PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550193

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550193

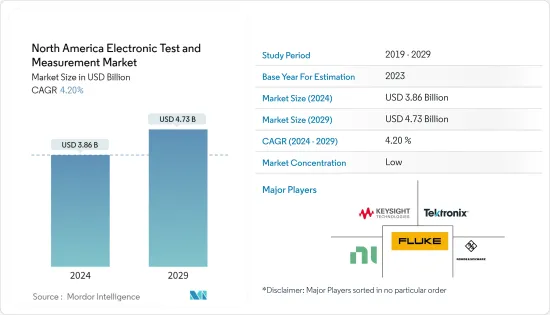

North America Electronic Test And Measurement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Electronic Test And Measurement Market size is estimated at USD 3.86 billion in 2024, and is expected to reach USD 4.73 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Key Highlights

- The North American test and measurement equipment market is poised for significant growth, driven by escalating demands in automotive, aerospace, defense, industrial transportation, IT/telecommunications, etc. These industries increasingly adopt IoT, 5G, M2M, and millimeter technologies, aiming for a more connected and secure world.

- Embedded and portable testing solutions, especially for IoT, are gaining traction in North America. These solutions boast features like remote troubleshooting and compatibility with the latest interfaces and protocols.

- Predictive maintenance is a cornerstone in the industrial landscape, transitioning from reactive problem-solving to proactive root-cause analysis. With the introduction of Industry 4.0, these devices have become essential for facility management, serving as proactive rather than reactive measures.

- Automotive firms swiftly embrace automated testing, propelling the demand for electronic testing equipment. The surge in electronic features in vehicles, spanning infotainment, connectivity, and safety, alongside the rising popularity of e-vehicles for green mobility, is further bolstering the electronic testing sector. Additionally, heightened R&D activities across the electronics value chain are set to amplify this demand.

- Yet, the market faces challenges. Price sensitivity and a growing preference for rental services are hindering growth. Many companies, especially those with limited capital, opt for rentals due to the high initial costs of owning such equipment.

North America Electronic Test And Measurement Market Trends

Rising Electrification in Automotive Sector is Driving the Demand

- The US automotive industry is a linchpin of the nation's economic landscape. In the past decade, the industry has witnessed significant shifts in production and sales. Data from CEIC reveals that US motor vehicle production hit 10,611,555 units in December 2023, marking a notable increase from the 10,052,958 units recorded in December 2022.

- Two pivotal legislations, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, inject hundreds of millions of dollars into the electric vehicle industry. These initiatives are laser-focused on bolstering US manufacturing and supply chains, particularly to ease the transition for both light-duty and medium to heavy-duty vehicles.

- The rapid evolution and deployment of autonomous driving technologies propel the demand for electronic test and measurement equipment. Notably, countries like the United States, Canada, and Mexico are witnessing a surge in autonomous vehicle adoption. Many vehicles on American roads are now equipped with ADAS (advanced driver assistance systems), pivotal in enhancing safety, curbing injuries, and saving lives.

- The Highway Loss Data Institute (HLDI) projects that by 2043, nearly all registered vehicles in the United States will feature integrated ADAS, encompassing features like rear parking sensors, lane departure warnings, rearview cameras, and blind-spot alerts.

- In March 2024, LeddarTech, a Quebec City-based automotive software firm, joined forces with Arm, a British semiconductor and software design specialist. Their collaboration is set to push the boundaries of ADAS and autonomous driving technology, particularly for software-defined vehicles. The primary goals of this partnership include enhancing CPU capabilities for ADAS, accelerating time-to-market, and championing the adoption of software-defined vehicles.

- This collaboration promises many benefits for automotive manufacturers and suppliers, especially those in Tier I and II, from faster innovation cycles to smoother implementation. As the automotive industry witnesses a surge in production, sales, and the adoption of cutting-edge technologies, the demand for electronic test and measurement equipment is steadily increasing. With vehicles becoming more connected and integrating with data, cellular networks, and infrastructure, the need for electronic testing devices and a diverse range of measurements is only set to grow.

The United States is Expected to Witness Significant Growth

- The United States presents significant growth opportunities in the electronic test and measurement sector, driven by diverse, thriving industries. Notably, the aerospace and defense sector is a pivotal end-user, fueling demand for cutting-edge test solutions. Recent reports highlight the dominant position of the US in global military spending, allocating a staggering USD 905.5 billion in 2023. This figure surpasses the combined military budgets of the next 15 nations, with China at USD 219.5 billion and Russia following as the second and third highest spenders.

- Investments and surging demand from commercial and military entities within the aerospace and defense segment are key drivers propelling the electronic test and measurement market. The US market also benefits from the presence of established industry leaders, whose robust manufacturing and R&D capabilities bolster the sector's growth and create lucrative revenue streams for test and measurement vendors.

- The US government's strategic focus on advanced manufacturing, green energy transitions, and cutting-edge communication tools responds to evolving trends like rapid urbanization. These trends fuel demand for smart appliances, green mobility solutions, and a burgeoning 5G telecom landscape, propelling the testing and measurement market to unprecedented growth.

- Additionally, the US boasts a significant presence of major automobile OEMs, further bolstered by the government's supportive infrastructure and regulations favoring electric vehicles. Coupled with a rising preference among younger consumers for luxury and premium vehicles, the market is set for significant growth.

North America Electronic Test And Measurement Industry Overview

The North American electronic test and measurement market is highly competitive and consists of several players. Companies continuously try to increase their market presence by introducing new products, expanding their operations, or entering strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Tektronix Inc., Keysight Technologies, and Teledyne LeCroy Inc.

- September 2023: Keysight Technologies Inc. expanded its industry-leading portfolio of Infiniium oscilloscopes with hardware-accelerated Infiniium MXR B-Series, which offers automated analysis tools that enable engineers to shorten time to market by finding anomalies quickly.

- September 2023: NI announced new options and extended capabilities for its third-generation PXI Vector Signal Transceiver (VST), the PXIe-5842. Combined with NI's software ecosystem, the PXIe-5842 is a versatile tool for testing and validating products in aerospace and defense applications. It also supports traditional RF capabilities such as signal analysis, spectrum analysis, and signal generation.

- July 2023: Teradyne launched Teradyne Archimedes analytics solution, an open architecture that brings real-time analytics to semiconductor tests, optimizing test flow and yield and lowering costs while reducing the security risks present with cloud-based solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Electronic Test and Measurement Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements Leading to the need for Test and Measurement Equipment

- 5.1.2 Emerging Trend of Electric and Hybrid Vehicle

- 5.2 Market Challenges

- 5.2.1 Price Sensitivity and Increasing Preference for Rental Services

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Semiconductor Automatic Test Equipment (ATE)

- 6.1.2 Radio Frequency (RF) Test Equipment

- 6.1.3 Digital Test Equipment

- 6.1.4 Electrical and Environmental Test

- 6.1.5 Data Acquisition (DAQ)

- 6.2 By Application

- 6.2.1 Communications

- 6.2.2 Semiconductors and Computing

- 6.2.3 Aerospace and Defense

- 6.2.4 Consumer Electronics

- 6.2.5 Electric Vehicles

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tektronix Inc.

- 7.1.2 Keysight Technologies

- 7.1.3 Rohde & Schwarz GmbH & Co. KG

- 7.1.4 National Instruments Corporation

- 7.1.5 Fluke Corporation

- 7.1.6 Teledyne LeCroy Inc.

- 7.1.7 Yokogawa Test & Measurement Corporation

- 7.1.8 Teradyne Inc.

- 7.1.9 Chauvin Arnoux Group

- 7.1.10 Advantest Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET