PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549975

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549975

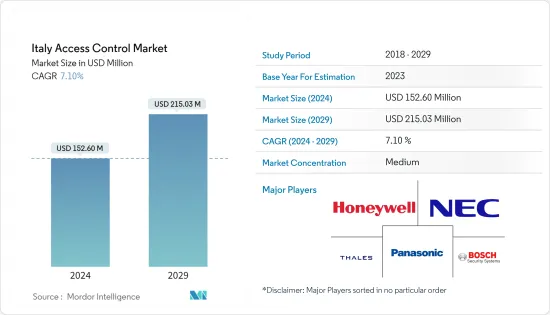

Italy Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Italy Access Control Market size is estimated at USD 152.60 million in 2024, and is expected to reach USD 215.03 million by 2029, growing at a CAGR of 7.10% during the forecast period (2024-2029).

Key Highlights

- Access control devices are components that are used in access control systems to enforce rules and regulations regarding the entry and exit of individuals. These devices play an important role in maintaining the security and integrity of a premises or system. Locks are fundamental devices in access control systems as they control the physical security of entrances.

- Card readers are devices that read access cards or key fobs to grant or deny access to individuals. These devices are often used in conjunction with authentication methods such as passwords or biometric analysis. Biometric devices use unique physical or behavioral characteristics, like facial recognition or fingerprints, to verify the identity of individuals and grant access.

- The Internet of Things (IoT) has increased the efficiency and standard of automation systems by enabling secure data exchange and tying smart objects to the Internet. Remote monitoring of key areas is made possible by cloud-based communication between connected security systems and devices. Additionally, the use of password authentication to thwart hacking makes IoT-based security systems secure. Because IoT can be used in a variety of solutions, such as smart alarm systems and smart garage door openers, it is replacing many businesses' traditional processes.

- Additionally, security systems that are cloud-based and mobile are becoming a superior choice. Mobile credentials provide a more convenient and secure alternative. Since people frequently carry their mobile phones with them wherever they go, access control devices have naturally developed for this market. Mobile access control also has remote functionality. For instance, after being alerted by an apartment intercom system, a tenant can grant access to a visitor from a mobile app on their phone.

- Cloud-based access control is intuitive to use and offers the most flexibility for administrators. Access credentials can easily be granted or revoked from any device or location. User authorization, access points, and data trends are centralized in a single, remotely accessible database.

- This is a significant advancement in the physical security industry as it eliminates the need for an on-site IT professional to manage the system. Another significant benefit that has helped fuel the growing popularity of cloud access control is scalability. Facility and property managers who manage security at multiple sites can easily manage their databases from one location. From protecting the perimeter to securing high-value assets, access control systems are a fundamental responsibility for organizational security departments.

- Several market players are collaborating with each other to enhance their market share. For instance, in May 2024, Ermessrl, one of the prominent players providing solutions for the identification and security of people, signed a distribution agreement with Zwipe, a pioneer in the development of biometric technology on cards for identification, access control, and payment. According to this partnership, Ermessrl agreed to distribute Zwipe's biometric access cards in Italy. ZwipeAccess utilizes advanced biometric capture and matching technology to securely store the cardholder's encrypted fingerprint template directly within the card's smart chip during issuance.

- However, the lack of awareness about security solutions and the high prices associated with access control devices can be significant restraints to the growth of the studied market. The cost of implementing access control systems, including hardware, software, and installation, can be a barrier for some organizations, especially smaller businesses or budget-constrained entities.

- Additionally, the complexity of integrating access control devices with existing systems can pose a challenge. Organizations may need help in seamlessly integrating access control devices with their current infrastructure, leading to delays or complications in implementation.

- Also, the conflict between Russia and Ukraine will significantly impact the semiconductor industry. The conflict has already exacerbated the electronics and semiconductor supply chain issues and chip shortages that have affected the industry for some time. The disruption may result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, and aluminum, resulting in material shortages. This, in turn, could impact the manufacturing of access control devices.

Italy Access Control Market Trends

The Biometric Readers Segment is Expected to Drive the Market's Growth

- Biometric Readers are devices that use physiological or behavioral data measurements to determine authorization for access. These may include facial recognition, fingerprint recognition, hand/finger geometry, vein geometry, iris recognition, retina scan, voice recognition, and signature dynamics. In the biometric access control system, biometric authentication refers to recognizing humans by their physical uniqueness. These remove the requirements of cards, fobs, keys, and key pins and use strict measuring procedures to make the authorization of a person's identity.

- The access control system not only facilitates entry but also provides the data related to the entry of visitors. Various software, such as attendance software, can be integrated with any existing payroll software to give an automatic record of information collected by the attendance system, saving time and resources in a recording. A standard biometric access control system is comprised of four main types of components: a sensor device, a quality assessment unit, a feature comparison and matching unit, and a database.

- There are biometric readers who are only focused on one type of biometric (face, fingerprint, and finger vein), and there are many who use multiple biometrics to confirm data. For example, fingerprint and finger vein biometrics are often embedded in the software, providing maximum security. Fingerprint biometrics are the most common mode of biometrics, but voice recognition and face recognition are now getting almost as accepted as fingerprints.

- Biometric readers find application in healthcare facilities to ensure secure access to patient records, medication storage areas, and restricted zones. By implementing biometric access control, hospitals and clinics can prevent unauthorized personnel from accessing confidential information and maintain the integrity of medical facilities.

- Biometric readers are vital in ensuring secure access to government buildings, public institutions, and airports. The increasing construction in Italy is anticipated to offer lucrative opportunities for the growth of the studied market. For instance, according to Eurostat, the revenue of construction in Italy is anticipated to amount to approximately USD 57.68 billion by 2025.

The Commercial Segment is Expected to Witness a Higher Growth Rate in the Market

- The commercial sector in Italy has embraced electronic locks access control devices to enhance security and streamline access management. These devices are commonly used in office buildings, coworking spaces, and retail establishments. Electronic locks allow for efficient access control by providing customizable access permissions to different individuals or groups. They also enable centralized control and monitoring of multiple access points, ensuring only authorized personnel can enter restricted areas.

- Card readers are widely used in corporate offices to manage employee access and ensure that only authorized individuals can enter restricted areas. These devices provide an efficient and convenient solution for controlling access to sensitive information and valuable assets. Further, access control devices can be seamlessly integrated with other security systems, such as video surveillance and alarm systems. This integration enhances the overall security infrastructure and provides a comprehensive solution for organizations, leading to increased demand for these devices.

- With the rising threat of theft, vandalism, and unauthorized access, there is an increasing demand for robust security systems in Italy. Card readers and access control devices offer an effective solution for enhancing security, thereby driving their adoption in various sectors.

- Physical security is gaining a lot more traction, where there are more thefts than ever. Rising security concerns at residential locations are likely to be the driving force behind the adoption of the homeland security system. The growing acceptance of smart infrastructure projects like those for smart homes, buildings, and cities will support the market's expansion even more.

- The increasing value of commercial real estate in Italy is likely to augment the demand for the studied market. For instance, according to the European Public Real Estate Association (EPRA), as of 2023, the value of commercial real estate in Italy was estimated at almost USD 941 billion, up from approximately USD 909 billion in 2022.

Italy Access Control Industry Overview

The Italian access control market is a moderately fragmented market with the presence of several prominent market players like Thales Group, Bosch Security System Inc., Honeywell International Inc., Schneider Electric SE, and Panasonic Corporation. Market players are striving to innovate new products by way of extensive investments in R&D, collaborations, and mergers to cater to the evolving demands of consumers.

- December 2023 - Honeywell announced its plans to improve and strengthen its building automation capabilities with the acquisition of Carrier Global Corporation's Global Access Solutions business for USD 4.95 billion in an all-cash transaction. The acquisition is anticipated to add three respected brands to Honeywell's portfolio, focusing on life safety and digital access solutions, including Onity, which offers electronic locks, including mobile credentials, hospitality access, and self-storage access.

- October 2023 - Thales, a prominent global technology and security provider, announced the SafeNet IDPrimeFIDO Bio Smart Card, a security key that facilitates strong multi-factor authentication for the enterprise. This new contactless smart card is claimed to allow users to quickly and securely access enterprise devices, applications, and cloud services utilizing a fingerprint instead of a password.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats

- 5.1.2 Technological Advancements

- 5.2 Market Challenges

- 5.2.1 Operational and ROI Concerns

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Access Control Solutions

- 6.2 Comparative Analysis of RFID and NFC Technology

- 6.3 Key Technological Trends

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Card Reader and Access Control Devices

- 7.1.1.1 Card-based

- 7.1.1.2 Proximity

- 7.1.1.3 Smart Card (Contact and Contactless)

- 7.1.2 Biometric Readers

- 7.1.3 Electronic Locks

- 7.1.4 Software

- 7.1.5 Other Types

- 7.1.1 Card Reader and Access Control Devices

- 7.2 By End-user Vertical

- 7.2.1 Commercial

- 7.2.2 Residential

- 7.2.3 Government

- 7.2.4 Industrial

- 7.2.5 Transport and Logistics

- 7.2.6 Healthcare

- 7.2.7 Military and Defense

- 7.2.8 Other End-user Verticals

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Thales Group (Gemalto NV)

- 8.1.2 Bosch Security System Inc.

- 8.1.3 Honeywell International Inc.

- 8.1.4 Tyco International PLC (Johnson Controls)

- 8.1.5 Allegion PLC

- 8.1.6 ASSA ABLOY AB Group

- 8.1.7 Schneider Electric SE

- 8.1.8 Panasonic Corporation

- 8.1.9 Brivo Systems LLC

- 8.1.10 NEC Corporation

- 8.1.11 Idemia Group

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKE