PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550156

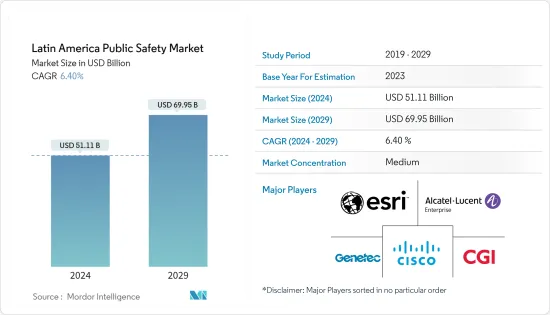

Latin America Public Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Latin America Public Safety Market size is estimated at USD 51.11 billion in 2024, and is expected to reach USD 69.95 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

A confluence of factors in Latin America is set to propel the public safety market. These include heightened public awareness of security needs, a push to replace outdated infrastructure, and a surge in large-scale data breaches, mirroring the rise in cyber threats. These breaches have notably shaken both corporate and governmental digital landscapes. Also, the advent of cloud-based solutions presents a silver lining, allowing public safety agencies to trim their ownership costs and provide a much-needed respite amid the technical and operational challenges they grapple with.

Public safety and security are essential for economic growth and community prosperity. The increasing crime rate and incidences of illegal activities in the region have raised concerns about the security of people, assets, and processes that drive the market. Governments are increasingly looking to intelligent mitigation plans to reduce the response time and damages caused by natural and artificial disasters, which will drive the market's growth.

Also, due to the growing proliferation of security risks, the number of initiatives to promote collaboration among public safety authorities regarding potential hazards to develop a prevention strategy to guarantee the highest level of security has been growing. For instance, in May 2023, the United Nations Office on Drugs and Crime (UNODC) organized Brazil's "Technical Meeting on Timber Identification Initiatives". The initiative aims to improve the regional capacity of the justice system and law enforcement actors and cooperation to intercept, investigate, and prosecute environmental crimes in the Amazon. Such initiatives will, therefore, create a favorable ecosystem for the market's growth.

The region is also witnessing a higher uptake of advanced digital solutions in the medical industry, including adopting medical record management software. For instance, in 2023, the Ministry of Health (Mexico) updated requirements for medical devices. It clarified its approach to defining and regulating software as a medical device (SaMD), paving the way for higher adoption during the forecast period.

The public safety market in Latin America is limited due to high installation and maintenance costs, the absence of advanced infrastructure in less developed countries or regions, and the need for interoperability between public safety and security systems. Various factors, including a lack of adaptability, inadequate training, and reliance on outdated systems, may hinder public safety agencies' adoption and integration of new technologies. In addition, the market is likely to need more efficient data management and storage capabilities.

The COVID-19 pandemic underscored the critical need for public safety measures as nations grappled with travel restrictions and lockdowns to curb the virus's spread. This heightened focus is expected to drive a surge in the adoption of public safety solutions in the coming years. Additionally, responding to the challenges posed by the pandemic, governments worldwide are bolstering their healthcare allocations. Notably, Peru's 2023 health budget saw a significant boost, reaching approximately USD 6.7 billion, an 8% increase from the previous year. These developments are poised further to bolster the market's growth during the forecast period.

Latin America Public Safety Market Trends

Software Component to Hold Significant Market Share

- Rising criminal activities are a prevalent trend in the public safety market. Under criminal law, illegal activities are defined as any activity that necessitates the physical or mental act of committing the crime. According to Semaforo Delictivo, domestic violence was the most frequent crime in Mexico in January 2024, with an estimated 20,814 reported incidents. Vehicle theft was the most common property crime, with 11,887 reported incidents. The increasing prevalence of criminal activities is a driving factor in the public safety market.

- Security personnel and video surveillance systems have been stalwarts for law enforcement in ensuring public safety. To enhance public safety, secure communities, and protect sensitive data, police departments are turning to advanced tools. This includes harnessing video and data analytics and integrating various video feeds for real-time insights and surveillance.

- For instance, in June 2023, the Federal District Court of the Brazilian capital, Brasilia, implemented a new security system to protect defendants from escape during trial and to detect potential criminals roaming its premises. With intelligent video analytics, authorities are alerted to possible riots, which triggers police action and prevents an outbreak of violence. Additionally, 30 buildings are managed from a single location.

- By deploying smart city technologies like IoT sensors and data analytics, cities can bolster public safety through efficient traffic management, swift emergency responses, and environmental monitoring. As technology evolves, investments pour in, and governments act, numerous Latin American cities harness technology to tackle challenges and uplift their residents. Leveraging technology elevates living standards and environmental sustainability, boosts productivity, enables better decision-making, and catalyzes economic growth, propelling the market forward.

- Public safety agencies are responding to the escalating impact of climate change, marked by a surge in both the frequency and intensity of weather-related incidents. These agencies are investing strategically to bolster their disaster preparedness and response capabilities. The region's vulnerability to natural disasters underscores the imperative for Latin American and Caribbean nations. Hence, disaster risk reduction must be a cornerstone of their policies, plans, and investments. A significant example was the European government's decision in July 2023 to allocate EUR 43 million (approximately USD 46.08 million) as a humanitarian aid fund for Latin America and the Caribbean. This fund is earmarked to tackle challenges from the crisis in Venezuela and food shortages to natural risks, transcontinental migrations, and the repercussions of widespread violence and displacement.

Brazil to Witness Significant Growth

- Brazil is witnessing a rapid expansion of its urban areas, a trend often correlating with heightened crime and safety concerns. With their inherently higher population densities, urban regions demand stricter public safety measures to safeguard their residents. Addressing public safety is paramount in tackling these urban security challenges. In 2022, the World Bank noted a substantial shift, with Brazil's urban population reaching 87.56%. It is estimated to grow further as CIA data projects an annual urbanization rate change of approximately 2.47% for Brazil from 2020 to 2025.

- Using technology for public security purposes, such as surveillance cameras and emergency communication systems, has necessitated the modernization of law enforcement and public security agencies. Surveillance cameras are essential to public safety, as they assist in responding to emergencies. For instance, in July 2023, the financial capital of Brazil, Sao Paulo, announced plans to install 20,000 cameras equipped with facial recognition technology to enhance public safety. Such trends will drive the country's demand for record management and criminal analysis solutions.

- Organizations in Brazil are increasingly turning to cyber security services and products, given the country's status as a prime target for cyber threats. Kaspersky Lab, a leading cyber-security firm, highlights Brazil's prominence in banking trojan attacks, with 1.8 million attempted infections recorded between June 2022 and July 2023. As technology rapidly evolves, so do cyber threats in Brazil. Businesses are grappling with various attacks, from ransomware and social engineering to IoT-based incursions and supply chain breaches. Notably, public safety agencies across the region are ramping up investments in cyber security to fortify critical infrastructure and data.

- Brazil continues to face challenges with elevated criminal activities, notably in homicide and robbery. While there has been a decrease, homicide rates persist as a major concern. Data from the Brazilian Citizen Council for Public Safety and Criminal Justice indicates that Salvador had the highest number of reported homicides in 2023. These circumstances have underscored the urgency for heightened law enforcement and public safety efforts to curb illegal activities and bolster the market's growth prospects.

Latin America Public Safety Industry Overview

The Latin American public safety market is moderately competitive and has the presence of various small and large players; the entry of new players further drives competition among the vendors. All the major players hold a significant presence in the market and are focusing on expanding the consumer base in the region. Some of the significant players in the market are Cisco Systems Inc., Esri Global, Genetec Inc., CGI Inc., and ALE International. Companies are increasing their market share by forming multiple partnerships, collaborations, and acquisitions and investing in introducing new products to earn a competitive edge during the forecast period.

May 2024 - Pager Inc., a digital healthcare enablement and care advocacy company, joined forces with AXA Partners Mexico (APM) to enhance APM's health assistance programs. This strategic collaboration introduces new capabilities, elevating the services APM offers. Leveraging Pager's expertise, APM now boasts an automated triage system. This system, powered by a fusion of AI and evidence-based clinical algorithms, steers APM members toward tailored care solutions. Moreover, through this alliance, APM introduces a novel offering: a dedicated personal medical assistant, enhancing care coordination services.

February 2024 - The Economic Commission for Latin America and the Caribbean (ECLAC) launched its Digital Development Observatory (DDO). This new tool is designed to collect and analyze data, identify trends, assess progress, and aid in the region's policy formulation and implementation for digital transformation. Such initiatives are anticipated to support the market's growth in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 and Other Macroeconomic Factors on the Latin America Public Safety Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data, Critical Infrastructure

- 5.1.2 Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 5.2 Market Challenges

- 5.2.1 Shortage of Skilled Personnel

- 5.2.2 Inadequate Physical Infrastructure, Including Outdated Communication Networks and Emergency Response Facilities

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.1.1 Location Management

- 6.1.1.2 Record Management

- 6.1.1.3 Investigation Management

- 6.1.1.4 Crime Analysis

- 6.1.1.5 Criminal Intelligence

- 6.1.1.6 Other Software

- 6.1.2 Services

- 6.1.1 Software

- 6.2 By Mode of Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 Medical

- 6.3.2 Transportation

- 6.3.3 Law Enforcement

- 6.3.4 Firefighting

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Argentina

- 6.4.4 Chile

- 6.4.5 Peru

- 6.4.6 Colombia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Esri Global

- 7.1.3 Genetec Inc.

- 7.1.4 Honeywell International Inc.

- 7.1.5 CGI Inc.

- 7.1.6 Thales Group

- 7.1.7 ALE International

- 7.1.8 Motorola Solutions Inc.

- 7.1.9 NEC Corporation

- 7.1.10 Atos SE

- 7.1.11 Idemia

- 7.1.12 Kroll LLC

- 7.1.13 Hexagon AB

- 7.1.14 SAAB

- 7.1.15 Central Square

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET