PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549929

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549929

France Video Surveillance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

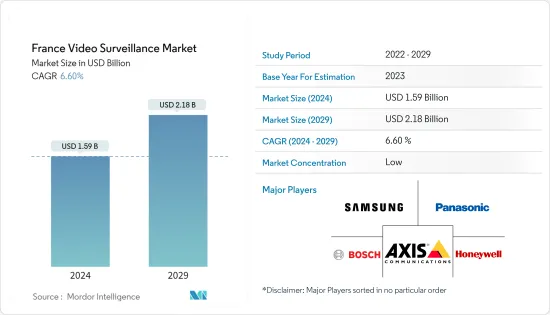

The France Video Surveillance Market size is estimated at USD 1.59 billion in 2024, and is expected to reach USD 2.18 billion by 2029, growing at a CAGR of 6.60% during the forecast period (2024-2029).

The landscape of public safety has been transformed by technological advancements in recent years, especially video monitoring. Once a mere tool for after-the-fact investigation, these systems are increasingly playing a proactive role in crime prevention and safety management. Initially, video cameras were installed as deterrents. However, their presence has become so normalized that their mere existence no longer deters criminal behavior as effectively. Moreover, in France, the market is significantly promoted by the rising importance of safety and security.

Given the rise in safety and security concerns, enterprises in all industry verticals and individuals are investing in video surveillance. For instance, the majority of rural communities are turning to CCTV and video surveillance technology in the form of aid to combat rising crime. This is because about 300 locations across the country have registered violence this summer, which was further followed by rioting in Paris after the shooting of a teenager by police. Notably, mayors in rural areas have also been getting targeted with verbal and physical abuse in recent years. In the first three months of 2023, about 900 acts of violence against elected officials were reported, as per a French English newspaper.

Thus, rural mayors in southeast France are the latest to adopt such technology, with plans underway for a centralized surveillance hub to monitor several locations simultaneously. For instance, the Alpes-Maritimes-based project utilized the existing systems at an administrative center near Nice, and their trained officers are required to continuously examine CCTV footage from various locations simultaneously. Moreover, the Cannes mayor, who is also president of the French mayors' association, and the Mayor of Grasse have both backed the plan. About 10 municipalities have already shown their interest in signing up to the project.

However, privacy concerns are arising among the population due to the rising incorporation of advanced technologies into the video surveillance market. For instance, France is reportedly experimenting with AI-driven video surveillance to be used during the Paris 2024 Olympics. The move followed the legislation passed in 2023, allowing AI video surveillance for a trial period during large-scale events. Videtics, Orange Business, ChapsVision, and Wintics developed AI software that uses algorithms to analyze real-time video streams from existing surveillance systems. However, France's surveillance plans for the 2024 Olympics are raising privacy concerns among people as proponents argue these systems will prevent terrorist attacks and privacy advocates warn of a "techno-securitarian drift" in France.

This is further supported by the government and judicial bodies of the country. For instance, the highest constitutional court in France issued a decision supporting the use of AI-powered surveillance cameras for the 2024 Paris Olympics despite privacy concerns. Such factors present the positive growth prospects of the French market.

France Video Surveillance Market Trends

Growing Crime Rates Showcasing Importance of Video Surveillance

- Following two years of significant decrease in crime rates during the COVID-19 pandemic, the recently released figures from the French Ministry of Interior revealed that nearly all misdemeanor crimes, in particular domestic violence and burglaries, increased across the country last year.

- Furthermore, the SSMSI stated that home burglaries, thefts without violence, and thefts of vehicles or vehicle accessories significantly increased markedly in 2022 after dropping precipitously during the COVID-19 pandemic. Specifically, home burglaries and vehicle thefts jumped by 11% and 9%, respectively, in comparison to the previous year. Despite the considerable uptick, the SSMSI further stated that these offenses remain "below their pre-crisis level, leaving the thefts of accessories from vehicles."

- Moreover, more than 300 locations across the country experienced violence in 2023 after rioting in Paris after the shooting of a teenager by police. In the first three months of 2023, about 900 acts of violence against elected officials, such as mayors, were reported in the country. Furthermore, mayors requested the government to help elected officials deal with the situation in Indre, in central France, where 95% of the 241 communes are rural.

- As a result, in recent years, the majority of rural communes have installed video protection systems after violent incidents. For instance, in June 2023, the Senate in France approved a controversial provision to a justice bill that would allow law enforcement to secretly activate cameras and microphones on a suspect's devices. This type of surveillance would be activated without notifying the owner of the device. The same provision would also allow agencies easier access to geolocation data to track suspected criminals.

The Hardware Segment Gaining Popularity

- With the rising urbanization, video surveillance cameras are a good investment in France as they reduce the risk of thefts and secure property, goods, people, and public spaces. This is further promoted by financial grants that are issued by regional authorities to contribute toward financing home and premises improvements, aiming to reinforce security. Both professionals and private individuals are eligible for the grants.

- For instance, created by the French State in 2007, the FIPD is the Interministerial Crime Prevention Fund (Donds Interministeriel de Prevention de la Delinquance in French). It helps municipalities and professionals acquire video surveillance equipment to ensure public safety in areas where crime and insecurity rates are high.

- Furthermore, since May 1, 2003, tobacconists have been able to claim a government grant of up to EUR 10,000 (~USD 10,718) to secure their business and stock. Distinctive security grants for tobacconists are rolled out by the DRDDI, which is the French Directorate-General of Customs and Indirect Taxes. These grants cover the implementation of an initial installation as well as the renewal of equipment when it becomes obsolete, also incorporating equipment maintenance with the aim of technical upgrades. Additionally, these grants are assigned for video surveillance equipment installed in specific areas.

- Since France is significantly famous for fashion shows and tourism owing to its beautiful infrastructure, the government always looks forward to securing it through various security means. For instance, in May 2024, a state-of-the-art security system using artificial intelligence was deployed at the Cannes Film Festival in a test for potential applications at the Paris Olympics two months later. Local authorities stated that 17 experimental cameras equipped with AI technology were used to identify events or behaviors deemed "suspicious" and to help detect abandoned packages, weapons, and people in distress.

France Video Surveillance Industry Overview

The French video surveillance market is fragmented, with major players such as Panasonic Corporation, Samsung, Honeywell, and Bosch. Partnerships, innovations, investments, and acquisitions are among the strategies used by market participants to improve their product offerings and gain a sustainable competitive advantage.

In March 2024, Hikvision announced a technology partnership with Can'nX, enabling Hikvision technologies to be integrated with the KNX protocol, which is the global standard for home and building automation. Owing to the collaboration, integrators can enhance their building automation solutions by integrating Hikvision AI-enabled devices, such as cameras, into building systems, surging the efficiency of building management and improving overall security.

In January 2024, Ajax Systems announced a strategic partnership with Serviacom. Serviacom will be providing its customers with innovative Ajax security and home automation solutions. This partnership is aimed at fortifying Ajax's presence in the French market by delivering top-tier products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmented Demand for IP Cameras

- 5.1.2 Emergence of Video Surveillance-as-a-Service

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Camera

- 6.1.1.1.1 Analog

- 6.1.1.1.2 IP Cameras

- 6.1.1.1.3 Hybrid

- 6.1.1.2 Storage

- 6.1.2 Software

- 6.1.2.1 Video Analytics

- 6.1.2.2 Video Management Software

- 6.1.3 Services (VSaaS)

- 6.1.1 Hardware

- 6.2 By End User Vertical

- 6.2.1 Commercial

- 6.2.2 Infrastructure

- 6.2.3 Institutional

- 6.2.4 Industrial

- 6.2.5 Defense

- 6.2.6 Residential

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Axis Communications AB

- 7.1.2 Bosch Security Systems Incorporated

- 7.1.3 Honeywell Security Group

- 7.1.4 Samsung Group

- 7.1.5 Panasonic Corporation

- 7.1.6 FLIR Systems Inc.

- 7.1.7 Schneider Electric SE

- 7.1.8 Fujifilm Corporation

- 7.1.9 Eagle Eye Networks

- 7.1.10 Johnson Controls

- 7.1.11 Dahua Technology India Pvt Ltd

- 7.1.12 D-Link India Limited

- 7.1.13 Veesion

- 7.1.14 Ava Security

- 7.1.15 Mobotix

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET