PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549921

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549921

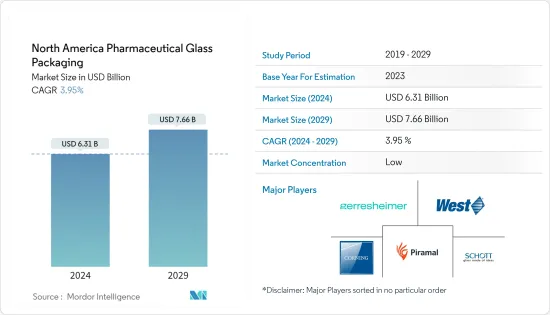

North America Pharmaceutical Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Pharmaceutical Glass Packaging Market size is estimated at USD 6.31 billion in 2024, and is expected to reach USD 7.66 billion by 2029, growing at a CAGR of 3.95% during the forecast period (2024-2029).

The United States is one of the major packaging markets globally, and many vital players produce glass containers for pharmaceuticals. As the economy continuously grows, increasing consumer spending on healthcare and medicines drives the demand for glass packaging solutions.

Key Highlights

- The rise in the usage of glass for pharmaceutical packaging is attributed to the advent of strict legislation designed to improve the integrity and quality of pharmaceuticals produced domestically. The pharmaceutical industry's growing need for sterile medical packaging products is anticipated to fuel the market's expansion during the forecast period.

- The United States is a dominant force in the pharmaceutical market in both consumption and development. STAT, a health-focused media outlet, projected that by 2023, the nation's spending on prescription drugs would reach USD 600 billion, a significant increase from the estimated USD 500 billion in 2019. This surge in spending is poised to bolster the demand for pharmaceutical glass packaging within the United States.

- Amid rising concerns over costly pharmaceutical imports, the US government authorized a pilot project allowing wholesalers and pharmacists to import FDA-approved medicines from Canada. This move is poised to escalate the demand for glass pharmaceutical packaging in Canada shortly.

- Moreover, the surging need for sterile medical packaging, particularly from the pharmaceutical sector, is set to bolster the market's growth during the forecast period. According to the projections from StatCan, in 2024, the revenue from Canada's pharmaceutical and medicine manufacturing industry is expected to reach USD 9.94 billion.

- However, pharmaceutical glass packaging is increasingly substituted by plastic due to benefits like low cost and lightweight, which help in transportation and negate chances of accidental breakages. The need to minimize tertiary packaging of pharmaceutical products by reducing manufacturing costs is challenging the market's growth.

North America Pharmaceutical Glass Packaging Market Trends

The United States is Anticipated to have a Significant Share During the Forecast Period

- The United States is a critical player in the global pharmaceutical market, boasting a robust cadre of manufacturers specializing in glass containers for pharmaceuticals. With the economy's steady growth trajectory, heightened consumer healthcare spending propels the demand for advanced glass packaging solutions.

- Moreover, the US pharmaceutical sector has witnessed significant expansion in recent decades, primarily fueled by a heightened focus on research and development. Pharmaceutical firms channel over 21% of their revenues into R&D efforts, a figure the Pharmaceutical Research and Manufacturers of America (PhRMA) underscored. This commitment, however, comes with risks, as a failure to secure regulatory approval for a drug can result in substantial financial setbacks.

- According to a report published by UNICEF in May 2023, UNICEF distributes more than 2 billion vaccines every year to help keep children safe from diseases like measles, pneumonia, and poliomyelitis. This includes estimating and pooling vaccine needs from countries it supports to obtain adequate commercial terms from vaccine manufacturers that those countries could achieve independently. Such continued initiatives would bolster the demand for glass vials and ampules across the market in the upcoming period.

- The pharmaceutical industry is witnessing a surge in demand for oncology drugs, high-potency medications (like antibody conjugates and fast-acting steroids), and injectables. For instance, Bormioli Pharma, a leading global player in pharmaceutical glass packaging, saw a remarkable 40% Y-o-Y growth in its top-line revenue, primarily driven by solid sales in North America. This growth was further fueled by the company's significant investments and expansions in glass packaging, particularly for injectable drugs. In a notable move, marking its 200th anniversary in 2023, Bormioli Pharma unveiled its aim to incorporate 50% sustainable raw materials in its pharmaceutical packaging by 2025.

- According to the US Census Bureau, glass and glass product manufacturing has been witnessing growth over the last few years. In 2024, it is expected to be valued at USD 705.83 million, an increase from USD 565.06 million in 2014. Such an increase in glass production would further leverage the pharmaceutical glass packaging in the country during the forecast period.

The Glass Bottle Segment is Anticipated to Hold a Significant Share in the Market

- Glass packaging is widely utilized across the United States, with seven of the ten most popular drugs for sale in the country being packaged in glass bottles or syringes, as reported by PharmaceuticalTechnology. Other drugs packaged in glass include Avastin (20 to 50 cc), Opdivo (20 to 50 cc), Herceptin (50 cc), Keytruda (50 cc), and Humira (50 cc). Syringes are also commonly used for the majority of drugs.

- Corning Incorporated was recently awarded a government contract of USD 204 million to commence the construction of an industrial furnace at a temperature of 2,000 °F in New Jersey. The furnace will transform molten glass into a medical-grade tube, which will then be packaged and packaged into vials, each containing a vaccine. During the COVID-19 pandemic, the industry settled on a 10-milliliter vial containing between eight and fifteen vaccine doses as the industry standard.

- In addition, consumers, legislators, customers, and the media have been continuously focusing on the environmental characteristics of packaging, and glass is the primary choice, which is also expected to fuel the growth of glass packaging in the United States. According to a study conducted by IBM and the National Retail Federation, nearly 70% of consumers in the United States and Canada consider it important that a brand is sustainable or eco-friendly.

- Moreover, in the pharmaceutical packaging market, glass bottles are anticipated to occupy a significant share by volume, driven by the increasing number of applications in solid and liquid oral medications, as the containers provide convenience, safety, and security.

- The increasing demand for sterile medical packaging products from pharmaceutical industries would further drive the growth of the studied market during the forecast period. According to StatCan, in 2024, the pharmaceutical and medicine manufacturing industry revenue is expected to reach USD 9.94 billion.

North America Pharmaceutical Glass Packaging Industry Overview

The North American pharmaceutical glass packaging market is fragmented due to the presence of various players such as Schott AG, Corning Incorporated, Gerresheimer AG, PGP Glass USA Inc., and West Pharmaceutical Services Inc. Market players are finding new ways, such as strategic partnerships or collaborations, to innovate the development of glass packaging in the region, fostering growth.

- May 2024 - West Pharmaceuticals Services Inc., a prominent player in injectable drug administration based in the United States, inaugurated a new facility in Seoul, South Korea. This expansion also saw an increase in their warehouse capacity. The upgraded office, strategically located in Seoul's commercial hub, positions West to engage more closely with its current and prospective clients. The facility boasts a specialized training area to host various events, from customer training and seminars to technical exchanges. These sessions will focus on pivotal topics, including the ever-evolving global regulatory landscape, with a keen eye on drug safety and packaging.

- March 2024 - SCHOTT AG, one of the leading providers of pharmaceutical containment solutions, is set to establish its inaugural facility in the United States. The site will be able to manufacture glass pre-fillable syringes, catering to treatments like GLP-1 therapies, which combat ailments such as diabetes and obesity. Additionally, the facility will focus on producing pre-fillable polymer syringes, which are crucial for storing and transporting mRNA drugs that require deep-cold conditions. The venture commands a substantial investment of USD 371 million, with groundbreaking slated for late 2024 and operations expected to commence in 2027.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advent of Strict Legislation Designed to Improve Integrity and Quality is Expected to Fuel the Demand for Glass Packaging

- 5.1.2 Increasing Demand for Sterile Medical Packaging

- 5.2 Market Restraints

- 5.2.1 Availability of Substitute Products

6 MARKET SEGMENTATION

- 6.1 By Product Types

- 6.1.1 Bottles

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Cartridges and Syringes

- 6.1.5 Other Products

- 6.2 By Country

- 6.2.1 United States

- 6.2.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schott AG

- 7.1.2 Corning Incorporated

- 7.1.3 PGP Glass USA Inc.

- 7.1.4 West Pharmaceutical Services Inc.

- 7.1.5 Gerresheimer AG

- 7.1.6 Bormioli Pharma SpA

- 7.1.7 Berlin Packaging

- 7.1.8 Stoelzle Glass Group

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET