PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549905

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549905

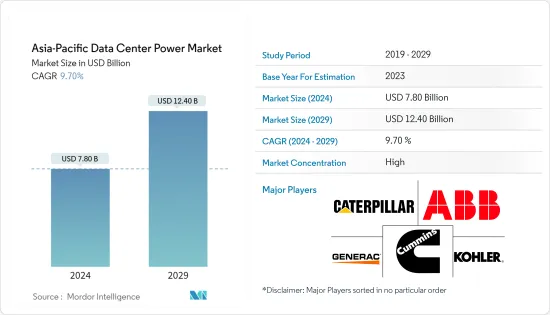

Asia-Pacific Data Center Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia-Pacific Data Center Power Market size is estimated at USD 7.80 billion in 2024, and is expected to reach USD 12.40 billion by 2029, growing at a CAGR of 9.70% during the forecast period (2024-2029).

Asia-Pacific is experiencing a surge in demand for edge data centers, fueled by the rising deployments of 5G technology. Increasing data traffic and data center constructions and servers are laying the demand for power solutions. Operators are exploring the adoption of new-age generator sets that run on hydrotreated vegetable oil (HVO), natural gas, and other eco-friendly alternatives. These factors are expected to augment the market studied.

Key Highlights

- The upcoming IT load capacity of the Asia-Pacific data center power market is expected to reach 23 K MW by 2029.

- The region's construction of raised floor area is expected to increase by 74.5 million sq. ft by 2029.

- The region's total number of racks to be installed is expected to reach 4.2 million units by 2029. India is expected to house the maximum number of racks by 2029.

- There are close to 160 submarine cable systems connecting the Asia-Pacific, and many are under construction. One such submarine cable that is estimated to start service in 2024 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 km with landing points in China, Taiwan, Japan, South Korea, Thailand, and Vietnam.

Asia-Pacific Data Center Power Market Trends

IT and Telecom to Hold Significant Share

- In Asia-Pacific, the hyper-connectivity environment has reinforced the importance of telcos, which play a foundational role in supporting consumers' and enterprises' connectivity and collaboration needs. Across Asia-Pacific, 75% of the operators registered positive revenue growth. South Korea is second to Hong Kong in the world rankings of telecom market maturity. The country is also on the leading edge of the latest telecom developments, including around 6G. In terms of investment, in November 2022, Malaysian companies Celcom and DiGi approved the merger agreement. Once the two companies are fully merged, the new entity will be one of the largest carriers in Malaysia, with over 20 million subscribers.

- The advent of 5G in Asia-Pacific has accelerated small-cell deployment for high-speed network connectivity. Many nations have created exemption standards that can be applied when deploying new small cells. For instance, in Singapore, The Infocomm Media Development Authority (IMDA) has directed the building developers and owners to provide rooftop spaces free of charge for telecommunication equipment and telecom providers.

- Favorable policies and regulations from governments have been pivotal in attracting new investments in data centers. These policies have nurtured an environment with substantial economic and social capital that supports the data center market. The Malaysian government aims to establish a smart grid and increase the proportion of renewable energy to 31% in 2025 and 40% in 2035. This government initiative may address the concerns regarding sustainable power scalability and meet the demands of hyperscalers and providers. Such scenarios also address the demand for backup power solutions.

- In terms of innovations, as of June 2023, Vertiv unveiled a thermal management optimization service, the Vertiv EnerSav, to help data center operators achieve energy savings in Asia. Vertiv introduced the Vertiv EnerSav service to help operators identify cost-saving opportunities within their facilities by reducing energy consumption without needing a significant infrastructure overhaul. The service is available across Asia, including Southeast Asia, New Zealand, and Australia.

India to Register Significant Growth

- India is one of the fastest-growing economies in the world, and due to the combined impact of several end-user segments utilizing power systems, the country is expected to showcase major market growth.

- A majority of the current data centers are being built in Mumbai, Chennai, and Hyderabad. The central and state governments came up with the draft data center policies and incentives. Some states like Uttar Pradesh and Telangana have already rolled out the policies. As resources like power and water have become even more scarce in India, market players will strive to make cleaner and greener data centers than ever before. The cooling and supporting backup infra components are expected to evolve into more efficient and cleaner options.

- In terms of policy, the Government of India and various state governments are redrafting their data center policies to support the infrastructural growth of data centers in India through tax subsidies. Under a national policy framework for data centers, the IT ministry intends to provide up to INR 15,000 crore (USD 1.8 billion) as incentives. As per the policy, the government plans to invest up to INR 3 lakh crore (USD 35 billion) in the data center ecosystem over the next five years.

- The United Nations Intergovernmental Panel on Climate Change anticipates that India will be affected by more frequent and intense weather events in the coming decades. Site selection and climate-related disaster scenarios are becoming increasingly important planning tools for data center providers who aim to be sustainable and resilient in the face of climate impact and extreme weather events. Such factors lead to a major demand for backup power solutions.

- Since the pandemic, cloud computing has evolved as a mission-critical technology for businesses, governments, and consumers. In 2023, 65% of enterprises increased their cloud adoption compared to the previous year, and 84% of the organizations adopted SaaS. Facebook and Google are establishing their mega projects in India and taking measures to lower their carbon footprints. Overall, the data center power market is in favorable condition.

Asia-Pacific Data Center Power Industry Overview

The Asia-Pacific data center power market is slightly consolidated among the players and has gained a competitive edge in recent years. A few major players in the market include ABB Ltd, Caterpillar Inc., and Cummins Inc. These major players with a prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In March 2023, Vertiv Group Corp. announced that its Vertiv Geist Upgradeable Rack PDUs come with a combination outlet C13/19, simplifying purchasing, inventory management, and deployment. The universal C13/C19 outlet on Vertiv Geist Upgradeable Rack PDUs can easily accommodate new rack configurations, eliminating the need to modify or replace rPDUs as rack densities increase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Mega Data Centers and Cloud Computing

- 4.2.2 Increasing Demand to Reduce Operational Costs

- 4.3 Market Restraints

- 4.3.1 High Cost of Installation and Maintenance

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Power Infrastructure

- 5.1.1 Electrical Solution

- 5.1.1.1 UPS Systems

- 5.1.1.2 Generators

- 5.1.1.3 Power Distribution Solutions

- 5.1.1.3.1 PDU

- 5.1.1.3.2 Switchgear

- 5.1.1.3.3 Critical Power Distribution

- 5.1.1.3.4 Transfer Switches

- 5.1.1.3.5 Remote Power Panels

- 5.1.1.3.6 Others

- 5.1.2 Service

- 5.1.1 Electrical Solution

- 5.2 End User

- 5.2.1 IT and Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media and Entertainment

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Philippines

- 5.3.6 Singapore

- 5.3.7 Malaysia

- 5.3.8 Japan

- 5.3.9 New Zealand

- 5.3.10 Thailand

- 5.3.11 Hong Kong

- 5.3.12 Taiwan

- 5.3.13 Vietnam

- 5.3.14 South Korea

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Caterpillar Inc.

- 6.1.3 Cummins Inc.

- 6.1.4 Eaton Corporation

- 6.1.5 Legrand Group

- 6.1.6 Rolls-Royce PLC

- 6.1.7 Vertiv Group Corp.

- 6.1.8 Schneider Electric SE

- 6.1.9 Rittal GmbH & Co. KG

- 6.1.10 Fujitsu Limited

- 6.1.11 Cisco Systems Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS