PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550012

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550012

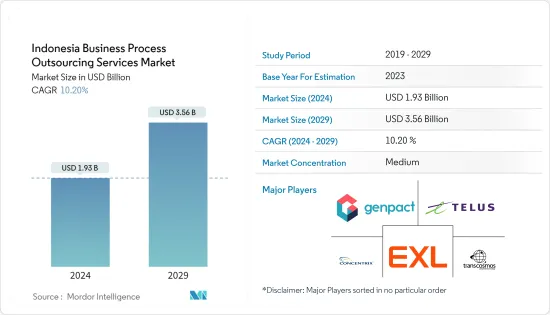

Indonesia Business Process Outsourcing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Indonesia Business Process Outsourcing Services Market size is estimated at USD 1.93 billion in 2024, and is expected to reach USD 3.56 billion by 2029, growing at a CAGR of 10.20% during the forecast period (2024-2029).

The business process outsourcing (BPO) market in Indonesia has been experiencing significant growth and evolution.

Indonesia's competitive labor costs relative to those of developed countries make it an appealing option for outsourcing businesses. Across diverse sectors like banking, financial services, telecommunications, healthcare, and retail, companies opt to outsource non-core functions, such as customer service, technical support, back-office operations, and IT services, to Indonesian BPO service providers. This strategy is expected to cut operational expenses and enhance overall efficiency.

Indonesia features a vast and varied talent pool that is proficient in several languages, including English, Bahasa Indonesia, and regional dialects. Annually, the country churns out a substantial number of graduates, especially in fields like business administration, information technology, engineering, and finance. This ensures a consistent influx of skilled professionals available for BPO operations. Indonesian workers are recognized for their robust work ethic, adaptability, and customer service orientation, rendering them highly suitable for outsourcing roles that demand communication and problem-solving skills.

The Indonesian BPO industry is poised for growth, fueled by the increasing adoption of cloud computing outsourcing services across diverse verticals like BFSI, HR, and IT and telecommunications. The retail industry has also experienced notable transformation in recent years, integrating technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and big data analytics, which bodes well for the market's future expansion. These BPO services are in high demand due to their numerous advantages, including improved service quality, flexibility, and cost reduction, driving the market's proliferation.

The Indonesian business process outsourcing (BPO) industry has experienced remarkable growth and has become a pivotal driver of the country's economy. It offers a wide array of specialized services, including web development, research, and IT-related customer support, catering to diverse client needs. Both large corporations and small businesses leverage outsourcing to enhance competitiveness and maintain an edge in their respective markets, contributing to a favorable market outlook. Several trends underpinning the expansion of these services include the adoption of omnichannel solutions, the increasing importance of social media management, the integration of AI solutions, a shift toward remote work preferences, strategic business collaborations, uptake among SMEs, and the utilization of progressive web applications.

The progression of cloud technologies has emerged as a significant catalyst for the expansion of the BPO industry, primarily due to its array of benefits, including scalability, cost-effectiveness, reliability, and agility. Consequently, many market players are transitioning toward cloud-based delivery models for BPO services to enhance their brand presence, thus amplifying the uptake of such services.

Indonesia Business Process Outsourcing Services Market Trends

Customer Care to Hold Major Market Share

- The customer care industry is one of the primary areas of focus for BPO services in Indonesia. Many companies, both domestic and international, outsource their customer service operations to Indonesian BPO service providers. These outsourced call centers handle a wide range of customer inquiries, including product inquiries, order management, technical support, billing inquiries, and after-sales service. By outsourcing customer care functions, companies can improve service levels, reduce operating costs, and focus on their core business activities.

- Indonesia is often chosen as a preferred location for call centers due to its abundant pool of highly skilled workforce. The country boasts a well-educated and proficient labor force, offering businesses access to a talented pool of professionals for call center outsourcing. This ensures that companies can rely on top-quality support from knowledgeable and experienced agents.

- Indonesia offers the advantage of relatively low labor costs, making it a cost-effective solution for outsourcing call center services. This allows businesses to achieve significant savings without sacrificing the quality of service provided.

- Despite Indonesia's ranking of 79 out of 113 countries in the EF English Proficiency Index (EF EPI), major cities like Jakarta and Bali boast an abundance of English-speaking residents with moderate to high proficiency levels. This is largely attributed to the vibrant tourism industry in these areas. In addition, English is a mandatory subject in Indonesian schools from elementary to high school, further contributing to the English-speaking skills of the population.

- Moreover, government initiatives play a significant role in enhancing English proficiency and skill development in the country. For example, in 2023, the Indonesian Ministry of Education, Culture, Research, and Technology allocated over IDR 34 trillion (USD 2.2 trillion) for higher education programs. Since 2021, the Ministry has been providing tuition support to Indonesian students through the Kartu Indonesia Pintar (KIP) Kuliah Merdeka, or Smart Indonesia Card, initiative. This program aims to encourage higher education participation, particularly among students from low-income households.

Telecom and IT to Hold Major Market Share

- The telecommunications industry in Indonesia is experiencing rapid expansion, driven by substantial investments in infrastructure and technology. This growth is fueling increased demand for customer support, technical assistance, and other business process outsourcing (BPO) services. For instance, Indosat Ooredoo Hutchison (IOH) in Indonesia intended to initiate the sale of a minority stake in its fiber business as soon as March 2024, with the potential valuation of the asset exceeding USD 1 billion.

- As per data released by Telkom Indonesia, by the conclusion of the 2023 fiscal year, the combined tally of telecommunication towers within the PT Telkom Indonesia Group reached approximately 43,047 units. Telkom Indonesia stands as the foremost provider of telecommunication and networking services in Indonesia. The company delivers an extensive array of network and telecommunication services, encompassing fixed-line connections, cellular services, network and interconnection solutions, and internet and data communication services.

- BPO firms in Indonesia are integrating cutting-edge technologies like artificial intelligence, automation, and analytics to enhance service efficiency and lower expenses. For example, in April 2024, Nvidia and PT Indosat Ooredoo Hutchison, a telco company in Indonesia, were set to establish an artificial intelligence center in Central Java. This initiative was valued at USD 200 million. Moreover, the growing acceptance of cloud computing in the IT industry further amplifies the need for BPO services associated with cloud management and support.

- Companies in Indonesia are undergoing digital transformation, heightening the demand for IT services such as managed services, cloud solutions, and IT support. Initiatives like the Indonesia Digital Economy 2020 Framework aim to strengthen the country's digital infrastructure, making Indonesia more attractive as a BPO hub. To support this effort, the government has implemented the e-commerce roadmap, which provides guidelines for expanding the digital economy. The government plans to invest over USD 70 billion in digital infrastructure improvements from 2020 to 2024, including the expansion of broadband networks, data centers, cloud computing systems, and other IT infrastructure, to facilitate digital growth.

- The Indonesian BPO market, driven by the dynamic telecom and IT industries, is set for continued growth. With supportive government policies and technological advancements, Indonesia is becoming an increasingly attractive destination for BPO services. The synergy between the telecom and IT industries and the BPO industry creates a robust environment for business outsourcing, serving both domestic and international markets.

Indonesia Business Process Outsourcing Services Industry Overview

The Indonesian BPO market encompasses a wide range of services, including customer support, back-office operations, finance and accounting, IT support, and more. This diversity leads to the presence of numerous small and medium-sized BPO companies specializing in different niches. Therefore, the Indonesian business process outsourcing services market is fragmented.

Indonesia's business process outsourcing (BPO) industry has significantly benefited from various measures and regulations implemented by the Indonesian government to attract investment and drive growth. For instance, in March 2023, the Indonesian parliament passed an emergency decree on investment and jobs into law, replacing the 2020 Jobs Creation Law. This new law aims to boost business sentiment in the country and is expected to create substantial growth opportunities for the Indonesian BPO industry. In addition, Indonesia's geographic proximity to BPO powerhouses such as the Philippines and India could help attract customers to the Indonesian BPO market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Trends

- 4.3 Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Streamlined Operations with Extended Focus on Core Operations

- 5.1.2 Lack of In-house Expertise in All Simultaneous Operations

- 5.2 Market Restraints

- 5.2.1 Security and Lack of Proper Control

- 5.3 Key Use Cases

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 HR

- 6.1.2 Sales and Marketing

- 6.1.3 Customer Care

- 6.1.4 Others

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 Telecom and IT

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Others

- 6.3 By Region

- 6.3.1 Java

- 6.3.2 Sumatra

- 6.3.3 Kalimantan

- 6.3.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Concentrix Corporation

- 7.1.2 Conduent Inc.

- 7.1.3 ExlService Holdings Inc.

- 7.1.4 Foundever

- 7.1.5 Genpact

- 7.1.6 KPSG

- 7.1.7 Majorel

- 7.1.8 Relia Inc.

- 7.1.9 Teleperformance

- 7.1.10 TELUS

- 7.1.11 Transcom

- 7.1.12 Transcosmos Inc.

- 7.1.13 TTEC Holdings Inc.

- 7.1.14 VADS BERHAD

- 7.1.15 WNS (Holdings) Ltd

8 VENDOR SHARE ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS