PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549828

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549828

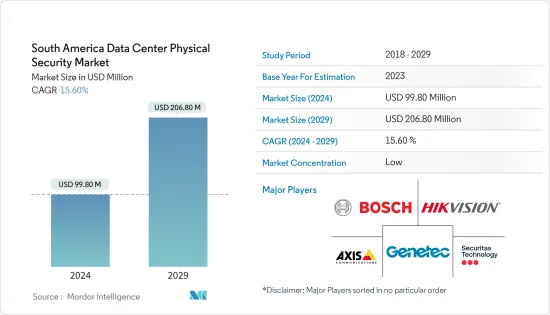

South America Data Center Physical Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The South America Data Center Physical Security Market size is estimated at USD 99.80 million in 2024, and is expected to reach USD 206.80 million by 2029, growing at a CAGR of 15.60% during the forecast period (2024-2029).

The security measures for the data center can be divided into four layers: perimeter security, facility controls, computer room controls, and cabinet controls. The first layer focuses on discouraging, detecting, and delaying unauthorized entry into the perimeter. If there is a breach in the perimeter monitoring, the second layer restricts access through an access control system using card swipes or biometrics. The third layer further restricts access by using various verification methods, monitoring restricted areas, deploying entry restrictions, providing biometric access control devices, and using radio frequency identification. These layers ensure entry for only authorized personnel. Additional measures to restrict access include cabinet locking mechanisms addressing concerns about insider threats such as malicious employees.

The upcoming IT load capacity of the South American data center construction market is expected to reach 1800 MW by 2029.

The region's construction of raised floor area is expected to increase 7.8 million sq. ft by 2029.

The region's total number of racks to be installed is expected to reach 392K units by 2029. Brazil is expected to house the maximum number of racks by 2029.

Close to 60 submarine cable systems are connecting South America, and many are under construction. One submarine cable estimated to start service in 2025 is Carnival Submarine Network-1 (CSN-1), which stretches over 4500 Kilometers with a landing point in Barranquilla, Colombia.

South America Data Center Physical Security Market Trends

The IT & Telecom Segment to Hold Significant Share

- The demand for telecom data center construction in the country is increasing for physical security solutions. In South America, government biometric identification initiatives and the increasing prominence of biometrics in various sectors are expected to drive market growth.

- The rollout of 5G networks would strengthen the nation's digital economy and increase demand for high data center storage infrastructure. The arrival of 5G is expected to bring a major increase in speeds, low latencies, and an unforeseen level of network capabilities.

- The Chilean government has substantially invested in fiber-optic networks, with connections reaching more than 90% of the population. Due to this, most Chilean families now have access to high-speed internet services, enabling them to benefit from the expanding range of available digital services.

- In terms of 5G connectivity, all Brazilian municipalities with at least 200,000 residents will have a 5G network by July 31, 2026, with at least one antenna. Brazil's 5G spectrum auction held in October 2021 raised about USD 8.5 billion. By 2035, introducing 5G in Brazil may have a USD 1.2 trillion economic impact and a USD 3 trillion productivity boost. Data center construction is increasing with network traffic, leading to demand for major physical security solutions.

- Owing to such factors, the demand for data centers from the telecom segment is constantly rising, mirrored by a rapid rise in the data center's physical security. The manufacturers of data centers are developing cutting-edge, affordable solutions that are scalable and secure to fulfill the rising demand from the telecom industries.

Brazil to Hold Significant Growth

- Brazil's digital economy demonstrates the potential for continued growth over the medium and long term. The Brazilian government plays a significant role in developing local data center infrastructure. According to the government, the country's General Data Protection Act (LGPD) was implemented in August 2020. It is now expected to force many enterprises to migrate their cloud access to private networks and update their encryption services to extend user data protection.

- About 10-15% of data is created and processed outside a centralized data center or cloud, but the number is expected to cross 60-70% by 2025, a global trend that is also expected in Brazil. Such factors will lead to significant physical security solutions demand in terms of video surveillance and access control solutions.

- Microsoft, Amazon Web Services, and Google are Brazil's major cloud service providers. These cloud service providers will collocate their workloads with existing colocation operators and collaborate with new market entrants to provide cloud-based services.

- In Brazil, Sao Paulo is the most connected city, with a high availability of digital business and financial centers, making it a favorable location for facility development. The region is also witnessing a boost in investments in the market due to Brazil's data localization law, the Lei Geral de Protecao de Dados Pessoais (LGPD), which has implemented regulations to store the data generated within the country.

- According to the latest Security Industry Association's (ABESE) survey, the Brazilian market for electronic security equipment comprises video surveillance at 39.6% and access control at 20.8%. With more than 26,000 companies, including data center companies, and an average market growth rate of 8% per year, businesses in the market expect to meet the demand. Such a scenario is expected to cater to the demand in the market.

South America Data Center Physical Security Industry Overview

The South American data center physical security market is fragmented and has gained a competitive edge. A few major players are Axis Communications AB and Bosch Sicherheitssysteme GmbH. These major players with a prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

March 2023: Genetec Inc. and Axis Communications collaborated with the introduction of Axis Powered by Genetec, the industry's first enterprise-level access control offering that combines Genetec access control software with Axis network door controllers in a single, easy-to-deploy all-in-one offering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Access Control Systems

- 4.2.2 Advancements in Video Surveillance Systems Connected to Cloud Systems

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Physical Security Infrastructure

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Solution Type

- 5.1.1 Video Surveillance

- 5.1.2 Access Control Solutions

- 5.1.3 Other Solution Types (Mantraps, Fences, and Monitoring Solutions)

- 5.2 By Service Type

- 5.2.1 Consulting Services

- 5.2.2 Professional Services

- 5.2.3 Other Service Types (System Integration Services)

- 5.3 End User

- 5.3.1 IT & Telecommunication

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Other End User

- 5.4 Country

- 5.4.1 Brazil

- 5.4.2 Chile

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Axis Communications AB

- 6.1.2 Hangzhou Hikvision Digital Technology Co. Ltd

- 6.1.3 Securitas Technology

- 6.1.4 Genetec Inc.

- 6.1.5 Bosch Sicherheitssysteme GmbH

- 6.1.6 Johnson Controls International

- 6.1.7 Honeywell International Inc.

- 6.1.8 Siemens AG

- 6.1.9 Schneider Electric

- 6.1.10 ABB Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS