PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549913

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549913

India Video Surveillance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

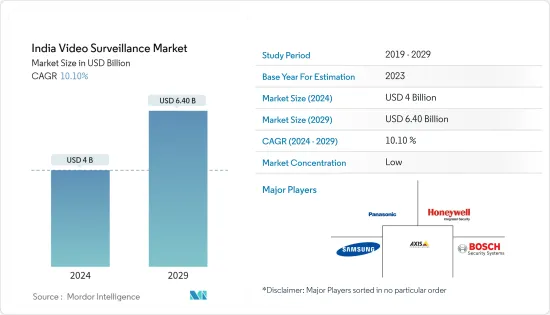

The India Video Surveillance Market size is estimated at USD 4 billion in 2024, and is expected to reach USD 6.40 billion by 2029, growing at a CAGR of 10.10% during the forecast period (2024-2029).

Key Highlights

- After independence, India inherited historical territorial conflicts with the disputes that would lead to devastating terror attacks. To counter such terror strikes, India emanated expansion and modernization of its security forces as well as police organizations, which also included the integration of technologies such as video surveillance. Similarly, crimes can come from internal sources in many other nations, including citizens or visitors. Therefore, the video surveillance market is additionally driven by the need to provide a safer environment in cities and urban areas.

- As per The Wire, several Indian cities, including Delhi, Chennai, and Hyderabad, are among the world's most surveilled cities. Notably, almost 91.1% of CCTV cameras installed in the country are present only in these four cities. Incidentally, Indian cities with high surveillance also have higher crime indices. For instance, the NCRB data indicated a 9% increase in crimes against the elderly registered in the country in 2022 compared to 2021.

- Surveillance through CCTV coverage has often been regarded as an important medium to reduce and monitor crime in urban spaces. On the contrary, according to the more recent coverage of the 2021 Forbes report, even the most surveilled cities in the country may still be among the least safe, such as Hyderabad's crime index standing at 42.9, implies that CCTV surveillance does not largely affect the rate of crime in a locality. It is essential to understand the perception of safety that the installation of CCTV cameras facilitates in effectively addressing the threat of mass surveillance inherent under CCTV coverage and countering any misconceptions that arise.

- Moreover, CCTV and IP video surveillance are quickly evolving the norm in public spaces as emerging video surveillance tools permit greater networking of cameras, cheaper access, greater fields of vision, and come with a host of tools such as tracking, facial recognition, and vehicle tracking.

- However, the unregulated usage of CCTV leads to the movement of public data and citizens' activities, which can be subject to interference and gross misuse. As mentioned, CCTV surveillance in public spaces can be utilized to identify and target protestors who can suppress collective action and political dissent. Consequently, any number of dissenters can also violate the constitutional right to freedom of speech and expression and the right to protest.

- There is still a huge demand for safe city projects in India to ensure public safety, thus driving the demand for video surveillance. With the successful deployment of surveillance and smart city projects in several Indian cities, more areas are expected to adopt similar video surveillance systems with central control rooms equipped with high-end large video wall solutions to monitor minute details. Emerging technologies in video analytics, biometrics, face recognition, and CCTV are becoming equally important for city surveillance monitoring and analysis, and these requirements provide huge opportunities for US companies.

India Video Surveillance Market Trends

Rising Smart City Initiatives is Driving the Demand for Video Surveillance

- In the last decade, the rate of urbanization in India has increased by 4%. This rapid urbanization process emphasizes the need to build smart cities. The smart city mission, inaugurated on June 25, 2015, had been a collaborative initiative involving the Ministry of Housing and Urban Affairs and all state and union territory governments. Under the project, a hundred cities and towns across various states and UTs have been chosen. The mission aims to propel cities by enhancing infrastructure, promoting a clean and environment-friendly atmosphere, and ensuring a quality life for their residents.

- Consequently, ensuring security has emerged as a vital necessity, thus leading to the growing deployment of video surveillance systems in the form of vital necessity. For instance, in January 2024, Uttar Pradesh announced the implementation of a network of 100,000 Closed-Circuit Television (CCTV) cameras under the Smart City Mission, which was an initiative that the Urban Development Department spearheaded in partnership with the Home Department, focuses largely on the safety of women, children, and the elderly.

- Also, in February 2024, Lucknow Smart City went under artificial intelligence-enabled camera surveillance for the safety of citizens. A total of 1,000 AI cameras equipped with face recognition technology have been installed across the city.

- The major reason behind the huge incorporation of surveillance cameras in the country is the associated benefits. For instance, high-tech surveillance cameras provide critical insights into the daily operations of a city, which can be used to improve infrastructure planning. For example, data on pedestrian traffic can inform the construction of sidewalks or pedestrian bridges.

- Surveillance cameras can also monitor the usage of public amenities, aiding in effective resource allocation. By providing a bird's-eye view of city operations, these cameras create a data-driven, efficient, and user-centric urban environment. Thus, the rising smart city initiatives have been driving the growth of the market.

The Hardware Segment is Gaining Popularity

- The CCTV, video surveillance, and security industry is growing phenomenally. It is being tipped as the fastest-growing sector in the security segment owing to unprecedented demand for security solutions. This surge in demand is not just a fleeting trend; projections show a sustained upward trajectory for the industry.

- For instance, in recent years, Forbes India released a report that claimed Delhi to be the most highly surveilled city in the world. Further, the 2023 Status of Policing in India Report ("2023 Report"), which was the first of its kind report that surveyed public opinions on digital surveillance in India, stated that about 51% of respondents reported that their residential or household colony has CCTV coverage, with the significant proportion of respondents reporting CCTV coverage in residential areas from the states of Haryana (67%), Karnataka (68%), and Andhra Pradesh (65%); Maharashtra reported 33% of CCTV coverage in residential areas. Moreover, CCTV coverage surged with rising income levels - high-income areas reported at 73% across India, with middle-income reported to be 63%, low-income reported 45%, and coverage in slums is just 28%.

- Also, the Indian government has rolled out several incentives and supportive policies for the CCTV manufacturing sector. This regulatory environment is pivotal in nurturing an ecosystem conducive to growth and innovation.

- For instance, in February 2023, the Department of School Education (DSE) authorized the school management committee (SMC) in every government school across the state to spend up to INR 1.50 lakh out of the Consolidated Children Welfare Fund (CCWF) for the installation of close circuit television (CCTV) cameras.

- Moreover, the Make in India initiative, launched with much fanfare, has catalyzed various industries, including the burgeoning CCTV sector. This initiative aims to transform India into a global manufacturing hub, and the CCTV industry is an integral part of this vision. All these factors will likely add new growth opportunities to the hardware segment of the market.

India Video Surveillance Industry Overview

The Indian video surveillance market is highly fragmented, with major players such as Panasonic Corporation, Samsung, Honeywell, and Bosch. Partnerships, innovations, investments, and acquisitions are among the strategies used by market participants to improve their product offerings and gain a sustainable competitive advantage.

January 2024 - Johnson Controls India introduced state-of-the-art domestic security cameras, emphasizing their commitment to the Make in India initiative. With over 75% of local components, the Illustra Standard Gen3 cameras showcase dedication to self-reliance and solidify Johnson Controls' role as a key player in global manufacturing.

December 2023 - Prama India unveiled its latest range of indigenously manufactured Ranginview Camera series and bespoke Video Security Products at the IFSEC India Security Expo 2023. The latest products embedded with cutting-edge technologies, such as artificial intelligence (AI) and IoT security technologies and applications, were displayed at the PRAMA booth. The PRAMA booth at the IFSEC India displayed a wide range of indigenously manufactured products and innovative solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmented Demand of IP Cameras

- 5.1.2 Emergence of Video Surveillance-as-a-Service

- 5.1.3 Increasing Demand for Video Analytics

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Camera

- 6.1.1.1.1 Analog

- 6.1.1.1.2 IP Cameras

- 6.1.1.1.3 Hybrid

- 6.1.1.2 Storage

- 6.1.2 Software

- 6.1.2.1 Video Analytics

- 6.1.2.2 Video Management Software

- 6.1.3 Services (VSaaS)

- 6.1.1 Hardware

- 6.2 By End-user Vertical

- 6.2.1 Commercial

- 6.2.2 Infrastructure

- 6.2.3 Institutional

- 6.2.4 Industrial

- 6.2.5 Defense

- 6.2.6 Residential

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Axis Communications AB

- 7.1.2 Bosch Security Systems Incorporated

- 7.1.3 Honeywell Security Group

- 7.1.4 Samsung Group

- 7.1.5 Panasonic Corporation

- 7.1.6 FLIR Systems Inc.

- 7.1.7 Schneider Electric SE

- 7.1.8 Aditya Infotech Ltd

- 7.1.9 Videocon Industries Ltd

- 7.1.10 Zicom Electronic Security Systems

- 7.1.11 Dahua Technology India Pvt. Ltd

- 7.1.12 D-Link India Limited

- 7.1.13 Godrej Security Solution

- 7.1.14 Digitals India Security Products Pvt. Ltd

- 7.1.15 Total Surveillance Solutions Pvt. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET