PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550242

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550242

Europe Proximity Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

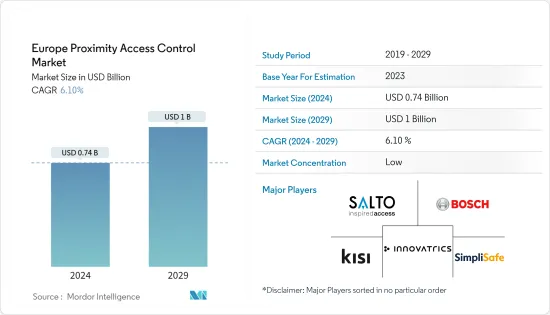

The Europe Proximity Access Control Market size is estimated at USD 0.74 billion in 2024, and is expected to reach USD 1 billion by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

Key Highlights

- Organizations are actively seeking advanced technology solutions, such as proximity access control systems, to bolster their security measures in response to the surge in theft, burglaries, and other disruptions. They aim to not only secure their facilities but also to enhance and expand their safety operations. The most common use of proximity cards is for access to residential areas, secure areas, parking spaces, and doors.

- The growing construction of residential buildings and large apartments in major cities such as Germany, the United Kingdom, France, and Sweden will create a huge demand for proximity access control systems. For instance, in March 2024, Germany approved the construction of 18,500 new homes. Additionally, the German government announced a substantial EUR 18.9 billion (USD 20.22 billion) in subsidies earmarked for new constructions and building renovations in 2024. Such factors will boost the demand for proximity access control systems.

- The popularity of proximity cards is due to their cost-effectiveness, low maintenance requirements, ease of use, and security features. Europe has adopted comprehensive data protection legislation, including the General Data Protection Regulation (GDPR), and proximity access control systems assist organizations in meeting these requirements by offering secure access controls and data protection safeguards.

- Europe's businesses and institutions are undergoing a process of infrastructure modernization, necessitating advanced access control solutions to replace obsolete systems. This trend of proximity access control solutions aligns with the region's progress in technology and innovative building initiatives. Smart cities provide a variety of advantages, such as integrated access control, CCTV surveillance, smart road systems, and public safety monitoring. For example, in July 2024, the United Kingdom had an average population density of 280 inhabitants per km2, making it an ideal location for implementing smart cities.

- Proximity access control systems can result in significant cost savings over time. These systems reduce the need for personnel changes to rekeying locks, minimize the risk of lost and stolen keys, and simplify access management access. In Europe, sectors such as healthcare and education need proximity access control solutions to protect patient records, pharmaceutical products, and educational institutions. These systems also facilitate the efficient management of attendance and visitor access. The security of governments and critical infrastructure facilities in European countries like Germany, the United Kingdom, and France is paramount, thus necessitating the implementation of proximity access control systems to protect sensitive locations, data centers, and governmental buildings.

- Proximity access control systems are typically considered secure; however, potential risks are associated with their use, such as hacking or unauthorized access to the system. Also, compliance with regulatory requirements can be challenging, particularly in highly regarded industries, such as financial services, government services, and information technology (IT). This step can lead to additional costs and effort, thus impeding the market's growth.

- The ongoing geopolitical conflicts in Europe, such as the Ukraine war, have reduced consumer spending. Further, the construction segment grapples with a significant challenge; FIEC's data is projected to decline by 5.7% in residential construction in 2024, compounding a 2.6% decrease from the previous year. Such factors are expected to hamper market growth for a short period.

Europe Proximity Access Control Market Trends

Biometric Scanners to Hold Significant Market Share

- The field of biometrics continues to expand, so the demand for improved security authentication technology has increased compared to other security techniques. The need for strict security regulations in many areas of society has created a strong demand for biometrics, raising the expectations of biometric scanning technology. In recent years, biometric authentication has become increasingly popular, particularly with the introduction of two-factor verification for online banking, and the number of companies utilizing biometric authentication is on the rise.

- Biometric scanners have become increasingly popular due to heightened security concerns in European countries such as the United Kingdom, Germany, and France for various purposes, including border control and financial services. Biometrics provide a heightened level of security by utilizing unique physiological or behavioral characteristics to authenticate users, thus reducing the likelihood of identity theft and unauthorized access.

- Governments in these countries have actively promoted biometric technology for various purposes, such as national identification schemes, electronic governance, and immigration controls. For example, Germany will transition from children's paper passports to biometric documents containing embedded electronic chips in 2023. The children's tickets did not include the security chips and fingerprint biometric data required for admission in the United States, Australia, and certain African countries. Also, the child's photo could be altered instead of the biometric passport.

- The European Union plans to roll out a new digital border system next autumn, mandating British travelers to provide fingerprints and facial scans upon initial use. The entry/exit system (EES) is slated to commence operations in October 2024, as the i and Times newspapers reported. Eurotunnel, known for its Folkestone to Calais car transport service, is currently trialing the technology. This system collects personal data at borders and then integrates it into a centralized EU database.

- Further, in March 2024, Zwipe AS partnered with SCAP, France's leading distributor of access control cards and readers. The collaboration aims to bring Zwipe's cutting-edge "biometric system-on-card" to SCAP's diverse clientele in France. SCAP's extensive customer network encompasses key players in France's security landscape, such as access system manufacturers, integrators, and various corporations spanning airports, healthcare, and government. Such development in biometric scanners will drive the segment growth.

The United Kingdom to Witness Significant Growth

- The increasing concern for safety in both residential and commercial settings has led to a surge in the demand for sophisticated access control solutions in the United Kingdom, such as proximity systems, to improve the security of businesses and individuals. In July 2023, the government planned to make EUR 20 million (USD 21.74 million) in funding available to implement pay as you go technology for passengers across Southeast England by December 2023.

- This technology will enable tens of thousands of Southeast passengers to tap into their bank cards or smart devices to travel. Passengers will no longer need to plan to secure the best prices or manually search their phones and wallets for the right ticket, as they can tap into their card or smart device and be automatically guaranteed the best price on the day of travel.

- The prevalence of data breaches, particularly those involving unauthorized access to confidential data, has heightened public awareness of the necessity of security measures. Both organizations and individuals are driven to invest in comprehensive access control measures to avoid such incidents. According to crimerate.co.uk, at the beginning of 2024, police forces in England and Wales handled 243,759 reports of burglary, marking a 3.5% drop from the 252,701 cases reported in 2023. This shows an annual crime rate of 4.22 per 1,000 individuals in 2024, down from 4.38 in 2023.

- Adopting biometric scanners, wireless locks, mobile access control systems, and the increasing urbanization of developing countries are expected to provide significant growth prospects for market participants. As access control solutions become more widespread, governments increasingly seek to protect their assets. However, the market for proximity access control is highly competitive due to the high security and privacy requirements of various businesses and individuals in the United Kingdom.

- Implementing proximity access control systems, such as biometric scanners, is a common practice in transportation facilities, such as airports, to provide secure entry into restricted areas and screening of passengers. For instance, in September 2023, the implementation of universal, mandatory facial recognition at airports was met with strong resistance, with one major United Kingdom airport disregarding requests for polite reminders. In Manchester, United Kingdom, individuals are being made aware of the new requirements to provide face biometric information when boarding flights to destinations in the United Kingdom, Ireland, the Channel Islands, and the Isle of Man. These factors are anticipated to boost the market growth in the United Kingdom.

Europe Proximity Access Control Industry Overview

The European proximity access control market is fragmented and consists of several players. Companies continuously try to increase their market presence by introducing new products, forming strategic partnerships, expanding their operations, implementing mergers and acquisitions, and collaborating. Some of the major players include SALTO Systems, Bosch Security Systems GmbH, Kisi Inc., Innovatrics, and SimpliSafe Inc.

- March 2024: Nuki revealed that it incorporated Silicon Labs solutions into its latest Nuki Smart Lock, the first smart lock with native Matter-over-Thread support. This technology brings smart features to European-style door knobs.

- March 2024: Allegion introduced the Schlage XE360 Series Wireless Locks, an electronic lock collection designed to meet the needs of the multifamily market. This new series represents the latest advancement in electronic lock technology by Schlage, offering a variety of sought-after options and features catered to multifamily properties. The locks are designed to seamlessly integrate into a wide range of common area openings, ensuring versatility and convenience for property managers and residents alike.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Adoption of Biometric Methods such as Facial, Fingerprint, and Iris Recognition

- 5.1.2 The Rise of Cloud-based Proximity Access Control Systems

- 5.1.3 Integration of Advanced Technologies like Machine Learning and IoT

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness

- 5.2.2 Complex Installation of the Systems

- 5.2.3 Increasing Risks of System Failures

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Type

- 6.2.1 Card Readers

- 6.2.2 Biometric Scanners

- 6.2.3 Proximity Readers

- 6.2.4 Alarms

- 6.2.5 Metal Detectors

- 6.2.6 Door Controllers

- 6.2.7 Wireless Locks

- 6.3 By End-user Industry

- 6.3.1 Government Services

- 6.3.2 Banking and Financial Services

- 6.3.3 IT and Telecommunications

- 6.3.4 Transportation and Logistics

- 6.3.5 Retail

- 6.3.6 Healthcare

- 6.3.7 Residential

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SALTO Systems

- 7.1.2 Bosch Security Systems GmbH

- 7.1.3 Kisi Inc

- 7.1.4 Innovatrics

- 7.1.5 SimpliSafe Inc.

- 7.1.6 Johnson Controls

- 7.1.7 Identiv Inc.

- 7.1.8 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.9 HID Global

- 7.1.10 Honeywell International Inc.

- 7.1.11 Dahua Technology Co. Ltd

- 7.1.12 Genetec

- 7.1.13 Schneider Electric

- 7.1.14 Avigilon (Motorola Solutions Inc.)

- 7.1.15 Verkada Inc.

- 7.1.16 Idemia

- 7.1.17 Vicon Industries

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET