analysis

- 8.1.3.4 Market Outlook

- 8.1.4 Industrial Robotics

- 8.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.4.3 Use Case Analysis

- 8.1.4.4 Market Outlook

- 8.1.5 Blockchain

- 8.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.5.3 Market Outlook

- 8.1.6 Additive Manufacturing/3D Printing

- 8.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.6.3 Use Case Analysis

- 8.1.6.4 Market Outlook

- 8.1.7 Cybersecurity

- 8.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.7.3 Use Case Analysis

- 8.1.7.4 Market Outlook

- 8.1.8 Cloud Edge Computing

- 8.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.8.3 Use Case Analysis

- 8.1.8.4 Market Outlook

- 8.1.9 Others (digital twin, mobility and connectivity)

- 8.1.9.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.9.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.9.3 Market Breakdown by Type (Digital Twin, Mobility and Connectivity)

- 8.1.9.4 Use Case Analysis

- 8.1.9.5 Market Outlook

- 8.1.1 Artificial Intelligence and Machine Learning

- 8.2 By End-User Industry

- 8.2.1 Manufacturing

- 8.2.2 Oil, Gas and Utilities

- 8.2.3 Retail & e-commerce

- 8.2.4 Transportation and Logistics

- 8.2.5 Healthcare

- 8.2.6 BFSI

- 8.2.7 Telecom and IT

- 8.2.8 Government and Public Sector

- 8.2.9 Others (Education, Media & Entertainment, Environment etc)

- 8.3 By Country

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 United Kingdom

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Other European Countries

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Google LLC (Alphabet Inc.)

- 9.1.2 IBM Corporation

- 9.1.3 Microsoft Corporation

- 9.1.4 Oracle Corporation

- 9.1.5 Accenture PLC

- 9.1.6 Cognex Corporation

- 9.1.7 Hewlett Packard Enterprise

- 9.1.8 SAP SE

- 9.1.9 EMC Corporation (Dell EMC)

- 9.1.10 Adobe Inc.

- 9.1.11 Siemens AG

10 KEY TRANSFORMATIVE TECHNOLOGIES

- 10.1 Quantum Computing

- 10.2 Manufacturing as a Service (MaaS)

- 10.3 Cognitive Process Automation

- 10.4 Nanotechnology