PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550003

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550003

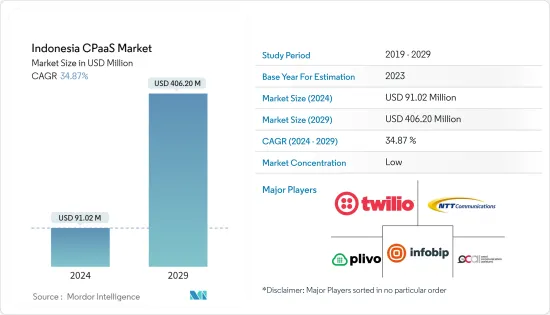

Indonesia CPaaS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Indonesia CPaaS Market size is estimated at USD 91.02 million in 2024, and is expected to reach USD 406.20 million by 2029, growing at a CAGR of 34.87% during the forecast period (2024-2029).

In the Indonesia CPaaS market, trends such as rich conversational channels, AI-integrated CPaaS ecosystems, and conversational commerce are fueling market growth. These trends not only offer contextual engagement and heightened interoperability but also elevate accessibility. Additionally, Customer Data Platforms (CDP) empower organizations with real-time, in-depth customer insights. Furthermore, there's a growing synergy among CPaaS, CCaaS, CRM/CDP, and digital channel vendors, all aimed at enhancing the overall customer experience.

Key Highlights

- Indonesia is witnessing a notable trend of growing businesses embracing CPaaS. Industries spanning from retail, travel, and hospitality to healthcare and e-commerce are leveraging CPaaS to enhance customer interactions. As a result, integrating CPaaS into a company's marketing strategy is no longer just an option; it's a necessity. Particularly, the integration of CPaaS with customer-centric features, such as real-time automated events, signifies a significant shift in how businesses engage with their clientele.

- Indonesia's adoption of CPaaS is set to surge, driven by a rising appetite for contextual communication to enhance customer experiences. This heightened demand is underscored by a need for cost-effective communication solutions, a smooth transition to hybrid models, a robust market landscape, and enriched services. CPaaS empowers enterprises to execute a range of functions seamlessly, from dispatching customer messages-be it appointment confirmations or purchase notifications-to tracking orders.

- Low-code application development is an advanced software development strategy that expedites the creation of business applications by minimizing the reliance on traditional coding methods. This approach substitutes custom code written by users with pre-built UI components, scripts, integrations, a specialized development environment, and visual workflow tools. Low-code development enhances an organization's scalability and profitability and enables the potential for above-average returns on digital investments.

- CPaaS serves as a potent tool for enhancing business operations. It addresses security concerns by employing end-to-end encryption and provides a variety of communication services through a unified API, thereby adapting to changing communication requirements and improving customer satisfaction. CPaaS offerings utilize multiple aggregators to ensure comprehensive coverage for customers. However, this approach may result in messages taking longer or less efficient routes, leading to connectivity issues that can compromise message quality and delivery time.

- The digital strategy adoptions in large and small-scale enterprises in the country, in line with the governmental support to strengthen the country's digital economy, are supporting market growth by creating an opportunity for market vendors to offer their CPaaS solutions as an API to be integrated with digital service applications in various sectors in the country.

Indonesia CPaaS Market Trends

SME Organization Size Segment is Expected to Hold Significant Market Share

- "Making Indonesia 4.0" is one initiative that aims to improve the nation's digital infrastructure and encourage companies to use contemporary technologies. This trend would most impact SMEs that are planning to use CPaaS to incorporate advanced communication technologies into their operations without having to incur large capital expenditure costs.

- For CPaaS providers, the enormous and rapidly expanding market for SMEs in Indonesia offers a significant chance to expand their operations across the ecosystem. A fantastic platform for SMEs is CPaaS (Communication Platform as a Service), which enables businesses to create, manage, and use applications without having to deal with the hassle of setting up and maintaining communication infrastructure. It includes a modern customer management platform, redundancy, and multi-layer data security that allows users complete control over the platform.

- SMEs, brands, and organizations must now regularly stay in touch with their customers, particularly online. The desire is for deeper consumer connection; improved business solutions can readily meet this need. By sending their target audience rich communication like photographs, videos, documents, etc., on their normal SMS function, RCS Business Messaging, WhatsApp Business Solution, and Viber Business Messages enable small and large organizations to interact and engage with their target audiences.

- Indonesia's e-commerce market has grown at an exponential rate, and SMEs have been essential to this growth. For e-commerce companies to handle order confirmations, manage client relations, and give delivery updates, CPaaS solutions are crucial. For instance, SMEs on sites like Shopee and Tokopedia use CPaaS for automated customer communications, which greatly enhances customer satisfaction and operational effectiveness. This connectivity provides quick and easy communication, enabling SMEs to compete with larger enterprises.

- In addition to assisting MSMEs in maintaining relationships with their current clients in their local areas, CPaaS also enables them to connect with potential clients across Indonesia. Cloud and AI-enabled communication solutions allow MSMEs to connect with potential clients in multiple markets with personalized messaging, utilizing numerous channels since digital is rapidly becoming a major component of business operations for enterprises of all sizes in Indonesia. MSMEs may scale their communications strategies up or down as necessary with CPaaS, allowing them to develop and expand at their own rate. The investment money that would have been spent on growth and lead-generating services is reduced.

- According to Oxford Insights, Indonesia secured the 42nd spot out of 193 countries in the 2023 Government AI Readiness Index, with a commendable score of 61.03. Fueled by a youthful, tech-savvy demographic and positive macroeconomic indicators, Indonesian firms are increasingly embracing AI's potential. Moreover, both domestic and foreign investors are keenly observing the burgeoning AI landscape in Indonesia, hinting at a promising future for AI-integrated CPaaS solutions in the country.

- The ongoing development of solutions, growing partnerships, and collaboration among industry rivals in Indonesia also drive the entire CPaaS market. For instance, in March 2024, Vonage, a cloud communications provider aiding businesses in their digital transformation and a subsidiary of Ericsson, unveiled a strategic partnership with Telkomsel, a prominent player in Indonesia's digital telecommunications landscape. The collaboration aims to bolster network capabilities for developers, enterprises, and Communication Service Providers (CSPs) by leveraging APIs.

Retail and E-commerce End User Segment Holds Significant Market Share

- CPaaS enables retail and e-commerce companies to open more channels and influence shoppers' buying behavior. They can do this by sending coupon codes or suggested product notifications based on past activities to enhance conversions and decrease shopping cart abandonment rates.

- With modern commerce depending on instant and relevant offers, retail and e-commerce organizations prioritize cross-channel engagements to stay on top of their customers' expectations. The retail business has changed, moving away from a more direct single point of communication toward omnichannel communications via the web and social media. This has resulted in rapidly evolving customer purchasing trends. Due to the rising consumer demand, a better shopping and service experience across all channels is in high demand.

- Retailers nationwide are being advised to use real-time communication systems by expanding retail sales across many locations to serve their customers better and broaden their clientele. The industry's growth is also fueled by fast-shifting consumer purchasing behaviors.

- Anker Indonesia sought to increase the frequency of its digital marketing efforts to extend its reach beyond email or SMS campaigns. Seeing a low average email use among Indonesian customers, the company started utilizing WhatsApp to develop a new customer engagement channel. Using WhatsApp, the company started a weeklong campaign, sending targeted messages to customers who had opted in. The campaign promoted a special offer on headphones, leading to high engagement and sales. Key results from the campaign include a 63% increase in message open rates, 300 messages sent per second, a 27% add-to-cart rate, and a 6.7% sales conversion rate, all within one week.

- With a high mobile penetration rate, Indonesian consumers heavily rely on mobile devices for shopping and communication, making CPaaS solutions crucial for businesses to reach their customers effectively. According to the World Bank, as of the third quarter of 2023, approximately 52% of the respondents in Indonesia stated that coupons and discounts were the main drivers for their online purchases. Meanwhile, around 14% of respondents stated that the social media "buy" button encouraged them to make online purchases.

- Indonesia stands out as a significant player in the Southeast Asian e-commerce landscape. Official projections suggest that retail e-commerce sales in Indonesia are poised to hit approximately USD 90.47 billion by 2026. The broader retail market in Indonesia is on a growth trajectory, with sales anticipated to soar to about USD 243 billion by 2026. Such expansions in the segment are expected to create demand for CPaaS solutions in the country.

Indonesia CPaaS Industry Overview

The Indonesian Communication Platform-as-a-Service (CPaaS) Market is highly fragmented, with major players like Twilio Inc., Infobip Ltd, NTT Communications Corporation, Plivo Inc., and OCA Indonesia Inc. (Telkom Indonesia). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their solutions and service offerings and gain sustainable competitive advantage.

- June 2024 - Mekari, a prominent player in the Indonesian tech scene, made waves by acquiring Jojonomic, a key player in no-code solutions, including their flagship product, the Officeless Operating System.

- February 2024 - Qiscus, a startup offering an omnichannel communication platform, reported a remarkable 1.7x surge in revenue for 2023. This growth was underpinned by the successful handling of over 2 billion customer conversations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.2.1 Pure-Play CPaaS

- 4.2.2 Enterprise-Grade CPaaS

- 4.2.3 Telco-Driven CPaaS

- 4.2.4 Service Provider-based CPaaS (Enablement Partners)

- 4.2.5 Hybrid CPaaS Offerings

- 4.3 Macroeconomic Factors Impact on the Market

- 4.4 Industry Value Chain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Increase in the Uptake of CPaaS-based Solutions Over Other Adjacent Models

- 5.1.2 Growing Demand for Low-code Enablement to Make Enterprise CPaaS Highly Usable for Customer Operations, Service, and Marketing

- 5.2 Market Challenges

- 5.2.1 Legacy and Implementation Challenges

- 5.3 Market Opportunities

- 5.3.1 Technological Innovations, Such as Integration With Payment Service, Lightweight Deployments to Further Drive Adoption

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 SME

- 6.1.2 Large-Scale Organization

- 6.2 By End User

- 6.2.1 IT and Telecom

- 6.2.2 BFSI

- 6.2.3 Retail and E-commerce

- 6.2.4 Healthcare

- 6.2.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Twilio Inc.

- 7.1.2 Infobip Ltd

- 7.1.3 NTT Communications Corporation

- 7.1.4 Plivo Inc.

- 7.1.5 OCA Indonesia Inc. (Telkom Indonesia)

- 7.1.6 Barantum

- 7.1.7 8x8 Inc.

- 7.1.8 Messagebird

- 7.1.9 Route Mobile Limited

- 7.1.10 PT Vfirst Komunikasi Indonesia

- 7.1.11 Qiscus

- 7.1.12 Mekari Qontak (PT Mid Solusi Nusantara)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET