Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550143

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550143

Indonesia Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

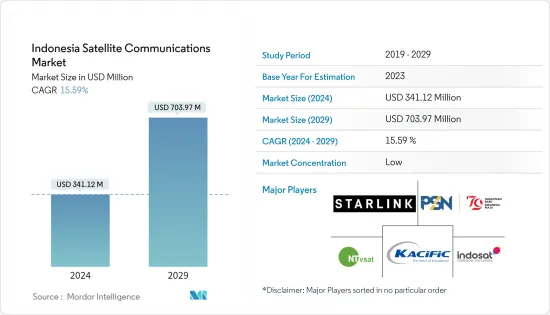

The Indonesia Satellite Communications Market is expected to register a CAGR of 10% during the forecast period.

Key Highlights

- Indonesia's satellite communications market is an essential component of its broader telecommunications infrastructure, driven by the country's unique geographic challenges. As an archipelago with over 17,000 islands, traditional terrestrial networks are insufficient to ensure nationwide connectivity. Consequently, satellite communication has emerged as a critical solution to bridge the digital divide between urban centers and remote regions.

- The Indonesian government and private sector have invested significantly in satellite technology to support various applications, including telecommunication, broadcasting, and internet services. For instance, in May 2024, Elon Musk officially launched SpaceX's Starlink satellite internet services in Indonesia, representing a significant milestone in the nation's efforts to enhance internet connectivity in remote regions. The launch event occurred at a community health center in Bali, where Musk emphasized the project's potential to transform internet access, particularly for remote medical clinics where connectivity can serve as a critical lifeline.

- The market is characterized by a mix of domestic and international players. PT Telekomunikasi Indonesia (Telkom), the state-owned enterprise, is a major player, operating several satellites, including the Telkom series. In addition to domestic operators, international satellite service providers like SES and Intelsat also have a significant presence in the market, offering services that complement local offerings. These collaborations have enhanced service delivery, particularly in underserved areas.

- Moreover, regulatory frameworks and government initiatives play a pivotal role in shaping the satellite communications market in Indonesia. The government has implemented policies to promote the development and deployment of satellite technology as part of its broader digital economy strategy. Programs such as the Palapa Ring Project aim to improve broadband infrastructure across the country, with satellites being integral to reaching the most remote regions. The government has also streamlined regulatory processes to encourage private sector participation and investment.

- Furthermore, technological advancements are also driving growth in the market. Innovations in satellite technology, such as high-throughput satellites (HTS) and the upcoming low earth orbit (LEO) satellite constellations, promise to enhance capacity and reduce latency, offering better service quality. These advancements are particularly relevant for Indonesia, where high-speed, reliable internet access remains a challenge in many areas. The adoption of these technologies is expected to further boost the market's expansion and improve connectivity.

Indonesia Satellite Communications Market Trends

Expansion of 5G Satellite Communication is Driving the Market

- The expansion of 5G satellite communication is significantly driving the growth of the market studied. This development is pivotal in addressing the connectivity challenges in the archipelagic nation, where terrestrial infrastructure often falls short. With 5G technology, satellite communication offers high-speed internet access even in remote and underserved areas, facilitating better integration into the digital economy and enhancing the quality of life for many Indonesians.

- Increased investments and strategic partnerships in Indonesia's telecom sector are driving the growth of 5G infrastructure. For instance, at the end of the 2023 fiscal year, PT Telkom Indonesia Group reported a total of approximately 43,047 telecommunications towers. Industry leaders are collaborating to deploy advanced satellite technologies, which are essential for meeting 5G's high bandwidth and low latency requirements. These investments are not only enhancing consumer connectivity but also strengthening sectors such as transportation, logistics, and aviation, thereby expanding the market's reach and impact.

- Furthermore, the Indonesian government's initiatives, such as launching the SATRIA-1 satellite, underscore the commitment to leveraging 5G satellite communication for national development. SATRIA-1 became operational in early 2024. It is expected to provide extensive coverage and high-speed internet to remote areas, thereby reducing the digital divide. This government-backed project highlights the strategic importance of satellite communication in achieving broader socio-economic goals.

- The Indonesian satellite communication market is rapidly evolving, with a significant shift toward embracing advanced technology, notably the integration of low earth orbit (LEO) satellites. LEO satellites, positioned closer to Earth, offer distinct advantages for 5G applications, notably by minimizing latency and elevating service quality. This transition to LEO satellites is poised to bolster communication networks, bolster IoT capabilities, and streamline real-time data transmission, all pivotal for contemporary digital services.

Other Regional Segment is Experiencing Major Growth

- Satellite communication in Indonesia is witnessing heightened demand, primarily propelled by regions like Sulawesi, Papua, Maluku, Bali, and Nusa Tenggara. These areas, known for their challenging terrains, struggle to establish and sustain robust terrestrial communication networks. Given Indonesia's vast archipelago comprising numerous remote and sparsely populated islands, the feasibility and cost-effectiveness of deploying extensive fiber-optic or ground-based communication systems are severely limited. Hence, satellite communication is the pivotal and efficient solution to bridge connectivity gaps in these remote locales.

- In Sulawesi, Papua, and Maluku, a substantial population resides in remote, underserved regions lacking terrestrial network coverage. Satellite communication emerges as a pivotal solution, facilitating connectivity and granting access to vital services such as education, healthcare, and emergency aid. These areas are also prone to frequent natural calamities, including earthquakes, tsunamis, and volcanic activities, often disrupting land-based infrastructure. In contrast, satellite networks exhibit greater resilience, guaranteeing uninterrupted communication channels, especially in times of crisis.

- While Bali and Nusa Tenggara are more developed and popular tourist destinations in their region, they still face challenges with inadequate terrestrial communication, particularly on smaller islands and in rural areas. Given that tourism is a critical economic driver, these regions rely heavily on robust communication networks. These networks are essential for hospitality, transportation services, and emergency responses. Satellite communications, therefore, play a crucial role in ensuring uninterrupted connectivity for tourists and businesses, enhancing both travel experiences and operational efficiencies.

- Moreover, the Indonesian government has taken a proactive stance on digital inclusion and connectivity. Recognizing the strategic importance of satellite communications, the government has launched initiatives like the Palapa Ring project. This project aims to extend high-speed internet access to remote and underserved areas, often utilizing satellite technology to complement terrestrial networks. Such governmental initiatives are significantly boosting the demand for satellite communication services in these regions.

Indonesia Satellite Communications Industry Overview

The Indonesian satellite communications market features a fragmented landscape, with numerous key players continually enhancing their offerings to outpace competitors. These companies invest heavily in research and development to introduce advanced technologies and improve service quality. Strategic partnerships and mergers are common as firms seek to expand their market presence and customer base.

- March 2024: The global satellite operator Intelsat announced an agreement to acquire additional capacity from Eutelsat's OneWeb LEO satellite constellation. This strategic move aims to enhance Intelsat's multi-orbit business model and leverage the increasing demand for LEO connectivity.

- February 2024: BlackSky, a prominent Earth observation and data analytics firm, announced a USD 50 million contract to deliver satellite imagery services and imaging spacecraft to the Republic of Indonesia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002703

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Expansion of 5G Satellite Communication

- 5.1.2 Growth of Low Earth Orbit (LEO) Satellites

- 5.2 Market Challenges

- 5.2.1 Shortfall of Skilled Resource

- 5.3 Technology Trends

- 5.4 Key Use Cases

6 MARKET SEGMENTATION

- 6.1 By Satellite Mass

- 6.1.1 10-100 Kg

- 6.1.2 100-500 Kg

- 6.1.3 500-1000 Kg

- 6.1.4 Below 10 Kg

- 6.1.5 Above 1000 Kg

- 6.2 By Orbit Class

- 6.2.1 GEO

- 6.2.2 LEO

- 6.2.3 MEO

- 6.3 By Communication Type

- 6.3.1 Broadcasting

- 6.3.2 Mobile Communication

- 6.3.3 Satellite Phone

- 6.3.4 Other Communication Types

- 6.4 By End User

- 6.4.1 Commercial

- 6.4.2 Military & Government

- 6.5 By Geography

- 6.6 Java

- 6.7 Sumatra

- 6.8 Kalimantan

- 6.9 Other Regions (Sulawesi, Papua & Maluku, and Bali & Nusa Tenggara)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pasifik Satelit Nusantara

- 7.1.2 Thales Alenia Space

- 7.1.3 PT Telekomunikasi Indonesia (Telkom)

- 7.1.4 Indosat Ooredoo Hutchison

- 7.1.5 Bank Rakyat Indonesia (BRI)

- 7.1.6 Thaicom

- 7.1.7 SES SA

- 7.1.8 Intelesat

- 7.1.9 Viasat

- 7.1.10 Inmarsat

8 INVESTMENTS ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.