PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550195

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550195

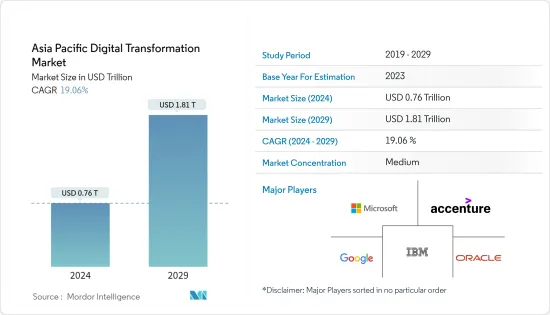

Asia Pacific Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Pacific Digital Transformation Market size is estimated at USD 0.76 trillion in 2024, and is expected to reach USD 1.81 trillion by 2029, growing at a CAGR of 19.06% during the forecast period (2024-2029).

Technological, economic, and socio-political factors are driving the digital transformation market in Asia-Pacific.

Key Highlights

- The rapid rise in internet penetration and smartphone adoption has set a robust foundation for the expansion of digital services. The growth in demand for digital products and services in the region is bolstered by substantial investments in telecommunications infrastructure, particularly in developing nations. This demand is primarily fueled by the region's expanding middle class, marked by increasing disposable incomes and a growing digital literacy.

- Government initiatives are pivotal in driving this growth. For instance, India's Digital India campaign and China's Made in China 2025 strategy are designed to bolster digital innovation and integration, spanning multiple sectors. These policies are backed by significant investments from both the public and private sectors, with a focus on bolstering digital capabilities and developing smart cities.

- Businesses are gradually turning to advanced technologies like cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) to boost operational efficiency, foster innovation, and elevate customer experiences. The competitive business environment necessitates digital transformation to maintain relevance and agility.

- In May 2024, People Tech Group, a provider of product engineering, data/AI, and enterprise solutions, partnered with Quest Global, a global company specializing in product engineering services, to enhance digital transformation initiatives for their worldwide clientele. Through this strategic merger, People Tech's strong capabilities in product engineering, data/AI, and enterprise solutions and Quest Global's extensive resources, expertise, and client reach are combined to create a force for innovation and solutions that serves clients globally.

- In March 2024, Digital China Group, a Chinese digital transformation service provider, inked a memorandum of understanding (MOU) with Bangkok's Digital Economy Promotion Agency (DEPA). The agreement focuses on collaborating in the development of Thailand's digital economy, including areas such as cloud computing, digital infrastructure, big data centers, and nurturing digital talent. Both parties are dedicated to pushing forward with advanced digital technologies, particularly emphasizing artificial intelligence.

- However, factors like infrastructure disparities, high costs, a shortage of skilled professionals, regulatory inconsistencies, data privacy concerns, resistance to change, and cybersecurity threats pose significant hurdles to the growth of the market.

Asia Pacific Digital Transformation Market Trends

The IoT Segment is Expected to Occupy the Largest Market Share

- The market is witnessing a rise in growth, propelled by the increasing embrace of IoT technology in key sectors like manufacturing, automotive, and healthcare. The traditional manufacturing sector is undergoing a digital transformation, with IoT spearheading the next industrial revolution of intelligent connectivity. This shift is reshaping how industries tackle their intricate systems and machines, aiming to boost efficiency and minimize downtime.

- The manufacturing industry is witnessing a surge in data points, mainly due to the widespread adoption of connected devices and sensors, facilitating M2M communication. Furthermore, as field devices, sensors, and robots advance, the market's scope is set to broaden. Enterprises are increasingly turning to agile, innovative approaches, leveraging technologies that not only complement human labor with robotics but also aim to reduce industrial accidents stemming from process failures. This shift is largely attributed to the advent of Industry 4.0 and the widespread acceptance of IoT in manufacturing.

- In July 2024, the Korean operators SK Telecom, KT, and LG Uplus, alongside the Radio Promotion Association of Korea (RAPA), inked a pact. The aim is to bolster the capacity of small and medium-sized manufacturers in designing 5G IoT products that seamlessly integrate with telecom networks.

- Moreover, smart city initiatives are poised to lead the growth of IoT in the coming years. IoT devices and systems are set to proliferate, especially in transportation, utilities, and infrastructure. Government initiatives aligning with this trend are anticipated to drive adoption rates further.

- In February 2024, BT unveiled its NB-IoT network, aimed at bolstering the advancement of smart cities and industries in the United Kingdom. This network, covering 97% of the UK populace, is built upon EE's robust mobile infrastructure. BT's NB-IoT network introduction enables the seamless integration of low-data-demand assets, like street lighting and underground water sensors, into smart networks. This integration not only prolongs the battery life of these assets but also boosts efficiency and cuts costs.

Japan is Expected to be the Fastest-growing Market

- Government initiatives, such as "Society 5.0," are propelling the Japanese digital transformation market. This push aims to seamlessly integrate smart technologies into society. Furthermore, the market is witnessing rapid innovation, buoyed by significant strides in AI, IoT, and robotics.

- The rising number of internet subscribers in Japan enhances the digital transformation market by increasing demand for online services, driving the adoption of digital platforms, and enabling the broader implementation of IoT, AI, and cloud technologies, thereby fostering innovation and efficiency across various industries. According to TRAI, as of December 2023, Delhi, the capital of India, boasted the highest concentration of internet subscribers, with an overall count of nearly 257 subscribers for every 100 residents. This far surpassed the national average of 67.3 subscribers per 100 people.

- Moreover, Japan's aging population is driving the imperative for automation and digital solutions to combat labor shortages. In response, Japanese firms are heavily investing in digital overhauls to not only stay competitive but also to broaden their global footprint. Moreover, as consumer demands for seamless digital interactions escalate, businesses are compelled to embrace advanced technologies. This confluence of factors underscores Japan's proactive stance in digital transformation.

- In April 2024, the International Labour Organization (ILO), in partnership with the Department of Information and Communications Technology (DICT) and the government of Japan, joined forces to establish and inaugurate the Digital Transformation Center (DTC). This center is specifically designed to cater to MSMEs (micro, small, and medium-sized enterprises) and other stakeholders in the region of Pampanga. This initiative will boost digitalization, granting enterprises improved access to training and technology.

- In July 2024, in Tokyo, the Vietnam-Japan Digital Transformation Association (VADX JAPAN) was officially launched, indicating a fresh era of digital collaboration between the two countries. The association's goal is to link Vietnamese businesses operating in Japan's IT sector, facilitating collaboration to exchange advanced technology initiatives and solutions.

Asia Pacific Digital Transformation Industry Overview

The Asia-Pacific digital transformation market is moderately competitive due to the presence of major players like Accenture PLC, IBM Corporation, and Microsoft Corporation. Market players are bolstering their portfolios and pursuing lasting competitive edges via strategic partnerships and product rollouts.

- June 2024: Marking a pivotal moment, Datastreams propelled Malaysia's digital transformation through a strategic joint venture (JVC) with MRIC Alliance Sdn Bhd, a Malaysian systems integrator. The JVC is set to revolutionize multiple sectors. In healthcare, its focus lies on rolling out personalized health services, leveraging AI for solutions, and enhancing responses to infectious diseases.

- April 2024: Singapore and the Philippines joined forces to harness significant growth opportunities, particularly in artificial intelligence (AI) and digital transformation. Moreover, they are jointly focusing on initiatives in renewable energy, establishing a carbon credit market, and advancing industries like smart cities, showcasing shared interests.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 INDUSTRY ECOSYSTEM ANALYSIS (Detailed Coverage of Key Stakeholders in Digital Transformation Industry Product/Solution Providers, System Integrators/VARs, Connectivity Providers, Regulatory Bodies, End-users, Service Providers, etc.)

- 4.4 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Artificial Intelligence and Machine Learning

- 5.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.1.3 Market Breakdown by Type (Demand Forecasts | Trends | Market Outlook)

- 5.1.1.3.1 Machine Learning

- 5.1.1.3.2 Natural Language Processing (NLP)

- 5.1.1.3.3 Context-aware Computing

- 5.1.1.3.4 Computer Vision

- 5.1.1.3.5 Other Types

- 5.1.1.4 Market Breakdown by End-user (Manufacturing, Oil and Gas, Utilities, Automotive and Transportation, Retail, BFSI, Process Industries, and Others)

- 5.1.1.5 Market Breakdown by Country (United States and Canada)

- 5.1.1.6 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.1.7 Market Outlook

- 5.1.2 Extended Reality (VR and AR) for Industrial Applications

- 5.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.2.3 Market Breakdown by Use-cases (Training & Simulation, Production & Assembly, 3D Modeling, Sales & Marketing, and Others)

- 5.1.2.4 Relative Growth Forecast Analysis for VR & AR

- 5.1.2.5 Market Breakdown by Country (United States and Canada)

- 5.1.2.6 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.2.7 Market Outlook

- 5.1.3 IoT

- 5.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.3.3 Market Breakdown by Type (Solutions, Platforms, and Services)

- 5.1.3.4 Market Breakdown by Type (Solutions, Platforms, and Services)

- 5.1.3.5 Market Breakdown by Use-case (Predictive Maintenance, Business Process Optimization, Asset Tracking & Supply Chain Management, and Others)

- 5.1.3.6 Market Breakdown by End User (Automotive, Process Industries, Oil and Gas, Automotive and Aerospace, Manufacturing, and Others)

- 5.1.3.7 Market Breakdown by Country (United States and Canada)

- 5.1.3.8 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.3.9 Market Outlook

- 5.1.4 Industrial Robotics

- 5.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.4.3 Market Breakdown by Type (Articulated, Linear, Cylindrical, Parallel, SCARA, and Others)

- 5.1.4.4 Market Breakdown by End User (Metal and Machinery, Electrical and Electronics, Automotive, Chemical and Manufacturing, and Others)

- 5.1.4.5 Market Breakdown by Country (United States and Canada)

- 5.1.4.6 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.4.7 Market Outlook

- 5.1.5 Blockchain

- 5.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.5.3 Market Breakdown by Type (Logistics & Supply Chain, Counterfeit Management, Quality Control & Compliance, and Others)

- 5.1.5.4 Market Breakdown by Use-case (Automotive, Aerospace and Defense, Industrial, Retail and Others)

- 5.1.5.5 Market Breakdown by Country (United States and Canada)

- 5.1.5.6 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.5.7 Market Outlook

- 5.1.6 Digital Twin

- 5.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.6.3 Market Breakdown by Type (Manufacturing, Energy and Power, Aerospace, Oil & Gas, Others)

- 5.1.6.4 Market Breakdown by Country (United States and Canada)

- 5.1.6.5 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.6.6 Market Outlook

- 5.1.7 Additive Manufacturing

- 5.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.7.3 Market Breakdown by Type (Equipment, Materials, Services and Software)

- 5.1.7.4 Market Breakdown by End User (Automotive, Manufacturing, Healthcare, Others)

- 5.1.7.5 Market Breakdown by Country (United States and Canada)

- 5.1.7.6 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.7.7 Market Outlook

- 5.1.8 Industrial Cyber security

- 5.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.8.3 Market Breakdown by Type (Network, Application, Endpoint, Cloud, Others)

- 5.1.8.4 Market Breakdown by End User (Power, Utilities, Transportation, Chemicals & Manufacturing)

- 5.1.8.5 Market Breakdown by Country (United States and Canada)

- 5.1.8.6 Analysis of the Key Market Incumbents and Emerging Players

- 5.1.8.7 Market Outlook

- 5.1.9 Wireless Connectivity

- 5.1.9.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.9.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.9.3 Market Breakdown by Type (Wi-Fi, NFC, ZigBee, Z-Wave, LTE Cat-M1, NB-IoT, Sigfox, Others)

- 5.1.9.4 Market Breakdown by End User (Automotive and Transportation, Industrial, Telecommunication, Healthcare, Others)

- 5.1.10 Industrial 3D Printing

- 5.1.10.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.10.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.10.3 Breakdown by Machine & Services

- 5.1.11 Edge Computing

- 5.1.11.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.11.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.11.3 Market Breakdown by Hardware, Platforms, Software and Services

- 5.1.11.4 Market Breakdown by End User

- 5.1.12 Smart Mobility

- 5.1.12.1 Current Market Scenario and Market Projections for the Forecast Period

- 5.1.12.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 5.1.12.3 Market Breakdown by Type (Traffic Management, Smart Ticketing, Mobility Ridesharing, Ride Hailing, Mobility-as-a-Service, and Smart Highway)

- 5.1.12.4 Smart Materials

- 5.1.12.5 Intelligent Process Automation

- 5.1.1 Artificial Intelligence and Machine Learning

- 5.2 By Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 Indonesia

- 5.2.5 Philippines

- 5.2.6 Malaysia

- 5.2.7 Singapore

- 5.2.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Accenture PLC

- 6.1.2 Google LLC (Alphabet Inc.)

- 6.1.3 IBM Corporation

- 6.1.4 Microsoft Corporation

- 6.1.5 Oracle Corporation

- 6.1.6 Hewlett Packard Enterprise

- 6.1.7 SAP SE

- 6.1.8 EMC Corporation (Dell EMC)

- 6.1.9 Cognex Corporation

- 6.1.10 Adobe Inc.

- 6.1.11 Siemens AG

7 KEY TRANSFORMATIVE TECHNOLOGIES

- 7.1 Quantum Computing

- 7.2 Manufacturing-as-a-Service (MaaS)

- 7.3 Cognitive Process Automation

- 7.4 Nanotechnology