PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550215

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550215

Asia-Pacific Card-based Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

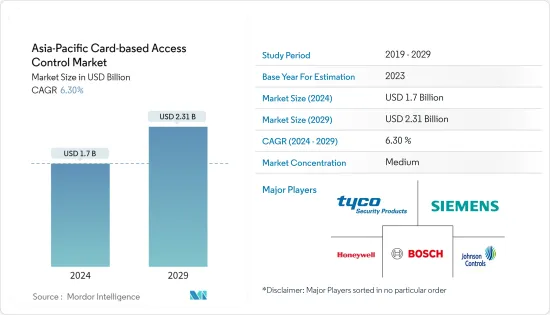

The Asia-Pacific Card-based Access Control Market size is estimated at USD 1.7 billion in 2024, and is expected to reach USD 2.31 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

Key Highlights

- Within a card-based access system, several components collaborate. The access control card reader, in particular, plays a pivotal role. It scans data from the key card or fob and determines access permissions. These systems have become a fundamental aspect of modern security measures, enabling businesses to remotely monitor and manage facility access, bolstering both security and operational efficiency.

- Expanding industrial, manufacturing, and commercial sectors driven by the "Make in India" campaign, coupled with the increasing need to secure data and assets and the growing urban population due to rising crime rates in the region, is anticipated to drive the demand for card-based access control systems in Asia-Pacific.

- The rise in terrorist threats and the government's increased investment in security are two key factors fueling the demand for card-based access control systems in the Asia-Pacific. The region's expanding economy is driving a substantial need for security systems.

- Access control cards are commonly used to maintain physical safety at the doors. In these card access control systems, the users' credentials are stored in one or the other form to restrict or allow access to the cardholders.

- The swift urbanization in emerging economies throughout Asia-Pacific serves as a key catalyst for the card-based access control systems market. For instance, the urban population in the region is projected to reach 2.5 billion by 2025, with countries such as China and India taking the lead.

- The establishment of new cities and structures necessitates advanced security systems to regulate access and ensure safety. This results in a rising demand for card-based access control systems, which provide enhanced control and monitoring capabilities in comparison to traditional methods.

- As urban areas continue to grow, the requirement for secure access in residential, commercial, and governmental buildings escalates, propelling the adoption of access control technologies. This pattern is especially noticeable in nations undergoing substantial infrastructural advancements, where the integration of modern security solutions is imperative.

- Card-based access control systems are also subject to various associated issues, such as keycards falling into the wrong hands, incorrect setup, lack of integration with other building systems, and outdated technology and equipment. Such matters may negatively affect the card-based access control market in Asia-Pacific.

- The card-based access control market in Asia-Pacific is semi-consolidated, with less number of players occupying a moderate level of market share. Vendors operating in the market are focusing on new product development, strategic partnership, acquisition, and expansion to meet the growing demand from the customers, further supporting the market's growth.

- For instance, in April 2024, Aritech introduced the NXG-183x-EUR Keypad along with the door access feature for the Aritech Reliance XR series. By utilizing the upgraded MIFARE capabilities of Reliance XR and the new keypad, individuals can incorporate fundamental door control into their Aritech Reliance XR security setup.

- However, the increasing R&D expenditures by significant market players and vendors coupled with various benefits like ease of access, one-time setup, crew protection from unauthorized visitors, protection against data breaches, prevention of theft, and strong security for office/individual property, are anticipated to significantly improve market prospects for Asia-Pacific card-based access control market during the forecast period.

- Macroeconomic factors like government regulations on import/export greatly influence the availability and reliability of card-based access control systems. These regulations differ across nations, often demanding thorough certifications, testing, and compliance with particular standards. Despite their goal of ensuring safety and quality, these regulations can present substantial obstacles for manufacturers, distributors, and consumers. Delays in card-based access control system availability due to import/export rules can impede their prompt deployment in different end-user sectors.

Asia-Pacific Card-based Access Control Market Trends

Healthcare Industry Expected to Witness Significant Growth

- The healthcare industry, with its dynamic and varied staff, needs a reliable access control system that would boost security and increase productivity. The system ensures that only authorized staff may enter specific hospital locations using pre-defined user groups. Security managers, for example, are permitted access to the control room, while the medical staff is allowed access to the pharmacy. Hospitals can efficiently trace who enters the ward, determine if their visit is allowed, and, if required, refuse entrance due to comprehensive visitor management.

- Keyless entry enhances facility security. Securing a hospital, with its numerous access points, proves far more challenging with traditional keys than with card-based systems. Sealing a facility's exterior doors during an emergency is critical, as each door demands individual attention with a physical key. In contrast, card-based access systems offer heightened flexibility and swiftness in swiftly securing buildings and restricted zones.

- Installing smart cabinet locks can increase physical security at the rack level, particularly for hospital server rooms and document management systems. When properly implemented, access control systems prevent trespassers from physically accessing private medical information. Instant access to medical rooms or equipment might be crucial in a hospital or clinic environment. The authentication procedure must be quick and precise to restrict access points without slowing workflow. Clinicians can easily regulate admission using an access control system with contactless identification.

- Access control systems in hospitals commonly utilize proximity cards, smart card technology, or magnetic stripe cards. In a proximity or contactless smart card setup, hospital staff need only bring their ID badge close to a designated reader to enter a particular building or zone. Such systems offer precise control over access permissions, bolstering security across the healthcare facility or medical campus.

- Rigorous access control regulations must be followed in several hospital facilities. For instance, sensitive information is handled in medical research laboratories and operating rooms. Thus, anyone who gives in must be recognized. As a result, medical facilities use card-based access control solutions to authorize access to restricted areas.

- The increasing number of hospitals and clinics and rising spending on hospital security across the region are expected to create demand for the card-based access control market. For instance, according to the Ministry of Finance Japan, the Japanese government allocated approximately JPY 37.7 trillion (USD 0.23 trillion) from its yearly budget for the fiscal year 2024 toward social security, with roughly JPY 12.4 trillion (USD 0.077 trillion) of social security funds designated for healthcare, indicating a steady increase in these sectors.

India Is Expected to be One of the Fastest Growing Markets

- Primarily owing to the rapidly growing security concerns, coupled with the increasing crime rates in the country, access control solutions are increasingly being deployed in data centers, office premises, hotels, entertainment stores, retail stores, government institutions, and banks, among others.

- Multiple factors, such as the increasing installation of these systems across the commercial and defense sectors, have been instrumental in driving the market's growth. Various private and government entities are also significantly investing in enhanced security systems for data protection and to provide a safer and more secure environment for employees.

- The country's urban cities, including Hyderabad, Bangalore, Chennai, Delhi-NCR, and Mumbai, among others, are making impressive progress in advancing security systems pertaining to government buildings, IT hubs, and commercial spaces. The introduction of technologically advanced, contactless smart systems for various applications is further catalyzing product demand, owing to their seamless experience.

- The need for high-quality office space in key urban centers is expected to surpass current levels in the future as remote work becomes less of a factor in the Indian commercial real estate sector, further supporting the demand for a card-based access control market. According to IBEF, the demand for commercial real estate space in the top seven cities in India stood at 38 million square feet as of 2023.

- Moreover, CBRE reports a slight 3% year-on-year dip in office leasing activity, with a significant 25% quarter-on-quarter decline, bringing the total to 14.4 million square feet in Q1 2024. Bangalore led the space take-up, with Delhi-NCR and Hyderabad closely behind. Together, these three cities represented 65% of the quarter's leasing activity.

- In India, there has been a tremendous increase in the number of consumers onboarding the smart home revolution. While convenience is one of the factors, security is the top feature Indians look for in a smart home offering. Video door monitoring, motion-sensing cameras integrated with night vision technology, smart alarms, digital locks, windows, and alarms are among the range of electronic gadgets aimed toward enhancing the security of a house.

- Moreover, the country is increasingly adopting technologies in its industrial space, which is expected to further boost demand over the coming years. Residential and commercial space development is an application of access control solutions that have been witnessing a rise due to the launch of multiple construction schemes. For instance, the Indian government is working on several projects that overlook the development of the country's infrastructure through various government flagship programs, such as the 100 Smart Cities Mission and Make in India, among others.

Asia-Pacific Card-based Access Control Industry Overview

The Asia-Pacific card-based access control market has various major players that have been using various strategies, such as new product launches, joint ventures, expansions, partnerships, acquisitions, and others, to increase their footprints in this market, creating intense rivalry among local players. The Asia-Pacific card-based access control market is semi-consolidated. Some of the key players include Honeywell International Inc., Robert Bosch GmbH, Johnson Controls, Siemens, and Tyco Security Products.

- June 2024: Honeywell solidified its position as a premier security solutions provider for the digital era by finalizing the acquisition of Carrier Global Corporation's Global Access Solutions business for a substantial USD 4.95 billion. This strategic move not only bolsters Honeywell's foothold in the security sector but also sets the stage for heightened innovation in the rapidly expanding realm of cloud-based services and solutions. Furthermore, this transaction reinforces Honeywell's strategic alignment around three key megatrends, including automation, and complements its Building Automation segment.

- January 2024: SecuGen has revealed its latest product, the SecuGen IQ SC1 contact smart card reader. This marks the company's debut in the standalone smart card reader market. The reader is equipped with a USB full-speed interface and is capable of reading and writing smart cards at a maximum speed of 600 kbps. According to the company, the device has a lifespan of up to 200,000 card insertion cycles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Evolution of Smart Card Technology in Access Control

- 5.1.2 Increasing Need for Enhanced Security and Government Policies for Security Concerns

- 5.2 Market Restraints

- 5.2.1 High upfront Cost and Growing Applications for Alternative Technologies

6 MARKET SEGMENTATION

- 6.1 By Card Type

- 6.1.1 Swipe Cards

- 6.1.2 RFID Proximity Cards

- 6.1.3 Smart Card (Contact and Contactless)

- 6.2 By Component

- 6.2.1 Card Readers

- 6.2.2 Access Control Keypads

- 6.2.3 Access Control Panels

- 6.2.4 Electronic Lock Hardware

- 6.2.5 Other Components

- 6.3 By End-user Vertical

- 6.3.1 Commercial

- 6.3.2 Residential

- 6.3.3 Government

- 6.3.4 Industrial

- 6.3.5 Transport and Logistics

- 6.3.6 Healthcare

- 6.3.7 Military and Defense

- 6.3.8 Other End-user Verticals

- 6.4 By Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Robert Bosch GmbH

- 7.1.3 Johnson Controls

- 7.1.4 Siemens

- 7.1.5 Tyco Security Products

- 7.1.6 IDEMIA

- 7.1.7 Mantra Softech India Private Limited

- 7.1.8 Gemalto (3M Cogent)

- 7.1.9 eSSL

- 7.1.10 Realtime Biometric

- 7.1.11 IDCUBE

- 7.1.12 HID Global Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET