PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549804

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549804

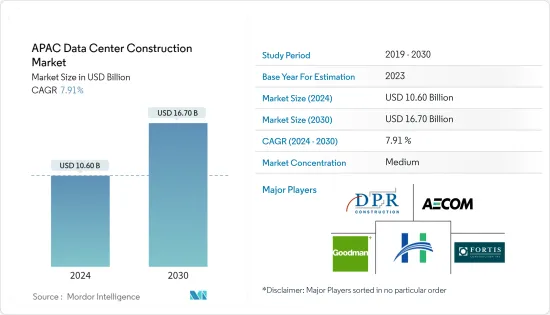

APAC Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2030)

The APAC Data Center Construction Market size is estimated at USD 10.60 billion in 2024, and is expected to reach USD 16.70 billion by 2030, growing at a CAGR of 7.91% during the forecast period (2024-2030).

The demand for data center services in the Asia-Pacific region is surging, driven by the rapid adoption of digital technologies, cloud computing, and the Internet of Things (IoT).

Under Construction IT Load Capacity: The upcoming IT load capacity of the Asia-Pacific data center market is expected to reach above 21,000 MW by 2030.

Under Construction Raised Floor Space: The country's construction of raised floor areas is expected to exceed 76 million sq. ft. by 2030.

Planned Racks: The region's total number of racks to be installed is expected to reach more than 3.5 million units by 2030. India is expected to house the maximum number of racks by 2030.

Close to 160 submarine cable systems are connecting the Asia-Pacific, and many are under construction. One such submarine cable that is estimated to start service in 2024 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 km and has a landing point in China, Taiwan, Japan, South Korea, Thailand, and Vietnam.

In addition, the growing adoption of sustainable energy across all regional governments is expected to drive more renovations and new infrastructure requirements in the existing and under-construction data centers. Taiwan aims to rely on renewable energy by generating 20% of its electricity through wind and solar PV promotion plans by 2025, resulting in renewable power capacity reaching over 26 GW during the forecast period.

APAC Data Center Construction Market Trends

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- Australia stands at the forefront of the data center solutions market. Spearheaded by initiatives such as the Australia Government Information Management Office (AGIMO), the nation is driving the optimization of data center resources through its Australia Government Data Centre Strategy 2010-2025. This strategy marks a pivotal shift, moving away from government-operated data centers towards third-party, multi-tenant facilities. Additionally, Australia's robust energy sector bolsters the growth of its data center market.

- Sydney stands out as a pivotal hub in its region, drawing significant investments primarily from the United States and the United Kingdom. Notably, Sydney's emphasis on renewable energy has positioned it as a prominent center for data centers. A standout achievement: Sydney now exclusively relies on renewable energy sourced from local wind and solar farms in regional NSW. Moreover, in collaboration with the Central Coast Council, the Hunter and Central Coast Development Corporation, and key industry players, the Greater Sydney Commission is spearheading the development of the Central Coast Strategy.

- Cloud services drive innovation, especially in emerging fields like generative AI (GenAI), which is now making waves in Australia. Australian organizations are increasingly modernizing their applications, transitioning from software-based to cloud-based business applications. This shift is fueling a steady rise in SaaS investments. While SaaS adoption brings benefits, it's becoming less of a choice as numerous vendors are pivoting to cloud-only delivery, irrespective of customer preferences.

- Furthermore, an increase in the penetration rate of the 5G network in the country is expected to increase data generation, which would raise the need for more space for storing and processing these data. Apart from personal usage, 5G technology is expected to heavily influence industrial automation, primarily in manufacturing, mining, and healthcare. This trend is expected to raise the occupancy rate in data centers in the coming years, driving the demand for data center construction in the country during the forecast period.

- In 2023, Australia's retail sales growth decelerated to 2% year-on-year (YoY). However, online retail bucked the trend, surging to approximately USD 41.4 billion in sales. Notably, online marketplaces, spanning a range of stores, experienced a robust 9.1% uptick in sales. Moreover, the food and liquor segment, driven by a spike in online grocery shopping, was pivotal in propelling the overall online retail growth.

North America Expected to Hold Significant Market Share During the Forecast Period

- Australia: In the 2024-2025 Federal budget, the federal government earmarked a minimum of USD 2.8 billion for technology systems and policy development, spanning the next four years. This allocation surpasses the previous year's budget of USD 2 billion. Additionally, a specific allocation of USD 288.1 million over the same four-year period is designated to enhance the adoption of Digital ID.

- First Nations digital inclusion programs secured substantial funding of USD 68 million in 2024. This allocation includes USD 40 million earmarked for deploying community wi-fi in remote areas; another USD 22 million is designated for establishing a First Nations Digital Support Hub. This initiative will also create a network of digital mentors aimed at enhancing online service accessibility and bolstering digital literacy and safety for First Nations individuals. Additionally, USD 6 million has been allocated to enhance the national data collection pertaining to First Nations' digital inclusion efforts.

- China: In March 2024, it unveiled ambitious plans to intensify its focus on research and development (R&D) in big data and AI. This initiative includes launching an 'AI Plus' program and establishing digital industry clusters aimed at global competitiveness. The 'AI Plus' initiative is poised to play a pivotal role in advancing China's digital economy, facilitating a deeper integration of AI with the real economy. This move is set to invigorate China's high-tech sector and spur economic growth.

- China's AI industry surged in 2023, with the core sector hitting a scale of 500 billion yuan (USD 69.48 billion) and boasting over 4,400 enterprises. Data from the China Center for Information Industry Development projects a 110% year-on-year increase, forecasting the market scale for large AI models to hit USD 2.1 billion.

- India: In February 2024, the government of India, through the Department of Telecommunications (DoT), introduced the 'Sangam: Digital Twin' initiative. This initiative calls for Expressions of Interest (EOI) from a wide spectrum of participants, including industry leaders, innovators, MSMEs, startups, academia, and forward-thinkers. 'Sangam: Digital Twin' aims to revolutionize infrastructure planning and design by harnessing the capabilities of 5G, IoT, AR/VR, AI, AI-native 6G, 'Digital Twin' technology, and cutting-edge computational tools.

- From the above instances, government initiatives are spurring the adoption of digital services nationwide, such as smartphone penetration, increasing the usage of IoT devices, Cloud adoption, and others, driving a surge in data storage needs. Consequently, this uptick in demand is fueling growth in the regional data center construction market.

APAC Data Center Construction Industry Overview

The Asia-Pacific Data Center Construction Market is fragmented, with the top five companies occupying most of the market share. The major players in this market are AECOM, DPR Construction, Fortis Construction, Goodman Group, Hibiya Engineering Ltd., Larsen & Toubro Limited, Citramas Group, and others.

In March 2024, BW Digital and Citramas Group inked a memorandum of understanding (MoU) to develop a carrier-neutral digital ecosystem within Batam's Nongsa Digital Park (NDP), Indonesia. This move comes on the heels of BW Digital's recent land acquisition, spanning over 55,000 square meters at Citramas-owned Nongsa Digital Park in Batam. The purpose is to establish BW Digital's first data center in Southeast Asia, bolstering its digital infrastructure presence in Asia-Pacific.

In March 2024, the Australian industrial specialist, the Goodman Group, broke ground on its latest 50MW data center in Tsuen Wan, Hong Kong. This development represents Goodman's eighth foray into the Hong Kong data center market. Notably, the project involves transforming the Goodman Texaco Centre, a former industrial site situated at the heart of Hong Kong's key data center availability zone.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Germany

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 In the Asia Pacific region, sustainability is increasingly shaping the demand for data center construction services

- 4.2.1.2 Major initiatives undertaken by government to promote digital economy and connectivity

- 4.2.2 Market Restraints

- 4.2.2.1 Several nations, citing national security concerns, have recently bolstered their data regulations, impeding the expansion of the data center construction market.

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key APAC Data Center Construction Statistics

- 4.4.1 Number of Data Centers In the APAC, 2022 And 2023

- 4.4.2 Data Center Under Construction in the APAC, In MW, 2024 ? 2029

- 4.4.3 Average Capex and Opex For the APAC Data Center Construction

- 4.4.4 Data Center Power Capacity Absorption In MW, Selected Cities, APAC, 2022 and 2023

- 4.4.5 The top CAPEX spenders on Data center infrastructure in the APAC.

5 MARKET SEGMENTATION

- 5.1 Market Segmentation - By Infrastructure

- 5.1.1 Market Segmentation - By Electrical Infrastructure

- 5.1.1.1 Power Distribution Solution

- 5.1.1.1.1 PDU: Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2 Transfer Switches

- 5.1.1.1.2.1 Static

- 5.1.1.1.2.2 Automatic (ATS)

- 5.1.1.1.3 Switchgear

- 5.1.1.1.3.1 Low-Voltage

- 5.1.1.1.3.2 Medium-Voltage

- 5.1.1.1.4 Power Panels and Components

- 5.1.1.1.5 Others

- 5.1.1.2 Power Back up Solutions

- 5.1.1.2.1 UPS

- 5.1.1.2.2 Generators

- 5.1.1.3 Service - Design & Consulting, Integration, Support & Maintenance

- 5.1.2 Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.1.1 Immersion Cooling

- 5.1.2.1.2 Direct-To-Chip Cooling

- 5.1.2.1.3 Rear Door Heat Exchanger

- 5.1.2.1.4 In-Row and In-Rack Cooling

- 5.1.2.1.5 Racks

- 5.1.2.1.6 Other Mechanical Infrastructure

- 5.1.3 General Construction

- 5.1.1 Market Segmentation - By Electrical Infrastructure

- 5.2 Market Segmentation - By Tier Type

- 5.2.1 Tier-I and II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 Market Segmentation - By End User

- 5.3.1 Banking, Financial Services, and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Market Segmentation - By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Australia

- 5.4.5 Indonesia

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AECOM

- 6.1.2 DPR Construction

- 6.1.3 Fortis Construction

- 6.1.4 Goodman Group

- 6.1.5 Hibiya Engineering Ltd.

- 6.1.6 Larsen & Toubro Limited

- 6.1.7 GIC Private Limited.

- 6.1.8 Sino Group

- 6.1.9 Citramas Group

- 6.1.10 Aurecon Group Pty Ltd.

7 INVESTMENTS ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 ABOUT US

- 9.1 Industries Covered

- 9.2 Illustrative List of Clients in the Industry

- 9.3 Our Customized Research Capabilities