PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550229

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550229

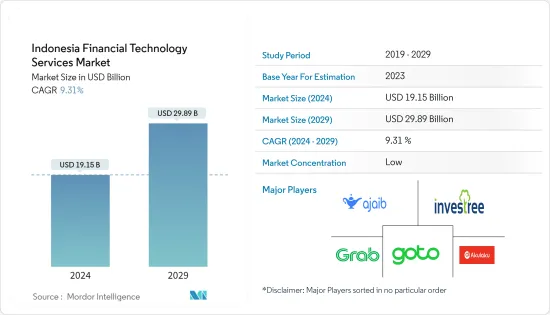

Indonesia Financial Technology Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Indonesia Financial Technology Services Market size is estimated at USD 19.15 billion in 2024, and is expected to reach USD 29.89 billion by 2029, growing at a CAGR of 9.31% during the forecast period (2024-2029).

Key Highlights

- Indonesia has been experiencing a significant surge in the adoption of digital payments due to its economic developments among the ASEAN countries. This is supported by the increasing use of smartphones and government efforts to increase financial inclusion. These factors have created a favorable environment for the growth of new and innovative payment systems, driving the country's demand for financial technology services.

- The emergence of the fintech landscape, along with the growth of digital payments, NFT, and cryptocurrency-based payments, supports the growth of the market. Moreover, in January 2024, the International Trade Administration reported that Indonesia's FinTech companies are growing. The country has recorded 20% of all fintech firms in ASEAN. It is expected to generate USD 8.6 billion in revenue by 2025, showing strong future growth potential in the financial technology services market.

- The Commodity Futures Trading Regulatory Agency (Bappebti) reported a significant surge in cryptocurrency transactions in Indonesia in March 2024. The transaction value soared to IDR 103.58 trillion (Apprximately USD 6.4 Billion), a 207.5% increase compared to February 2024. Thus, the demand for financial technology service providers is increasing to manage the digital trading and investments of cryptocurrencies in the country.

- However, the existing gap between financial literacy and inclusion in the fintech platforms in the country can restrict the market's growth. Individuals in the country have been aware of fintech services but need more means to access them, which would impact the adoption of financial technology services.

- The COVID-19 pandemic impacted the market by transforming the country's payment landscape, with a rise in digital transactions through the advancement of financial technology service providers. The adoption of digital platforms, such as e-wallets, internet banking, and Quick Response Code Indonesian Standard (QRIS), showed the shift from traditional offline to online financial activities post-pandemic and supported the market's growth.

Indonesia Financial Technology Services Market Trends

Digital Payments Contribute Significantly to Growth

- The demand for digital payments, combined with the increasing internet penetration and the country's increasing tech-savvy population, is fueling the market's growth by creating opportunities for financial technology service providers to collaborate with traditional banks to offer online services.

- Indonesia has been registering significant partnerships among fintechs and banks to facilitate the banks' digital service offering with the growth of aggregate value of e-money transactions, creating a growth opportunity for the vendors in the market. For instance, in February 2024, PT Krom Bank Indonesia Tbk (Krom) launched an application using the ecosystem of Kredivo GROUP, a market vendor, for loan products to target the younger generation.

- The market studied has been registering significant startup investments in line with the demand for digital payments in the country and the need for financial technology service providers. Global BFSI companies have been increasingly investing in Indonesia's burgeoning financial services sector. Mitsubishi UJF Financial Group (MUFG) invested in the Jakarta-based fintech unicorn Akulaku with USD 200 million. Such investments are expected to drive the market's growth during the forecast period.

- The adoption of digital payments in the B2B segments for better transaction management, the availability of mobile point-of-sale systems with a built-in enterprise resource planning (ERP)/accounting system, QRIS, debit, and credit card payment enablement, and financing support for MSMEs are supporting the demand for the country's financial technology service providers.

- The increasing startup investments in financial technology service companies in the country would support the market's growth by strengthening the supply side of the market. For instance, in October 2023, LUNA, an Indonesia-based fintech and vertical software-as-a-service (SaaS) platform for merchants to improve their digital payment processes, announced the completion of a financing round that will fuel the market's growth.

Java Region to Register Significant Growth

- Indonesia has been witnessing significant growth in Internet penetration, which is anticipated to support the demand for digital transformation in the financial sector and create growth opportunities for financial technology service providers in the country's provinces.

- In February 2024, the Indonesian Internet Service Provider Association (APJII ) reported that the Java province had the highest penetration rate of Internet usage. The association reported that the Java province is the region with the highest penetration rate of Internet usage (83.64%), followed by Sumatera (77.34%), Kalimantan (77.42%), Bali and Nusa Tenggara (71.80%), Sulawesi (68.35%), and Maluku and Papua (69.91%).

- APJII reported that based on the urban or rural classification, the contribution of internet users in urban areas reached 69.5%, with a penetration rate of 82.2%. Indonesia's rural areas also contributed less at 30.5%, with a penetration rate of 74%. The increasing internet penetration in the country's urban areas in the JAVA region is expected to support the growth of the market in the coming years.

- The country's west Java Province has a large population, and the encore, using urbanization and urbanization province, would create a demand for technology in a technology-based region, fueling the demand for financial technology service technology in the market.

- The presence of major cities, such as Jakarta, Surabaya, Bekasi, and others, in the Java region, is expected to fuel the market's growth. In January 2024, Jakarta-based Komunal, a company in the FinTech sector, successfully raised an additional fund of USD 5.5 million to expand its services for digital deposits across various rural banks nationwide and transform the country's traditional banking model. This shows the growth of financial technology services in the major cities of the country's Java province during the forecast period.

Indonesia Financial Technology Services Industry Overview

The Indonesian financial technology services market is becoming highly competitive, with multiple vendors expanding their product lines to offer a broad portfolio of Financial solutions. Vendors have been rolling out advanced technology-based financial services through collaborations, expansions, and partnerships. Key players in the market are PT Ajaib Teknologi Indonesia, PT Investree Radhika Jaya, Grab Holdings Limited, PT GoTo Gojek Tokopedia Tbk, and PT Akulalu Silvrr Indonesia, among others.

- June 2024: Indonesian digital banking service provider Superbank launched its services on the Grab platform, which will allow the super-app's users and partners to open bank accounts and use it as a direct payment app for all Grab services without installing an additional app. This development shows the collaboration between a digital banking provider and the market vendor, Grab Holdings Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact and Recovery from COVID-19

- 4.4 Analysis of Macro-economic Scenarios

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Low-cost, Easy-to-use Investment Options

- 5.1.2 Rise of Cryptocurrencies and NFTs

- 5.2 Market Restraints

- 5.2.1 Lack of Technical Understanding Among Users

- 5.3 Number of Users

- 5.3.1 Digital Assets

- 5.3.2 Digital Investment

- 5.3.3 Digital Payment

- 5.3.4 Neobanking

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Digital Capital Raising

- 6.1.1.1 Crowd investing

- 6.1.1.2 Crowd Lending

- 6.1.1.3 Marketplace Lending

- 6.1.2 Digital Payments

- 6.1.2.1 Digital Commerce

- 6.1.2.2 Digital Remittances

- 6.1.2.3 Mobile PoS Payments

- 6.1.3 Neobanking

- 6.1.1 Digital Capital Raising

- 6.2 By Region

- 6.2.1 Java

- 6.2.2 Sumatra

- 6.2.3 Kalimantan

- 6.2.4 Other Regions (Sulawesi, Papua & Muluku, and Bali & Nusa Tenggara)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PT Ajaib Teknologi Indonesia

- 7.1.2 PT Investree Radhika Jaya

- 7.1.3 Grab Holdings Limited

- 7.1.4 PT GoTo Gojek Tokopedia Tbk

- 7.1.5 PT Akulalu Silvrr Indonesia

- 7.1.6 PT Dompet Anak Bangsa (GoPay)

- 7.1.7 Jenius (PT Bank Tabungan Pensiunan Nasional Tbk)

- 7.1.8 Kredivo Group Ltd

- 7.1.9 DANA (PT Espay Debit Indonesia Koe)

- 7.1.10 Xendit (PT Sinar Digital Terdepan)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET