PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549910

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549910

Europe Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

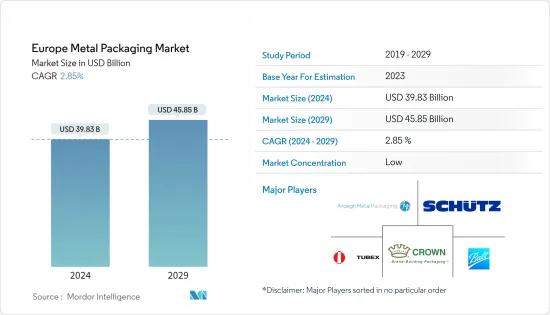

The Europe Metal Packaging Market size is estimated at USD 39.83 billion in 2024, and is expected to reach USD 45.85 billion by 2029, growing at a CAGR of 2.85% during the forecast period (2024-2029).

Metal packaging has been considered the best fit for a circular economy that attracts consumers as well as product manufacturers. Metal packaging solutions have applications in all fields, including retail, wholesale, industrial, and commercial. With a proven sustainability and safety record, metal packaging solutions are considered a smart solution for brand owners and fillers.

The recyclability benefit offered by metal packaging contributes to market growth as the properties of the material do not change even after multiple recycling attempts. This gives metal packaging a competitive advantage over other packaging materials. Metal packaging is the most recycled packaging in Europe. It has the highest recycling rate in European countries, according to Metal Packaging Europe, with aluminum cans accounting for around 75% and steel packaging around 83%.

According to Metal Packaging Europe, every European citizen consumes around 4 units of metal packaging solution weekly. The use of advanced technology, along with innovation, results in new product launches, providing market growth in the region.

The increase in the trade of bulk materials such as paints and varnishes drives the demand for metal packaging solutions, including shipping barrels and drums and bulk containers. The use of advanced technologies, such as QR codes, for tracing the drums or containers containing chemical and other hazardous products is significantly helping metal packaging manufacturers to stay ahead of the competition. For instance, Duttenhofer, a German head-tight drum specialist, introduced traceability for drums containing chemicals by investing in integrated technology over the past couple of years. The QR code is printed on a label applied to the drum, containing information about the drum manufacturer, serial number, and others.

The ability of metal packaging to adhere to different technologies makes it popular among brand owners who are looking for appealing packaging products. Digital printing, embossing, and debossing technologies are used to create a visual appeal of the metal. The eye-catching metal packaging solutions help the brand gain an advantage in retail display packaging, gaining consumer attraction in the store.

Moreover, the fluctuating prices of steel and aluminum may create an obstacle for metal packaging manufacturers as this results in the increased prices of the final product. The high investment cost of setting up the metal packaging line may create a growth barrier for small and medium-scale packaging manufacturers.

Europe Metal Packaging Market Trends

Increased Wine Consumption in European Countries is Expected to Drive the Sales of Metal Closures

- Flavor and aroma are the major aspects focused upon in the wine industry. The urge to preserve the freshness and quality of wine for a longer period is the major factor driving the sales of metal closures for wine bottles. Metal closures create a highly effective barrier that helps prevent the content from contamination and moisture. Also, the cost-effective and recyclability benefit offered by metal closures makes it an ideal choice for wine bottles. As per the study provided by Aluminium Closures Group (part of AMS Europe eV), four out of ten aluminum closures consumed in Europe are recycled.

- The winemakers and packers focus on the environmental impact, starting from the vineyard to the recycling process after use, giving the metal closure manufacturers a competitive advantage. Aluminum closures have a low environmental impact compared to other closure types. According to the Life Cycle Assessment (LCA), aluminum closures have better environmental performance and reduce the instances of bottled wine wastage due to corkage by 2% to 5%. Also, the aluminum closures are manufactured in bulk, which adds to the cost-benefit. The aluminum closures are made across the world and are a part of the local value chain. This helps in immediate reaction to the end-use industry needs as it can be transported economically.

- The availability of different types of metal closures helps to address the sealing concern for different types of wine. The screw caps are the most common metal closures used for sealing wine bottles due to the ease of use and the ability to preserve the quality of wine. Screw caps help in preventing the oxygen from entering the bottle as well as provide airtight sealing to it. In addition to this, it is also easy to open and reseal the bottle using a screw cap, which makes it a convenient choice for consumers. The crown caps are specially used for sparkling wines to provide a secure seal to the product.

- The innovations by metal closure manufacturers are gaining traction among winemakers and wine packers. For instance, Guala Closures Group offers NeSTGATETM, a range of connected closures for the wine market. The closure is equipped with a single-chip NFC, which will help detect unauthorized openings of the product. The company continues its commitment to supporting spirit and wine producers by adapting technological innovation.

- During the COVID-19 pandemic, wine consumption decreased due to the closure of bars and restaurants. However, the share of aluminum closures for wine in Europe increased by 2% as the retail sales of wine remained stable. Besides this, the European Union has initiated destroying the wine surplus in France, which may hamper the growth of metal closures used for wine packaging.

- Wine consumption and production in the European countries is high compared to other countries. Europe accounted for around 61% of the wine production in the world for the year 2023, according to the report presented by the International Organization of Vine and Wine. Wine production is high in France, followed by Italy, Spain, Germany, Portugal, and other European Countries. Therefore, the increased wine production and consumption in the region is expected to surge the demand for metal closures.

Increasing Cosmetic SMEs in the United Kingdom to Push the Demand for Metal Packaging

- The rising demand for aerosol dispensers in the cosmetic industry in the United Kingdom reflects the rise in demand for metal packaging. The aerosol containers used in the cosmetic and personal care industry are mostly made from steel and aluminum. The deodorants and sprays are packed in aerosol containers for ease of dispense.

- The aerosol containers are hermetically sealed, reducing the chances of leakage, which is a major concern for Gen Z, who are the major consumers of cosmetics and personal care products. The product can be easily applied to any large or small area using aerosol dispensers, which makes it an ideal choice for various cosmetics and personal care products. Also, the application of aerosol dispensers, such as sunscreen application, is increasing in the industry.

- The United Kingdom is the fourth-largest cosmetic and personal care market in the European countries, followed by Germany, France, and Italy. Besides this, the number of cosmetics and personal care SMEs is rising in the United Kingdom. The United Kingdom ranks first in terms of the number of cosmetics and personal care SMEs, followed by France, Poland, and Italy, according to data from the Cosmetic, Toiletry and Perfumery Association (CTPA). This is expected to aid the growth of the metal packaging market for the cosmetic and personal care industry.

- With the rising number of cosmetic and personal care SMEs, aerosol production in the United Kingdom is also high. Recently, the United Kingdom accounted for around 27% of the total aerosol production in Europe, which is 1,436 million units (Source - FEA). Cosmetics and personal care are the major end-use applications for aerosol containers, representing around 55% of European aerosol production. The availability of raw materials in the country provides added benefits to metal packaging manufacturers, resulting in reduced costs for imported materials.

- The introduction of the Plastic Packaging Tax in the United Kingdom may create growth opportunities for recyclable metal packaging solutions. Also, cosmetics brands that are focusing on achieving sustainability targets will focus more on recyclable and harmless materials for product packaging. This may push the sales of metal packaging in the cosmetic and personal care industry in the United Kingdom.

Europe Metal Packaging Industry Overview

The European metal packaging market is fragmented with the presence of various global and local players in the market, including Ardagh Metal Packaging SA (Ardagh Group), Ball Corporation, Crown Holdings Inc., TUBEX Packaging GmbH, Schutz GmbH & Co. KGaA, and Silgan Holdings Inc. The key players in the market are trying to focus on gaining a competitive advantage using advanced print and design technologies for metal packaging products such as cans. Also, the players are adopting an acquisition strategy to increase their presence and customer base with the rising demand for metal packaging among end-user brands and environmentally conscious customers.

In February 2024, Ardagh Metal Packaging SA announced its collaboration with Britvic Soft Drinks to launch the high-end innovative can design for the new Tango Mango product. The high-end, eye-catching design of the can may help the brand gain customers' attention.

In October 2023, Crown Holdings Inc. announced the acquisition of a beverage can and end manufacturing facility of Helvetia Packaging AG, located in Germany. The acquisition was aimed at expanding the company's European beverage can platform to Germany, with an annual can capacity of approximately one billion units. This acquisition was expected to help the company meet the increasing preference for beverage cans among local and regional customers for alcoholic and non-alcoholic drinks segments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Geopolitical Scenario on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Wine Production and Consumption in European Countries is Expected to Drive the Sales of Metal Closures

- 5.1.2 Increasing Cosmetic SMEs in the United Kingdom to Push the Demand for Metal Packaging

- 5.2 Market Restraints

- 5.2.1 The High Investment Cost of Setting up the Metal Packaging Line May Create a Barrier for Small and Medium-scale Packaging Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminium

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.1.1 Food Cans

- 6.2.1.2 Beverage Cans

- 6.2.1.3 Aerosol Cans

- 6.2.2 Bulk Containers

- 6.2.3 Shipping Barrels and Drums

- 6.2.4 Caps and Closures

- 6.2.5 Other Product Type (Tubes, etc.)

- 6.2.1 Cans

- 6.3 By End-user Industry

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Cosmetics and Personal Care

- 6.3.4 Household

- 6.3.5 Paints and Varnishes

- 6.3.6 Other End-user Industries (Automotive and Industrial)

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Spain

- 6.4.5 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ardagh Metal Packaging SA (Ardagh Group)

- 7.1.2 Ball Corporation

- 7.1.3 Crown Holdings Inc.

- 7.1.4 CANPACK SA (CANPACK Group)

- 7.1.5 Silgan Holdings Inc.

- 7.1.6 Greif Inc.

- 7.1.7 TUBEX Packaging GmbH

- 7.1.8 Mauser Packaging Solutions

- 7.1.9 Colep Packaging (RAR Group Company)

- 7.1.10 Schutz GmbH & Co. KGaA

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET