PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550001

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550001

North America Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

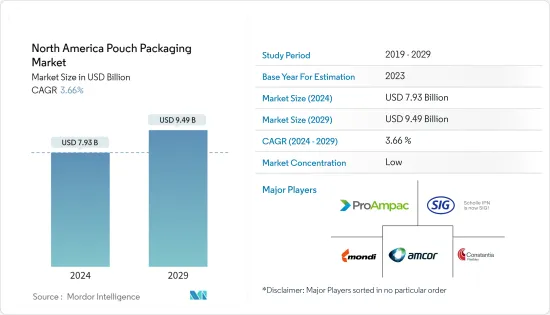

The North America Pouch Packaging Market size is estimated at USD 7.93 billion in 2024, and is expected to reach USD 9.49 billion by 2029, growing at a CAGR of 3.66% during the forecast period (2024-2029).

Key Highlights

- Pouches are widely used as a flexible and lightweight type of packaging that typically consists of a bag-like container made from materials such as plastic, paper, foil, or a combination of these. Pouches are sealed to enclose and protect various products, including food, cosmetics, and pharmaceuticals, and can be designed with features like resealable closures or spouts for easy dispensing. Pouches often incorporate specialized barrier films, such as aluminum foil or metalized layers, to protect sensitive products from factors like UV light and oxygen, maintaining product quality.

- Pouch packaging has found significant relevance in the North American ready-to-eat (RTE) and frozen food market segments. Pouches are easy to open, reseal, and store, thus making them ideal for quick meals or snacks. In addition to this, pouches allow for portion control, which is essential in the RTE and frozen food sectors where precise servings are desirable. Pouches can also be designed to be microwave-safe, allowing consumers to heat their ready-to-eat meals directly in the pouch, reducing the need for additional cookware. Such features of pouch packaging positively affect the growth of the market.

- Pouches are typically less expensive to produce and transport due to their lightweight nature and efficient use of materials. This leads to cost savings for manufacturers as well as the retailers. Pouches generate less waste than other packaging forms, such as cans or bottles, and they are often recyclable, contributing to waste reduction efforts. Furthermore, pouches offer ample space for branding and product information, making them an excellent choice for marketing and branding efforts. They can be designed with eye-catching graphics and labels.

- However, sustainability is a growing concern in North America. Pouches can be manufactured using eco-friendly materials and designed to be recyclable, aligning with the trend toward more environmentally conscious packaging choices.

- The surge in portion control trends within the food and pet food industries in North America is driving the demand for pouch packaging solutions, facilitating convenient serving sizes while ensuring freshness and convenience for consumers. Thus, changing consumer preferences, supply chain dynamics, and sustainability considerations in the packaging industry are driving innovation and adaptation in response to changing market demands and safety requirements.

North America Pouch Packaging Market Trends

Retort Pouches are Anticipated to Witness the Highest Growth in the Market

- The market for retort pouch packaging in North America is majorly driven by the increasing demand for convenience foods and the desire for longer shelf life without preservatives. Retort pouches are designed to extend the shelf life of various food products. The key to their effectiveness is the retort process, which involves heating the pouches to high temperatures to kill microorganisms, enzymes, and others. This process ensures that the product remains safe and retains its quality for an extended period.

- Retort pouches are widely used in food packaging since they are simple to use and take up little space. Retort pouches are also becoming more popular because of their extra features, including spouts, release valves, tear notches, slider closures with end clips, resealable zippers, and handles. These pouches are typically made from flexible, multi-layer materials that provide excellent barrier properties. The layers often include a combination of polyester, nylon, aluminum foil, and polyethylene. This combination effectively blocks out oxygen, moisture, and light, which are the primary factors that can lead to food deterioration.

- Retort pouches are versatile and can be used for various types of foods, including ready-to-eat meals, sauces, baby food, pet food, and even beverages. Additionally, retort pouches are incredibly lightweight and space-efficient compared to traditional rigid packaging like cans or glass jars. This further helps reduce transportation costs and optimize storage space for manufacturers and retailers.

- In February 2023, the Canadian Government revealed its plan to introduce labeling rules for plastic packaging and single-use plastics. Unless producers have assessed these products for recyclability, the labeling rules prohibit using the chasing-arrows symbol and other recyclability claims on consumer packaging and single-use plastics. Currently, plastic packaging makes up approximately half of all plastic waste, but less than 15% of plastic packaging is recycled. This initiative was part of Canada's plan to move toward zero plastic waste by 2030. Canadian manufacturers have sought to adopt enhanced packaging materials and systems for their products.

- As per Statistics Canada, in July 2023, the consumer price index (CPI) for processed meat was 195.3. The increasing consumption of processed meat in Canada has spurred a corresponding demand for retort pouches, as they offer convenient packaging solutions that ensure product preservation and ease of preparation, aligning with consumers' busy lifestyles.

The United States is Expected to Hold the Largest Market Share

- The United States is witnessing a high demand for on-the-go consumption and frozen food, among others, which is driving the growth of processed food, which, in turn, is boosting the pouch packaging market.

- According to the Flexible Packaging Association, recyclable films and pouches are currently becoming more mainstream. Foreign and domestic pressures, as well as consumers' demand for more eco-friendly options, are spurring countries to look at the issue of waste and recycling and find feasible solutions.

- The Flexible Packaging Association (FPA) indicates that the developments made in the areas of production processes and material innovation have decreased the weight of some flexible packaging by approximately 50%. Moreover, pouch packaging also permits space-saving opportunities, which means that substantial ratios of products could be shipped utilizing less fuel and energy.

- The pouch packaging market in the United States has seen several innovations in recent years to meet consumer demand for convenience, sustainability, and product freshness. In June 2023, Israel-based compostable packaging specialist Tipa partnered with two of the largest packaging manufacturers in the United States, PPC Flexible Packaging and Clearview Packaging. With main US facilities in Illinois and Utah, PPC Flexible Packaging is set to add Tipa's compostable laminates to its manufacturing portfolio to produce pouches for packaging baked goods, dry food, supplements, vitamins, and other products.

- As per Appinio data, in 2023, 24% of consumers in the United States preferred frozen food several times a week. As frozen food consumption in the country is high, there is an increased demand for pouch packaging, which offers convenient and space-efficient solutions for storing and transporting frozen foods.

North America Pouch Packaging Industry Overview

The North American pouch packaging market is fragmented due to the presence of several market players globally. Some major players are Amcor PLC, Mondi Group, ProAmpac Intermediate Inc., SIG Group AG, and Constantia Flexibles Group GmbH. The market players are expected to leverage the opportunity posed by the growth of several end-use verticals and are innovating to expand their market presence.

- February 2024 - Amcor collaborated with Stonyfield Organic, the country's leading organic yogurt maker, and Cheer Pack North America, a leading manufacturer of spouted pouch packaging, to launch the first all-polyethylene (PE) spouted pouch. The innovative pouch replaces Stonyfield Organic's prior multi-laminate structure with a more responsible pouch design for its YoBaby refrigerated yogurt.

- August 2023 - TC Transcontinental Packaging announced an investment of USD 60 million toward developing advanced mono-material recyclable flexible plastic packaging solutions, providing high-performance polyethylene films with more heat resistance. TC Transcontinental Packaging offers a variety of flexible plastic products, including rollstock, bags, and pouches, shrink films and bags, and advanced coatings, servicing a variety of markets, including dairy, coffee, meat and poultry, pet food, agriculture, beverage, home and personal care, industrial, consumer products, and medical.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Consumption of Ready-to-Eat Foods Across the Region

- 5.1.2 Increasing Demand for Light Weight packaging Solution

- 5.2 Market Challenges

- 5.2.1 Rising Concerns Regarding the Use of Plastic Packaging

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Standard

- 6.1.2 Aseptic

- 6.1.3 Retort

- 6.1.4 Hot-Fill

- 6.2 By Closure Type

- 6.2.1 Zipper

- 6.2.2 Spout

- 6.2.3 Tear Notch

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Personal Care

- 6.3.3 Healthcare

- 6.3.4 Other End-user industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 ProAmpack Intermediate Inc.

- 7.1.3 Mondi Group

- 7.1.4 Constantia Flexibles Group GmbH

- 7.1.5 Flair Flexible Packaging Corporation

- 7.1.6 Sealed Air Corporation (SEE)

- 7.1.7 Sonoco Products Company

- 7.1.8 Toyo Seikan Co. Ltd

- 7.1.9 Smurfit Kappa Group PLC

- 7.1.10 SIG Group AG

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS