PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549928

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549928

United Kingdom AC Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

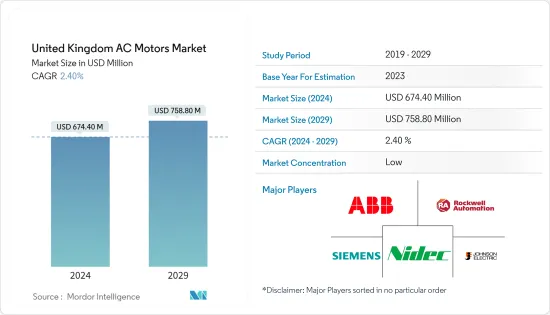

The United Kingdom AC Motors Market size is estimated at USD 674.40 million in 2024, and is expected to reach USD 758.80 million by 2029, growing at a CAGR of 2.40% during the forecast period (2024-2029).

Alternating current (AC) motors convert electrical energy to mechanical energy. They usually consist of a stator with a coil supplied with alternating current, which is then converted into mechanical power. AC motors can be single-phase or three-phase. Single-phase AC motors are primarily used for small power conversion, but three-phase motors are used for applications requiring more extensive power conversion.

The demand for AC motors is anticipated to increase in the United Kingdom due to several factors. For instance, since its exit from the European Union, the need to support the industrial sector's growth is imminent. As a result, the UK government has taken several initiatives to support the sector's growth, driving opportunities in the market studied as AC motors are widely used in industrial applications to drive industrial equipment/machinery.

The demand for AC motors in the United Kingdom is also anticipated to be driven by the growing proliferation of industrial automation and robotic solutions. Although the country lags in terms of industrial robot density compared to its European counterparts, such as Germany, Sweden, Switzerland, Slovenia, and Denmark, the recent shift in the outlook of the government and industrial enterprises toward advanced technologies is expected to create a favorable ecosystem for the market's growth.

AC motors are also widely used in several household appliances, including washing machines, water pumps, and drills. According to AMDEA, the UK's trade association for the manufacturers of domestic appliances, the share of household appliances is significant in the United Kingdom. In 2023, about 15 million large and 60 million small appliances were sold in the United Kingdom. Such trends are also anticipated to support the demand for AC motors in the United Kingdom over the coming years.

However, the higher initial cost involved, especially in AC motors used for industrial/commercial applications, remains a major challenge for the market's growth in the country. Furthermore, the energy efficiency of AC motors is another major factor influencing their adoption.

The COVID-19 pandemic significantly impacted the industrial sector's growth in the United Kingdom. Supply chain disruptions and demand fluctuation were among the prominent factors influencing the demand for AC motors during the pandemic, as industrial enterprises were reluctant to invest in new production facilities or plant expansion activities. However, several studies suggest the pandemic had a positive impact on consumer awareness about advanced manufacturing technologies such as automation and robotics, which is anticipated to support the market's growth in the long run by driving the adoption of advanced industrial technologies/machinery.

United Kingdom AC Motors Market Trends

Recent Initiatives to Revive the Industrial Sector in the UK to Support Market Growth

- The industrial sector is among the key pillars of the United Kingdom's economy. Although the industry has lagged recently due to several factors, it remains among the major contributors to the country's GDP. For instance, according to the House of Commons Library, from October to December 2023, about 9.3% of the UK's total economic output and about 8.1% of employment were attributed to the manufacturing sector.

- According to Make UK, the manufacturer's organization, the UK's manufacturing industry ranks 8th globally in terms of output value. In 2023, the country witnessed a significant jump in manufacturing output, reaching GBP 224 billion (~USD 284.5 billion). Similarly, according to the Office of National Statistics, in 2023, the gross value added (GVA) of the manufacturing sector in the United Kingdom reached GBP 199.79 billion (~USD 253.78 billion) compared to GBP 197.34 billion (~USD 250.67 billion) in 2022.

- Owing to the recent outbreak of COVID-19 and other macroeconomic factors, such as the economic instability the country has faced, the UK government has taken several initiatives to support the growth of its industrial sector. For instance, the government's Industrial Strategy aims to boost productivity by backing businesses throughout the country to create good jobs with investments in skills, industries, and infrastructure.

- In 2023, the UK government announced the National Semiconductor Strategy to enhance the country's prominence in semiconductor design, research, and advanced chip leadership. As part of the strategy, the government plans to invest up to GBP 1 billion (~USD 1.3 billion) in the next decade to improve access to infrastructure, support research and development, and facilitate higher international cooperation. Hence, such trends and developments are anticipated to drive opportunities in the market studied.

Discrete Industries to Hold a Significant Market Share

- Discrete industries, such as automotive, electronics, clothing, toys, and recreation, continue to hold a significant share in the manufacturing landscape of the United Kingdom. Over the years, these industries have transformed significantly, leading to a higher uptake of automation and robotics technologies, creating a favorable outlook for the market's growth as AC motors are widely used to drive industrial machinery, conveyors, robots, etc.

- For instance, the United Kingdom is among the major automotive markets globally, as the demand for automobiles is growing across different segments. The country is also among the major automobile producers across Europe. According to the Society of Motor Manufacturers and Traders (SMMT), automobile production in the United Kingdom stood at 1,025,474 units in 2023, with about 905,117 cars and 120,357 commercial vehicles produced during the year. According to SMMT, the production output was 17.0% higher than the previous year.

- Considering a stable demand, the country has several major automobile manufacturers, including Bentley, Aston Martin, Daimler, Jaguar, Lagonda, and Land Rover. According to the Office of National Statistics, the country has 2,380 VAT/PAYE-based enterprises in the automotive, trailers, and semi-trailers manufacturing industries in the 0-4 employment size band.

- Furthermore, the United Kingdom is also witnessing notable growth in the adoption of consumer electronics goods, especially smartphones. Several factors influence the demand for smartphones in the country, including the growing proliferation of digital technologies and the entry of several new vendors in the market, giving consumers a variety of options to choose from. Moreover, the arrival of 5G is also anticipated to influence the adoption rate of smartphones in the country, creating a favorable ecosystem for the market's growth.

United Kingdom AC Motors Industry Overview

The AC motor market in the United Kingdom has several vendors, enhancing the competitive index. Competition in the market is anticipated to continue growing as demand increases. Hence, the vendors operating in the market are adopting strategies such as new product development, partnerships, mergers, and acquisitions to strengthen their market presence further. Some key market players include ABB Ltd, Siemens AG, Johnson Electric International (UK) Ltd, Rockwell Automation, and Nidec Corporation.

- March 2024 - MOONS' Industries, a Shanghai-based company manufacturing an extensive range of motion control products, launched MOONS' Industries (UK). According to the company, the entity will be based in Reading, Berkshire. This move aims to further strengthen the company's presence in the European market.

- March 2024 - ABB Ltd unveiled its SP4 technology. According to the company, it achieves NEMA super premium efficiency even in AC induction motors operating without variable speed drives. Furthermore, the SP4 solution has been developed by the company to cater to the growing demand for more sustainable and efficient AC motors across different industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent Initiatives to Revive the Industrial Sector in the UK

- 5.1.2 Growing Demand for Household Appliances

- 5.2 Market Restraints

- 5.2.1 High Initiatial and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Induction AC Motor

- 6.1.1.1 Single Phase

- 6.1.1.2 Poly Phase

- 6.1.2 Synchronous AC Motor

- 6.1.2.1 DC Excited Rotor

- 6.1.2.2 Permanent Magnet

- 6.1.2.3 Hysteresis Motor

- 6.1.2.4 Reluctance Motor

- 6.1.1 Induction AC Motor

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Metal & Mining

- 6.2.6 Food & Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Siemens AG

- 7.1.3 Johnson Electric International (UK) Ltd

- 7.1.4 Regal Rexnord Corporation

- 7.1.5 Nidec Corporation

- 7.1.6 Toshiba Mitsubishi-Electric Industrial Systems Corporation

- 7.1.7 TEC Electric Motors Ltd

- 7.1.8 Rockwell Automation

- 7.1.9 TECO Electric Europe Ltd

- 7.1.10 TTE UK & Ireland Ltd

- 7.1.11 Mellor Electrics Ltd

- 7.1.12 WEG Electric Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET