PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549832

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549832

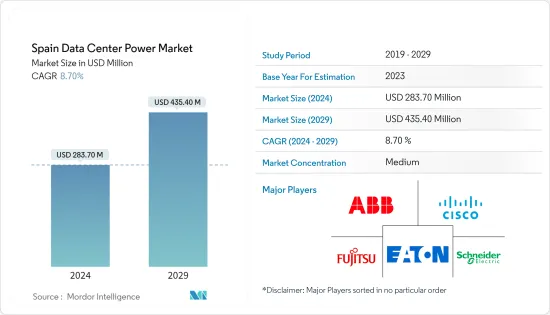

Spain Data Center Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Spain Data Center Power Market size is estimated at USD 283.70 million in 2024, and is expected to reach USD 435.40 million by 2029, growing at a CAGR of 8.70% during the forecast period (2024-2029).

The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Spanish data center market is expected to reach 399 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase by more than 1.9 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach 99,730 units by 2029. Madrid will likely house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 33 submarine cable systems connecting Spain, and many are under construction.

The increasing need for data storage has resulted in an upsurge in the number of data centers, and the rising usage of data centers has increased electricity consumption in the country. The country has made clear progress in increasing competition in electricity and natural gas markets. It has reduced the use of fossil fuels and increased the share of renewable energy. The country's economy is also becoming less energy-intensive. Moreover, to further reduce energy consumption, key market players are focusing on introducing efficient power management systems such as PDUs, busways, and UPS for the purpose of controlling unnecessary expenditures in data centers, which is expected to drive the market's growth.

Spain Data Center Power Market Trends

IT & Telecommunication Segment to Hold Major Market Share

- The increased adoption of cloud computing services in the country has increased the number of IT infrastructure components. Many technology companies have launched cloud services to support the digital transformation efforts of many enterprises. Moreover, the increased adoption of e-commerce services has facilitated digitization. These instances are increasing the demand for the data center power market.

- The data center market is achieving new records due to the increasing penetration of connected devices, including consolidation and the emergence of new players.

- The number of servers in data centers is likely to increase as the growing demand for these digital services and the changing adoption of end users, primarily focused on digital connectivity, require more data storage. Typically, this situation corresponds to increased demand for data centers. Increasing data centers necessitates increasing use of systems for power facilitation.

- The first 5G network in Spain was enabled in 2019, and 4G was introduced in 2013. Since its launch, the internet speeds of both the 4G and 5G networks have increased. High levels of broadband and cable connections for high-speed internet are easily accessible and affordably priced, which promotes digital penetration and the economy of the country. With a wide scope for improvement in connectivity, Spain's market for data centers is anticipated to expand as data demand and speed increase.

- In accordance with the connectivity plan, 100% of the population is expected to have access to high-speed broadband by 2025. It would improve connectivity in businesses and industrial parks and offer coupons to encourage SMEs to digitize. As a result, the demand for enterprises is anticipated to increase, which will be reflected in a rapid increase in the infrastructure and resources needed for data centers such as generators, PDUs, UPS, and others.

PDUs Expected to Hold Significant Share in the Market

- The growing focus on digitization, internet penetration, and e-commerce across the country has created a need for storage capacity, resulting in huge demand for data centers and increased power consumption. The growing need for data storage is leading to the adoption of intelligent power distribution units (PDUs) to optimize power consumption in data centers rather than simple multi-socket rack installations and servers and networking devices.

- PDUs are essential components of data center and server room infrastructure, allowing real-time monitoring of power consumption, voltage, current, and other electrical parameters. This data allows administrators to make informed decisions about power allocation and capacity planning.

- By tracking power consumption trends, managers can plan for future growth and avoid exceeding power capacity, preventing overloads that can lead to equipment failure. It also helps identify inefficiencies and optimize energy consumption. This eliminates unnecessary power consumption, lowers costs, and reduces your environmental footprint. Additionally, administrators can access and control it remotely, reducing the need for physical presence and minimizing disruption to operations.

- Industrial end users are gravitating toward cloud platforms such as Microsoft Azure, Google Cloud, and AWS. Growth trends indicate rapid adoption of cloud-based applications by end users. This opens the opportunity for intelligent and compact PDUs that can meet the increasing power requirements to operate such platforms.

- With the growth of mega data centers in the country, the need for PDUs is also increasing. Faster internet speeds and the associated proliferation of accessible devices play an important role in determining and estimating national data consumption. The number of 5G mobile connections has increased significantly, which means that the penetration rate of 5G mobile in the country is high. Increased data traffic is anticipated to further increase the demand for DC facilities with intelligent PDU systems.

Spain Data Center Power Industry Segmentation

The data center power market in Spain is moderately concentrated due to higher initial investments and low availability of resources. It is dominated by a few major players like Schneider Electric SE, Fujitsu Ltd, Cisco Technology Inc., Eaton Corporation, and ABB Ltd. These major players, with a prominent market share, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and increase their profitability. With technological advancements and product innovations, mid-size to smaller companies are also increasing their market presence by securing new contracts and tapping new markets.

- For instance, in December 2023, Eaton Corporation announced the launch of its new Rack PDU G4 (4th generation) that provides a high security and business continuity data center. It also combines with C39 outlets that securely connect both C14 and C20 power cords, backed by a locking mechanism and a built-in high retention system that secures the power cord.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Mega Data Centers and Cloud Computing

- 4.2.2 Increasing Demand to Reduce Operational Costs

- 4.3 Market Restraints

- 4.3.1 High Cost of Installation and Maintenance

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Power Infrastructure

- 5.1.1 Electrical Solution

- 5.1.1.1 UPS Systems

- 5.1.1.2 Generators

- 5.1.1.3 Power Distribution Solutions

- 5.1.1.3.1 PDU

- 5.1.1.3.2 Switchgear

- 5.1.1.3.3 Critical Power Distribution

- 5.1.1.3.4 Transfer Switches

- 5.1.1.3.5 Remote Power Panels

- 5.1.1.3.6 Other Power Distribution Solutions

- 5.1.2 Service

- 5.1.1 Electrical Solution

- 5.2 By End User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Caterpillar Inc.

- 6.1.3 Cummins Inc.

- 6.1.4 Eaton Corporation

- 6.1.5 Legrand Group

- 6.1.6 Rolls-Royce PLC

- 6.1.7 Vertiv Group Corp.

- 6.1.8 Schneider Electric SE

- 6.1.9 Rittal GmbH & Co. KG

- 6.1.10 Fujitsu Limited

- 6.1.11 Cisco Systems Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS