PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549908

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549908

Asia-Pacific Data Center Physical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

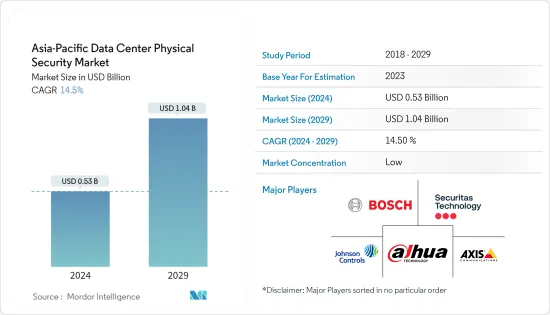

The Asia-Pacific Data Center Physical Security Market size is estimated at USD 0.53 billion in 2024, and is expected to reach USD 1.04 billion by 2029, growing at a CAGR of 14.5% during the forecast period (2024-2029).

Data center security employs a four-layered approach: perimeter security, facility controls, computer room controls, and cabinet controls. The first layer, perimeter security, focuses on deterring and detecting unauthorized personnel, aiming to delay potential breaches. Should a breach occur, the second layer, which employs access control systems like card swipes or biometrics, restricts further access. The third layer enhances physical security with various verification methods, including monitoring restricted areas, turnstiles, VCA, biometric access controls for fingerprints, irises, or vascular patterns, and radio frequency identification. While these layers primarily focus on authorized personnel, an additional layer, cabinet locking mechanisms, addresses concerns of insider threats, such as malicious employees.

Key Highlights

- The upcoming IT load capacity of the Asia-Pacific data center construction market is expected to reach 23K MW by 2029.

- The region's construction of raised floor area is expected to increase 74.5 million sq. ft by 2029.

- The region's total number of racks to be installed is expected to reach 4.2 million units by 2029. India is expected to house the maximum number of racks by 2029.

- There are close to 160 submarine cable systems connecting Asia-Pacific, and many are under construction. One such submarine cable estimated to start service in 2024 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 kilometers with a landing point in China, Taiwan, Japan, South Korea, Thailand, and Vietnam.

Asia-Pacific Data Center Physical Security Market Trends

The IT & Telecom Segment is Expected to Hold Significant Share

- In Asia-Pacific, the hyper-connectivity environment has reinforced the importance of telcos, which play a foundational role in supporting consumers' and enterprises' connectivity and collaboration needs. Across Asia-Pacific, 75% of the operators registered positive revenue growth. South Korea is second only to Hong Kong in the world rankings of telecom market maturity.

- South Korea is on the leading edge of the latest telecom technology developments, including around 6G. In terms of investment, in November 2022, Malaysian telcos Celcom and DiGi approved the merger agreement. Once the two companies are fully merged, the new entity will be one of the largest carriers in Malaysia, with over 20 million subscribers.

- Australia has deployed 5G in major cities and is in the process of auctioning off the spectrum to provide more services. In April 2021, the government allocated a high band 5G spectrum (in the 26 GHz band), which will enable extremely fast, high-capacity services. In the second half of 2021, the government allocated a low band 5G spectrum (in the 850/900 MHz band), which will be crucial for ensuring broader geographic coverage of 5G services. This will enable new applications for 5G in the enterprise market leading to major increase in data traffic and data center demand. This will lead to major physical security demand.

- The advent of 5G in Asia-Pacific has accelerated small-cell deployment for high-speed network connectivity. Many nations have created exemption standards that can be applied when deploying new small cells. For instance, in Singapore, The Infocomm Media Development Authority (IMDA) has directed the building developers and owners to provide rooftop spaces free of charge for telecommunication equipment the telecom providers.

- The Chinese government is focusing on improving the data center physical security solutions to meet the market demand. The Chinese government plans to build eight computing hubs and 10 data center clusters to build a unified data center system by 2025. The project aims to channel the growing demand from the east to the data centers in the western region of the country.

China is Expected to Hold Significant Growth

- The Chinese government is focusing on improving the data center physical security solutions to meet the market demand. The Chinese government plans to build eight computing hubs and 10 data center clusters to build a unified data center system by 2025. The project aims to channel the growing demand from the east to the data centers in the western region of the country.

- Many businesses are constantly investing in data center expansion, which will create market opportunities in data center applications. GLP Pte, for example, raised USD 500 million in new funds in February 2022 to help expand its data center platform in China amid rising investor demand for digital infrastructure assets. According to the company, the transaction could value China data centers between USD 4 billion and USD 5 billion. Such investments will propel the market forward.

- Cloud computing provides web-based infrastructure, wherein services such as additional computing and information storage are delivered to the clients. The cloud infrastructure is comparatively cheaper than the traditional system, wherein sizeable server farms and storage systems are allocated in a data center. Such factor relates with major construction in cloud data center catering to major physical security solutions demand.

- Chinese government is stridden into fifth-generation mobile telecommunications technology and the thriving e-commerce sector leveraging the potential of internet data centers, thereby enabling IDCs viable investments for the industry stakeholders. Further, the trend is supported by the emergence of powerhouses such as Tencent Holdings and Huawei Technologies, whose growth drives the construction of IDC facilities in the region leading to major demand for video surveillance and access control solutions.

Asia-Pacific Data Center Physical Security Industry Overview

The Asia-Pacific data center physical security market is highly fragmented due to players like Axis Communications AB, ABB Ltd, and Bosch Sicherheitssysteme GmbH, which play a vital role in upscaling the capabilities of enterprises. Market orientation leads to a highly competitive environment. These major players with a prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

April 2023: Schneider Electric launched of new services offer, EcoCare for Modular Data Centers services membership. Members of this innovative service plan benefit from specialized expertise to maximize modular data centers' uptime with 24/7 proactive remote monitoring and condition-based maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators

- 4.2.2 Advancements in Video Surveillance Systems Connected to Cloud Systems

- 4.3 Market Restraints

- 4.3.1 Operational and Return On Investment Concerns

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Solution Type

- 5.1.1 Video Surveillance

- 5.1.2 Access Control Solutions

- 5.1.3 Other Solution Types (Mantraps, Fences, and Monitoring Solutions)

- 5.2 By Service Type

- 5.2.1 Consulting Services

- 5.2.2 Professional Services

- 5.2.3 Other Service Types (System Integration Services)

- 5.3 End User

- 5.3.1 IT & Telecommunication

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Country

- 5.4.1 Indonesia

- 5.4.2 India

- 5.4.3 China

- 5.4.4 Australia

- 5.4.5 South Korea

- 5.4.6 Philippines

- 5.4.7 Thailand

- 5.4.8 Singapore

- 5.4.9 New Zealand

- 5.4.10 Japan

- 5.4.11 Malaysia

- 5.4.12 Vietnam

- 5.4.13 Hong Kong

- 5.4.14 Taiwan

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Axis Communications AB

- 6.1.2 Zhejiang Dahua Technology Co. Ltd

- 6.1.3 Securitas Technology

- 6.1.4 Bosch Sicherheitssysteme GmbH

- 6.1.5 Johnson Controls International

- 6.1.6 Honeywell International Inc.

- 6.1.7 Schneider Electric

- 6.1.8 Convergint Technologies LLC

- 6.1.9 ASSA ABLOY

- 6.1.10 Cisco Systems Inc.

- 6.1.11 ABB Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS