PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549856

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549856

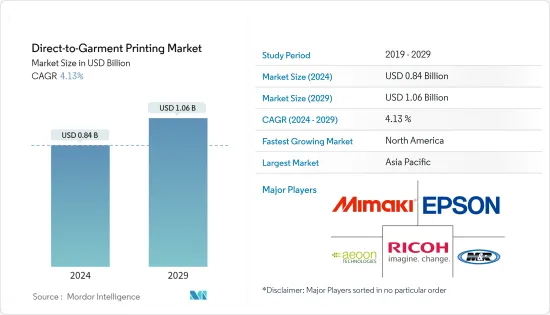

Direct-to-Garment Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Direct-to-Garment Printing Market size is estimated at USD 0.84 billion in 2024, and is expected to reach USD 1.06 billion by 2029, growing at a CAGR of 4.13% during the forecast period (2024-2029).

Key Highlights

- The direct-to-garment printing market has seen significant changes in recent years, driven by new technology, the growing e-commerce sector, changing consumer preferences, and a fast-evolving textile industry. These advancements have improved print quality and color accuracy, making creating detailed designs and bright colors on various fabrics easier.

- Modern direct-to-garment printers are more efficient, allowing quicker production times and larger volumes. This meets the demand for on-demand printing on textiles, reducing inventory costs and waste. This technology is especially beneficial for small and medium-sized businesses due to its low setup cost.

- Direct-to-garment printing is popular for many applications, including clothing and home decor. The high demand for personalized apparel and home decor items drives market growth. Additionally, the need for sustainable printing practices is increasing demand for direct-to-garment printing, as it uses eco-friendly inks.

- The growing need for customized textiles in the educational and corporate sectors is creating new growth opportunities for the market. Brands use direct-to-garment printing to produce branded merchandise and promotional items.

- Direct-to-garment printing works best on 100% natural fabrics, while synthetic fabrics like polyester need pre-treatment and may not produce the best results. This could slow the market growth. However, the ongoing innovation research and development of printer and ink manufacturers may overcome these fabric compatibility challenges.

Direct-to-Garment Printing Market Trends

Rising Demand for Specific Volume Printing Capabilities and the Emergence of On-demand Printing

- Consumers, particularly in the clothing and apparel sector, are increasingly seeking personalized and unique products. Direct-to-garment (DTG) printing, tailored for short runs (less production time), offers high-quality prints on small volumes without hefty setup costs. This makes it the go-to choice for those vendors looking to print personalized, small-batch products.

- Businesses, especially small and medium ones, find the ability to swiftly produce custom designs in small volumes on demand highly appealing. On-demand printing streamlines operations by reducing the need for extensive inventories and mitigating risks associated with overproduction and unsold stock. Leveraging DTG printing, companies can trim inventory costs and promptly adapt to the ever-evolving trends of the fast fashion industry.

- Technological strides in the market now enable brands to print on diverse materials. For example, Ricoh Company Ltd unveiled its cutting-edge direct-to-garment (DTG) printing technology, specifically designed for polyester fabrics. The Ri 4000 DTG printer, a part of this launch, ensures high-quality and durable prints on 100% polyester, addressing previous challenges.

- Also, DTG printing's alignment with sustainability is noteworthy. Its ability to cater to smaller runs translates to minimal waste. Moreover, the eco-friendly inks used in this process resonate well with environmentally conscious consumers and brands. Speed and agility, crucial in the fashion industry, enable brands to maintain their competitive edge.

- The increasing trend for limited-design customized apparel for corporate events and programs propels the demand for fast printing solutions and high-quality print. This on-demand printing requirement for specific events and programs is expected to impact the growth of the market significantly.

- The surge in demand for printed and customized clothing, particularly among the younger demographic, is propelling market growth. Additionally, as global consumer spending on clothing and footwear rises, the direct-to-garment printing market is poised for further development. According to United Nations Statistics Division data, consumer spending on clothing and footwear will increase from USD 2.302 trillion in 2023 to USD 2.880 trillion by 2029. The spending declined by 12.58% in 2020 due to the COVID-19 pandemic, but the market is slowly recovering, with a 17.95% increase in spending in 2021. It is projected to register a Y-o-Y of 4.07% in 2025.

A Cultural Shift in Asian Apparel and Home Decor Sector Aids the Market Growth

- Consumers in India, China, Japan, and other Asian countries seek garments that blend contemporary fashion with traditional symbols and patterns. The direct-to-garment printing allows for high-quality designs that capture the essence of local art forms, making it ideal for producing personalized apparel on demand. This capacity of direct-to-garment printing aligns with the region's diverse cultural heritage and growing consumer preference for clothing that represents unique cultural identities.

- The region is witnessing a surge in small and medium-sized enterprises and independent designers tapping into the niche market. The low setup cost benefit of direct-to-garment printing makes it an ideal printing solution for small and independent designers.

- Festivals and celebrations play a significant role in Asian culture, often requiring themed decorations. This increases the demand for customized printed apparel, decor solutions, and others, ultimately impacting the market growth.

- Consumers seek unique home textile products such as cushion covers, wall hangings, and curtains. The growth of the middle class in Asian countries, along with increasing disposable income, results in a willingness to spend more on home decor to make the living space more decorative and stylish. Direct-to-garment printing allows for custom design production, enabling homeowners to choose their style and preference through decor.

- The growth of e-commerce in the region has expanded the market for customized home decor products. The need for on-time production is expected to impact the market's growth in the area significantly.

Direct-to-Garment Printing Industry Overview

The direct-to-garment printing market is fragmented due to the presence of various global players. The key players include Mimaki Engineering Co. Ltd, Ricoh Company Ltd, Seiko Epson Corporation, The M&R Companies, Brother International Corporation, aeoon Technologies GmbH, and Kornit Digital Ltd. The players in the market are focusing on technological advancement through product launches, acquisitions, and expansion to stay competitive in the market.

January 2024: Seiko Epson Corporation announced the SureColor F-Series direct-to-garment (DTG) printer launch. The new printer will help the company serve small and medium-sized businesses. The new printer is compact and cost-effective, delivering high-quality output to empower designers to spend more time creating and honing their craft. It will help the brand leverage DTG printing in-house and expand print services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Small-volume Printing Capabilities and Trend for On-demand Gateway

- 5.1.2 Growing Trend for Home Decor among Consumers

- 5.2 Market Challenge

- 5.2.1 Difficult to Print on Certain Material

6 MARKET SEGMENTATION

- 6.1 By Substrate

- 6.1.1 Cotton

- 6.1.2 Silk

- 6.1.3 Polyester

- 6.1.4 Other Substrates

- 6.2 By Ink

- 6.2.1 Reactive

- 6.2.2 Acid

- 6.2.3 Other Inks

- 6.3 By Application

- 6.3.1 Clothing and Apparel

- 6.3.2 Home Decor

- 6.3.3 Technical Textiles

- 6.3.4 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 South Africa

- 6.4.5.3 United Arab Emirates

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mimaki Engineering Co. Ltd

- 7.1.2 Ricoh Company Ltd

- 7.1.3 Seiko Epson Corporation

- 7.1.4 The M&R Companies

- 7.1.5 Brother International Corporation

- 7.1.6 aeoon Technologies GmbH

- 7.1.7 GROUP ROQ (S. Roque- Maquinas e Tecnologia Laser SA Group)

- 7.1.8 Kornit Digital Ltd

- 7.1.9 Foshan Nuowei Digital Printing Equipment Co. Ltd

- 7.1.10 Xin Flying

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET