PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549868

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549868

Global Data Center Physical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

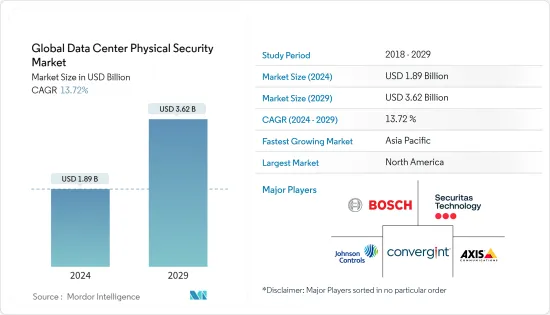

The Global Data Center Physical Security Market size is estimated at USD 1.89 billion in 2024, and is expected to reach USD 3.62 billion by 2029, growing at a CAGR of 13.72% during the forecast period (2024-2029).

Security measures can be categorized into four, namely perimeter security, computer room controls, facility controls, and cabinet controls. The first layer of data center security discourages, detects, and delays any unauthorized entry of personnel at the perimeter. In case of any infringement in the perimeter monitoring, the second layer of defense denies access. It is an access control system utilizing card swipes or biometrics.

The third layer of physical security further restricts access through various verification methods, including monitoring all restricted areas, deploying entry restrictions such as turnstiles, providing biometric access control devices to verify finger and thumbprints, irises, or vascular patterns, providing VCA, and using radio frequency identification. The first three layers ensure the entry of only authorized people. Further security to restrict admission includes cabinet locking mechanisms. This layer addresses the fear of an 'insider threat,' such as a malicious employee.

The upcoming IT load capacity of the global data center physical security market is expected to reach 71,000 MW by 2029.

The construction of raised floor area in the market studied is expected to increase to 273.9 million sq. ft by 2029.

The region's total number of racks to be installed is expected to reach 14.2 million units by 2029. North America is expected to house the maximum number of racks by 2029.

There are close to 500 submarine cable systems connecting the regions globally, and many are under construction. One such submarine cable that is estimated to start service in 2025 is CAP-1, which stretches over 12,000 km with a landing point in Grover Beach, United States.

Global Data Center Physical Security Market Trends

Access Control Solutions to Register Significant Growth

- Implementing strong access controls is vital in maintaining the security of data centers. In the past, instances of UPS theft of servers in data centers have been reported. Criminals choose to sell on the black market, but they are not always looking to sell complete PCs or UPS equipment. For many, the raw materials are where the value exists. UK metal theft offenses have been declining since 2012, reaching a low of 13,033 recorded offenses in 2016 and 2017, but have been on an upward trend since then, more than doubling to 29,920 offenses in 2021 and 2022.

- Access control is one of the most efficient, scalable, and financially profitable ways of securing data centers. Security mechanisms, such as physical security, information security, and data security, comprise the access control system. Players such as LenelS2 provide robust tracking for data center assets utilizing existing barcode infrastructure with no additional hardware or software requirement.

- The growing accessibility to biometric equipment is driving the growth of the access control industry. As fingerprint recognition provides easy and cost-effective access control, it is extensively used, fueling the market growth. The market growth can also be attributed to the increasing interconnectedness of devices and the surging security risks.

- According to IBM, the global average cost of a data breach reached an all-time high of USD 4.35 million in 2022, an increase of almost 13% over two years. The cost for US organizations was more than double at USD 9.44 million per data breach. The IBM report found that 83% of the organizations studied have had more than one data breach, with the four most popular methods, including stolen and compromised credentials, catering to 19% contribution as of 2023.

- Overall, during the forecast period, the market demand for access control solutions is expected to increase with increasing security breaches.

North America to Hold Significant Market Share

- The United States is a prominent market in North America, owing to the growing adoption of physical security solutions. According to Demand Sage Inc., more than 67% of enterprises in the United States have cloud-based infrastructure. Around 20% of total IT spending in the United States in 2023 was on cloud services. Such instances will lead to major data center adoption, catering to the demand for access control.

- California amended the CCPA with the California Privacy Rights Act (CPRA) and Consumer Data Protection Act (Virginia CDPA), which impose strict security and privacy requirements within the United States. Similarly, data protection regulations, such as the Personal Information Protection and Electronic Documents Act ("PIPEDA"), impose strict security and privacy requirements within Canada. These regulations must be complied with physical security solutions, which may propel the demand in the market studied.

- The key players in the market are focused on improving data center physical security solutions to meet the market demand. In June 2023, Bosch introduced a Mobile Access solution to buildings and restricted areas, which allows access without any identification media such as plastic cards.

- This Mobile Access solution is fully integrated into the tried-and-tested Access Management System from Bosch and provides various benefits, including efficiency, security, and convenience for building owners, visitors, and employees. This was initially available to customers in the Benelux region, Switzerland, Germany, Austria, Canada, and the United States..

Global Data Center Physical Security Industry Overview

The global data center physical security market is highly fragmented due to players like Axis Communications AB, ABB Ltd, and Bosch Sicherheitssysteme GmbH, which play a vital role in upscaling the capabilities of enterprises. Market orientation leads to a highly competitive environment. These major players, with a prominent market share, focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In April 2023, Schneider Electric launched EcoCare for Modular Data Centers services membership. Members of this innovative service benefit from specialized expertise to maximize modular data centers' uptime with 24/7 proactive remote monitoring and condition-based maintenance.

In May 2023, Alcatraz AI, one of the prominent providers of autonomous access control solutions, announced its participation at the Data Center Forum Helsinki in June 2023. The event was expected to bring together more than 400 data center professionals and provide Alcatraz AI with an ideal opportunity to demonstrate its innovative biometric access control solution for data center physical security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators

- 4.2.2 Advancements in Video Surveillance Systems Connected to Cloud Systems

- 4.3 Market Restraints

- 4.3.1 Operational and Return On Investment Concerns

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Solution Type

- 5.1.1 Video Surveillance

- 5.1.2 Access Control Solutions

- 5.1.3 Others (Mantraps, Fences, and Monitoring Solutions)

- 5.2 By Service Type

- 5.2.1 Consulting Services

- 5.2.2 Professional Services

- 5.2.3 Others (System Integration Services)

- 5.3 End User

- 5.3.1 IT and Telecommunication

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 South America

- 5.4.5 Middle East

- 5.4.6 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Axis Communications AB

- 6.1.2 Convergint Technologies LLC

- 6.1.3 Securitas Technology

- 6.1.4 Bosch Sicherheitssysteme GmbH

- 6.1.5 Johnson Controls International

- 6.1.6 Honeywell International Inc.

- 6.1.7 Schneider Electric

- 6.1.8 AMAG Technology

- 6.1.9 Brivo Systems LLC

- 6.1.10 Suprema Inc.

- 6.1.11 Assa Abloy AB

- 6.1.12 Milestone Systems A/S

- 6.1.13 Cisco Systems Inc.

- 6.1.14 ABB Ltd

- 6.1.15 American Integrated Security Group

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS