PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550147

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550147

Latin America Government & Security Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

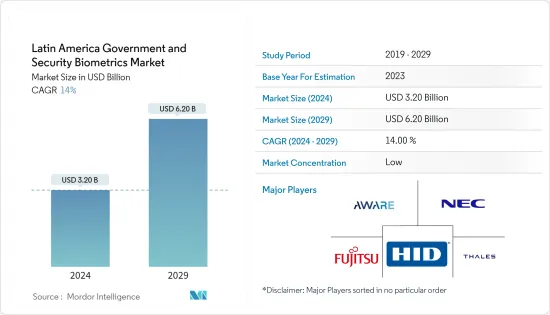

The Latin America Government & Security Biometrics Market size is estimated at USD 3.20 billion in 2024, and is expected to reach USD 6.20 billion by 2029, growing at a CAGR of 14% during the forecast period (2024-2029).

The Latin American government & security biometrics market is expected to grow during the forecast period due to proactive government initiatives, increasing security needs of organizations, and the integration of biometric technology in the government and security sectors. The region is poised to continue leveraging these advances to improve security, streamline processes, and create a safer environment for its citizens.

Key Highlights

- Biometrics technology is used in the government and security sector for various purposes, such as biometric voter registration systems, biometric law enforcement, biometric prison management, military base management systems, and biometric border control systems. The government uses cutting-edge biometric technology to identify terrorists and crooks.

- Regional government organizations have already implemented biometric systems because of the derived benefits, such as gaining access to physical and digital facilities, managing personnel identity, enabling self-service, and fostering greater trust in e-government interactions. For instance, in January 2023, officials in Brazil's capital took steps to tighten security at government facilities that were vandalized by tens of thousands of supporters of the outgoing president in what the administration called "anti-democratic" action.

- As Latin American nations increasingly integrate into the global economy, aligning their security and identification systems with international benchmarks, notably those established by organizations like ICAO for travel documents, becomes imperative. Embracing biometric technologies not only aids in meeting these standards but also streamlines cross-border transactions and travel.

- Moreover, advancements in biometric technologies, including improved accuracy, speed, and cost-effectiveness, have made these solutions more accessible and attractive to governments and security agencies in the region. For instance, facial recognition technology (FRT) is being rolled out in nearly forty Brazilian cities, aiming to streamline operations in public safety, transportation, and border control. These efforts fall under the umbrella of 'Smart City' initiatives. In addition, the declining costs of biometric hardware and software have also contributed to the increased adoption of these technologies.

- However, there are growing concerns among the public and government about the potential misuse of biometric data and the need to protect individual privacy. Developing robust data privacy regulations and ensuring compliance with these rules across the region is a significant challenge.

Latin America Government & Security Biometrics Market Trends

Facial Recognition is Expected to Hold Significant Market Share

- Facial recognition biometrics will likely be vital to next-generation security systems, providing greater reliability and accountability. This advanced security solution automatically identifies and verifies a person's identity based on digital or video images. It can be compared to other biometric technologies used for various activities.

- An increase in malware attacks in the region is anticipated to support the market's growth. According to the Federal Bureau of Investigation Internet Crime Report, the top international complainants for malware attacks are from Latin American regions, including Colombia, Mexico, and Brazil. Brazil accounted for 1,305 cases, the region's highest in 2023.

- The governments in the region are focusing on implementing facial recognition biometrics to offer improved security and enhance user experience. For instance, in January 2023, the National Civil Registry and the Colombian Union of Notaries introduced biometric facial recognition in remote processes.

- The addition of facial biometrics allows residents to complete residential registration remotely, either online or at ATM-style kiosks in high-traffic locations such as malls. Colombians are beginning to digitize their chip-enabled ID cards with their mobile phones. ID can be created through facial biometric authentication. By September 2023, more than 500,000 people had already created their IDs.

- Furthermore, in May 2023, Brazil implemented facial recognition technology at airports to facilitate passenger procedures. The new system can scan the biometric data of passengers' faces and check their identity in the country's databases. In Brazil, the Ministry of Infrastructure, in conjunction with the Department of Administration and Digital Government of the Ministry of Economy, partnered with Serpro to streamline processes by leveraging "Augmented Identity" technology, specifically through a facial recognition system.

Brazil is Expected to Witness Significant Growth

- In recent years, the Brazilian government has placed a greater emphasis on bolstering national security measures. Biometric technologies, such as fingerprint, facial recognition, and iris scanning, are being increasingly adopted by law enforcement, border control, and other government agencies to enhance identification and verification processes.

- Brazil grapples with a range of security challenges, notably crime and fraud. According to the Violence Atlas Study, Brazil allocates approximately USD 120 billion annually to combat crime and violence, accounting for 5.9% of its GDP. The private sector's expenditures mirror this commitment, representing 4.2% of the nation's GDP.

- Brazil lags in specific technologies, giving rise to favorable conditions for fraud. For example, more than half of the documents forged in Brazil do not contain machine-readable zones and are, therefore, particularly easy to make up. Among Brazilian ID documents, passports are the most forged (1.2% of all passports have signs of forgery), while driving licenses are the least likely to be forged (0.18% of forgeries).

- As Brazil advances the rollout of its new national identity card, designed to facilitate secure data exchange between the Federal Revenue Service and civil identification bodies, the government is bolstering security measures by delving into blockchain network development. Under initiatives like the Registro de Identidade Civil (RIC) project, the Brazilian government is rolling out biometric solutions to provide citizens with a secure, biometrically backed national ID card.

- With the rise of cybercrime and identity-related fraud, the Brazilian government and citizens are becoming more aware of the need for robust identity verification solutions. Biometric technologies are perceived as a reliable way to combat these challenges. According to the Netscout report, Brazil faced 328,326 distributed denial of service cyberattacks in the first six months of 2023, accounting for 42% of all such attacks in Latin America.

Latin America Government & Security Biometrics Industry Overview

The Latin American government & security biometrics market is fragmented and highly competitive and has several players. Several companies in the region are adopting strategic initiatives like introducing new products, partnerships, and mergers & acquisitions to remain competitive in the market.

- December 2023: IDEX Biometrics and Toppan Gravity announced the launch of biometric smart cards in Latin America. The collaboration introduced biometric cards featuring the innovative IDEX Pay fingerprint authentication payment solution. The cards were expected to be available in the market by Q1 2024.

- November 2023: Aware Inc. and Serban Group partnered to enhance the provision of biometric digital identity and authentication solutions. Their focus is on serving financial services firms, governments, and commercial enterprises in Latin America and Europe. Aware's dedicated program empowers technology providers to boost revenue streams by providing biometric solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Adoption of Biometrics to Enhance Security and Convenience for Citizens by the Government

- 5.2 Market Challenges

- 5.2.1 High Risk of Data Breach as Biometrics Technology Uses Personal Information

6 MARKET SEGMENTATION

- 6.1 By Authentication Type

- 6.1.1 Single Authentication Factor

- 6.1.2 Multi-factor Authentication

- 6.2 By Contact Type

- 6.2.1 Contact-based

- 6.2.2 Non-contact-based

- 6.3 By Product Type

- 6.3.1 Voice Recognition

- 6.3.2 Facial Recognition

- 6.3.3 Fingerprint Identification

- 6.3.4 Vein Recognition

- 6.3.5 Iris Recognition

- 6.4 By Application

- 6.4.1 Border Control

- 6.4.2 E-Passport

- 6.4.3 E-Visa

- 6.4.4 National ID

- 6.4.5 Healthcare & Welfare

- 6.4.6 Public Safety

- 6.4.7 Other Applications

- 6.5 By Country

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.5.3 Colombia

- 6.5.4 Argentina

- 6.5.5 Peru

- 6.5.6 Chile

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu

- 7.1.2 Thales Group

- 7.1.3 HID Global Corporation

- 7.1.4 Precise Biometrics AB

- 7.1.5 M2SYS Technologies

- 7.1.6 Aware, Inc.

- 7.1.7 NEC Corporation

- 7.1.8 Aratek

- 7.1.9 EyeLock Inc.

- 7.1.10 IDEMIA

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET